The U.S. inventory market is having an identification disaster, torn between the promise of blockbuster earnings and the panic over a synthetic intelligence (AI) bubble.

The Gravity of the Grift

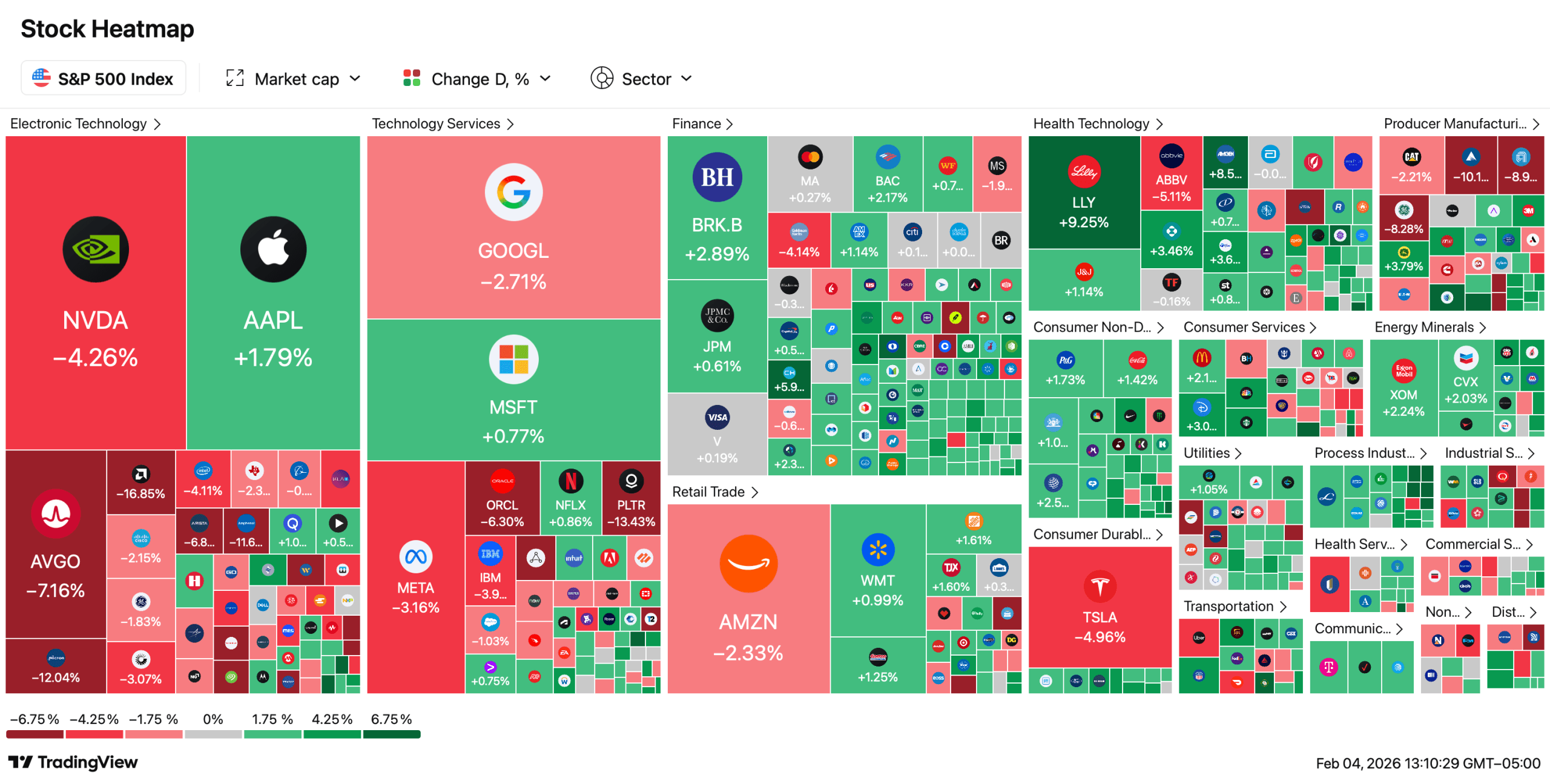

Wednesday’s combined buying and selling session is greater than only a squiggle on a chart; it’s a stark Rorschach take a look at for investor sentiment. With the Dow Jones Industrial Common climbing over 280 factors whereas the Nasdaq Composite slumped, the market is actually shifting in two reverse instructions.

