After bleeding billions from its flagship funds, Cathie Wooden’s ARK Funding Administration is reportedly taking a defensive flip. It’s getting into into the booming “buffer ETF” area with a contemporary lineup of loss-limiting merchandise.

The agency filed proposals final week for 4 new exchange-traded funds, the ARK Q1, Q2, Q3, and This autumn Outlined Innovation ETFs. These Change-traded funds are designed to cushion draw back dangers whereas limiting upside returns. Every product will observe a rolling 12-month technique beginning in January, April, July, and October, respectively. This house has turned out to be an buyers’ hunt for cover in a droop whereas already being dominated by BlackRock, Allianz, and Innovator.

Ark bets huge on buffer ETFs

In line with the report, the proposed ETFs will intention to defend buyers from round 50% of any decline in ARKK whereas providing full publicity to positive factors above a 5% threshold. ARKK is Ark’s $6.8 billion flagship innovation fund. It’s anticipated that the buffer ETF market led by BlackRock may hit $650 billion by 2030.

It added that belongings in defined-outcome ETFs have already hit $69 billion in 2025. In an atmosphere marked by price volatility, commerce tensions, and rising geopolitical dangers, draw back safety is changing into a scorching commodity.

Conventional, crypto, and all kinds of markets are already coping with large fluctuations led by an indecisive state of affairs created by US President Donald Trump. Within the contemporary commerce threats, Trump has set 14 nations on the record. This consists of key US allies Japan and South Korea, on discover to face a 25% to 40% improve from August 1.

Supply: Bloomberg.

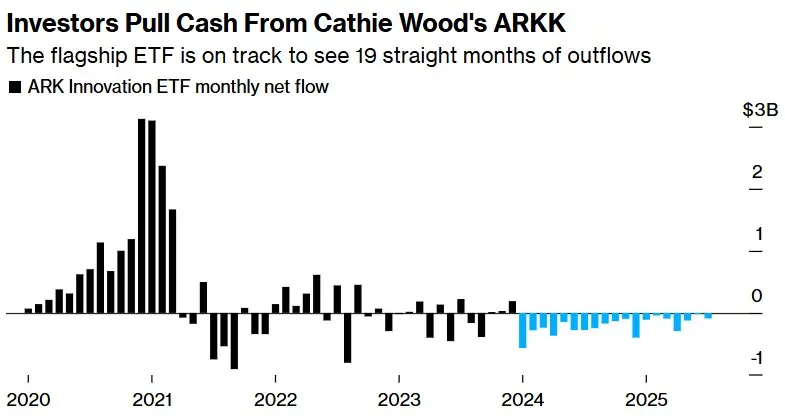

ARK’s timing isn’t unintentional as it’s racking up robust returns in 2025. ARKK is up 50% over the previous 12 months, and ARKW, the agency’s internet-focused fund, has gained 80%. The report mentions that the retail enthusiasm appears to be drying up as ARKK is now on tempo for its nineteenth straight month of web outflows. It has shed $2 billion prior to now yr. ARKK worth noticed a minor decline within the final buying and selling session. It traded round $70.44.

“These are like Food plan Ark,” acknowledged Eric Balchunas of Bloomberg Intelligence. “Buyers need the kick, however with out the sleepless nights.”

Cathie Wooden rebalances Ark Make investments

The buffer ETF push comes as Ark seems to fine-tune its core positions. On July 7, the agency added 659,428 shares of Beam Therapeutics (BEAM), approx. value over $13 million. In the meantime, it scaled again on Ionis Prescribed drugs (IONS), 908 Units (MASS), and Roblox (RBLX), too. It offered 12,143 shares of IONS (approx. value $522K) by means of the ARKG ETF.

Spot Bitcoin ETFs posted a complete web influx of $217 million on July 7. This marks three consecutive days of web inflows, suggesting secure market situations. Nonetheless, ARK 21Shares Bitcoin ETF (ARKB) reported an outflow of $10.07 million in the identical session. This is available in when ARKB noticed a large influx of $114.25 million on July 3 (earlier buying and selling session).

Bitcoin worth dropped marginally during the last 24 hours. BTC is buying and selling at a mean worth of $108,382 at press time. It’s nonetheless up by 87% during the last yr. Bitcoin’s 24-hour buying and selling quantity spiked by 19% to hit $47.25 billion.