This break up character highlights a basic debate: is the economic system nonetheless resilient, or are the long-awaited penalties of an costly AI arms race and a cooling labor market lastly right here? The divergence tells us that cash isn’t fleeing the market—it’s frantically rotating, looking for a protected story to consider in.

S&P 500 at 1:15 p.m. EST on Feb. 4, 2026.

Wall Road’s Whisper Community

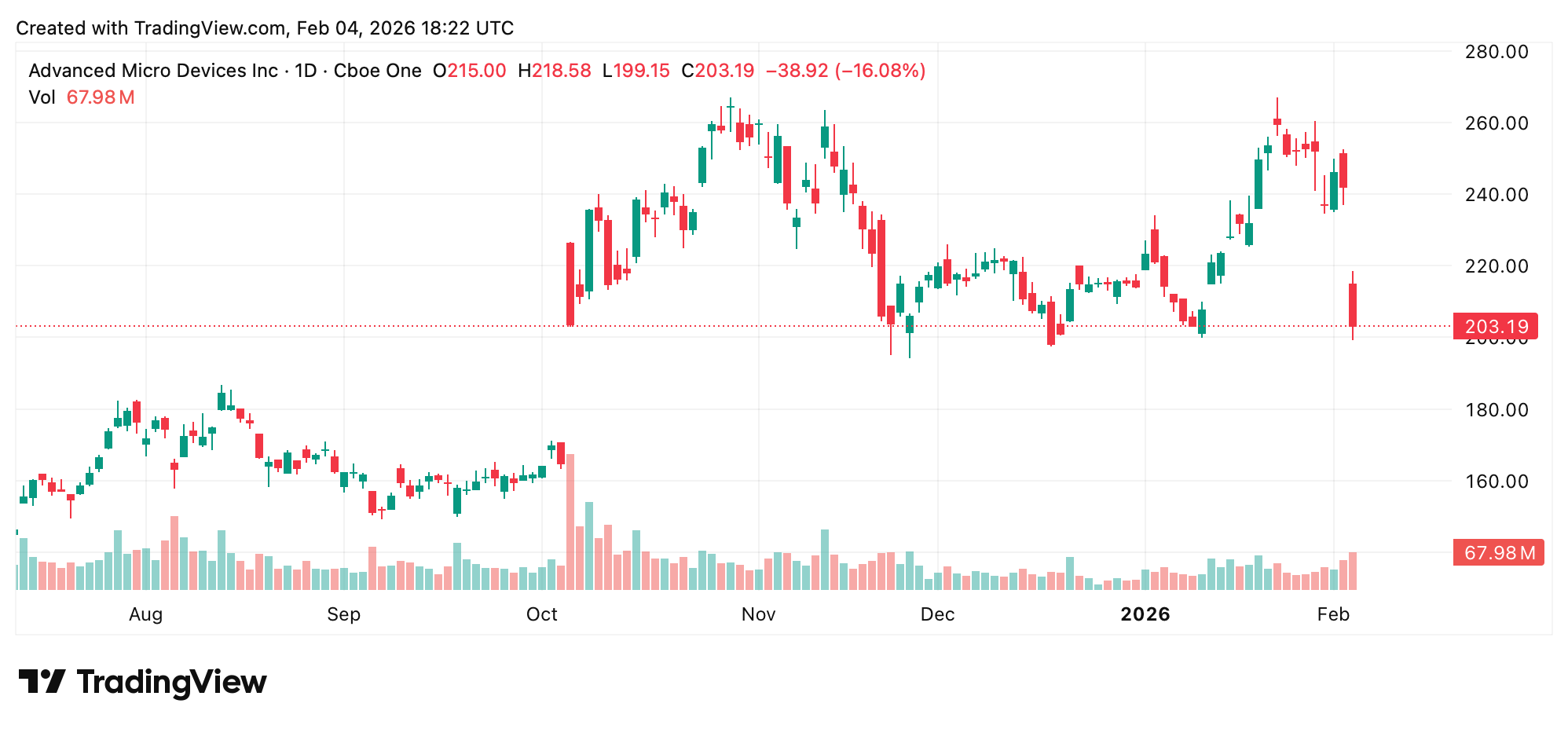

The chatter on the ground isn’t optimistic. John Praveen, managing director and Co-CIO, Paleo Leon in Princeton, New Jersey, informed Reuters, “there are some real considerations that AI investments will eat the software program firms’ lunches,” slicing to the guts of the tech sell-off. The concern is that large capital expenditures have gotten a black gap. The concern is that the “AI theme is probably not as instantly profitable as hoped,” Fawad Razaqzada at Foreign exchange.com defined to Bloomberg. Even stellar income aren’t sufficient to calm nerves, with shares like AMD plunging over 12% regardless of beating expectations, a basic signal that valuations had merely flown too near the solar.

Superior Micro Units (AMD) on Feb. 4, 2026.

The Onerous Numbers: A Story of Two Economies

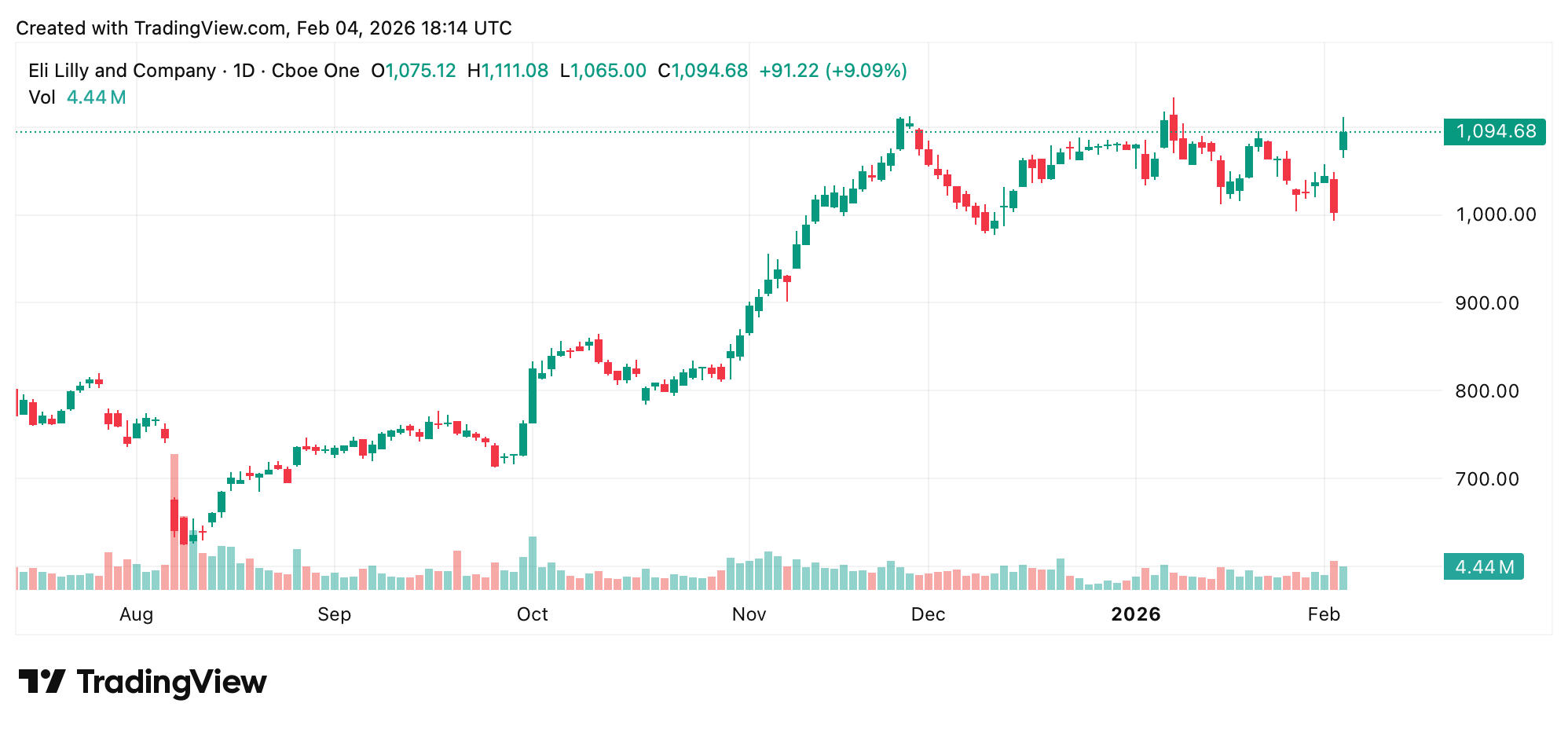

The info paints a contradictory image. In a single nook, company America exhibits muscle. Eli Lilly surged over 7% after crushing earnings expectations, and Tremendous Micro Pc jumped 12%, proving there are nonetheless successful trades. Within the different nook, the macroeconomic engine is sputtering. The ADP report confirmed personal employers added a meager 22,000 jobs in January, a fraction of the anticipated 48,000 and a transparent sign of a slowdown. Notably, skilled and enterprise companies bled 57,000 jobs, whereas manufacturing continued its lengthy retreat.

AI Anxiousness: The Hangover After the Occasion

The know-how sector is floor zero for the panic. It’s not nearly spending; it’s about existential spending. Traders are out of the blue questioning if the trillion-dollar bets on synthetic intelligence will ever generate commensurate returns. Microsoft’s latest cloud slowdown sparked a ten% plunge, serving as a wake-up name that even the mightiest can disappoint. The sell-off has been brutal and broad, engulfing software program giants from Salesforce to Adobe. The nervousness is that AI itself may disrupt the very software program fashions these firms are constructed on, turning them from disruptors into the disrupted.

Additionally learn: XRP Derivatives Paint a Cautious Image as Value Stalls Below $1.65

Protected Haven Samba

As tech trembles, a basic rotation is underway. Cash is dancing towards perceived security. Healthcare shares, buoyed by Lilly, are up. Shopper staples and industrials are attracting flows. Even gold, after a violent pullback, is clawing its approach again close to $5,000 an oz as buyers search a hedge towards uncertainty. In the meantime, the yield on the 10-year Treasury held regular round 4.27%, suggesting bond markets are in a “wait-and-see” mode, caught between weak jobs information and chronic inflation considerations within the companies sector.

Eli Lily and Firm on Feb. 4, 2026.

The Friction Level: A Actuality Test

The core rigidity is a collision between micro-optimism and macro-pessimism. Firm-specific excellent news is being overshadowed by systemic doubts. Can the stellar efficiency of some healthcare or industrial giants offset the gravitational pull of a softening job market and a deflating tech bubble? The market’s verdict, up to now, is a hesitant “possibly,” ensuing on this irritating stalemate. The delayed official authorities jobs report, now due Feb. 11, is simply amplifying the uncertainty.

The Crossroads: What Comes Subsequent

All eyes are on the following catalyst. The market is trapped in a ready recreation, caught between earnings from mega-caps like Alphabet and Amazon and the upcoming labor information. The trail ahead will depend on which narrative beneficial properties the higher hand: a smooth financial touchdown supported by sturdy company well being, or a deeper slowdown exacerbated by a tech-led correction. The wild swings in belongings like gold, silver and crypto present a market that’s desperately in search of route however discovering solely volatility.

FAQ ❓

- What’s inflicting the inventory market break up at present? Robust earnings from firms like Eli Lilly are boosting the Dow, whereas fears over AI spending and profitability are crushing tech shares, dragging down the Nasdaq.

- Why are tech shares falling even with good earnings? Traders concern that massive AI investments gained’t repay quickly sufficient and that AI may disrupt conventional software program enterprise fashions, making even sturdy present outcomes look much less worthwhile.

- What did the most recent jobs report present? Personal sector job progress was weak, with solely 22,000 jobs added in January, lacking forecasts and signaling a cooling labor market.

- The place are buyers placing their cash as an alternative of tech? Cash is rotating into “safer” sectors like healthcare and shopper staples, and a few are shifting into gold, which rose again close to the $5,000 an oz vary.