International demographic shifts and rising wealth might energy cryptocurrency adoption and asset demand effectively into the following century.

Demand for world property, together with cryptocurrencies, is predicted to be pushed by an growing older world inhabitants and elevated productiveness worldwide, leading to an older inhabitants with extra capital to take a position.

This dynamic will drive asset demand till the yr 2100, based on the US Federal Reserve Financial institution of Kansas Metropolis. “For asset demand, inhabitants growing older signifies that the upward pattern from latest many years will proceed,” a analysis report revealed on Aug. 25 mentioned.

“Utilizing demographic projections to increase our historic evaluation, we challenge that growing older will increase asset demand by a further 200% of GDP between 2024 and 2100.”

The report added that this dynamic might “suggest a continued decline in actual rates of interest,” boosting demand for various investments resembling Bitcoin (BTC).

Supply: Kansascityfed.org

Associated: Crypto dealer turns $3K into $2M after CZ put up sends memecoin hovering

Buyers will worth Bitcoin like gold in subsequent 75 years

Whereas cryptocurrencies are nonetheless thought of dangerous property, rising regulatory readability might lead the growing older inhabitants to worth Bitcoin (BTC) as a lot as gold over the following 75 years, based on Gracy Chen, CEO of cryptocurrency trade Bitget.

About one-third, or 34% of world cryptocurrency holders had been aged between 24 to 35 as of December 2024, based on a report by crypto fee firm Triple-A.

Whereas crypto stays a risky asset class, rising regulatory readability and institutional merchandise like ETFs might make Bitcoin extra engaging to older buyers, Chen advised Cointelegraph.

“The maturity of crypto rules being labored on in the mean time can play a very good function in fueling future calls for for the asset class.”

Chen added that crypto’s rising “authorities backing” and confirmed function as a retailer of worth will see the growing older inhabitants “evolve to worth Bitcoin as a lot as they’ve come to worth gold inside a 75-year hole.”

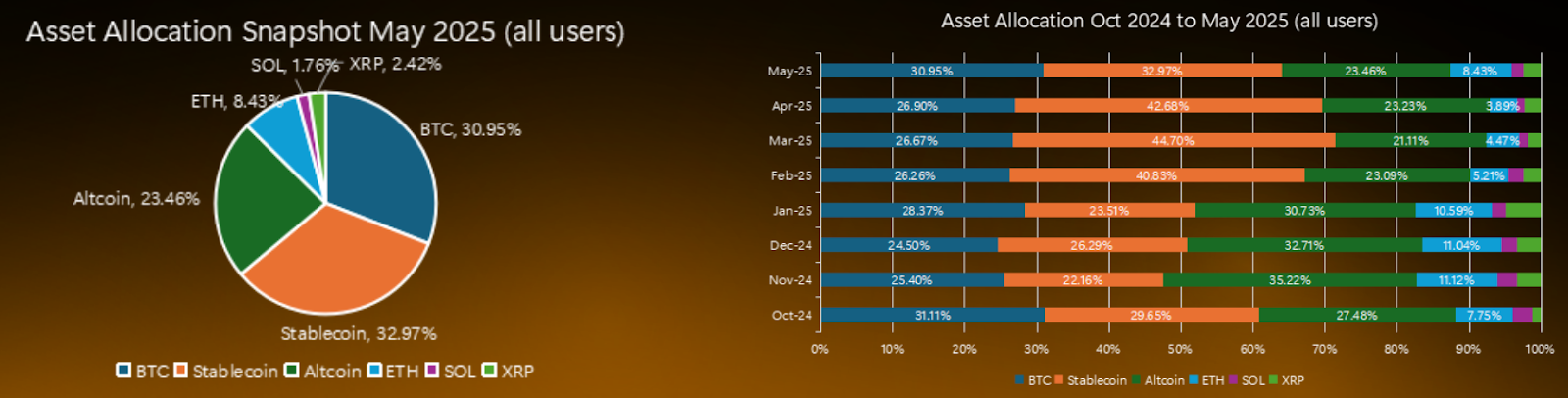

Crypto investor asset allocation. Supply: Bybit Analysis

Bitcoin accounted for one-third, or 30.95%, of complete property in investor portfolios as of Might, up from 25.4% in November 2024.

Associated: Bitcoin ETFs kickstart ‘Uptober’ with $3.2B in second-best week on report

Rising wealth fuels crypto diversification

Analysts at cryptocurrency trade Bitfinex mentioned that rising world wealth will probably translate into higher threat urge for food and diversification into rising asset courses resembling crypto.

“Growing private wealth will increase diversification into newer property, as threat urge for food develops,” the analysts advised Cointelegraph. “We see larger wealth ranges feeding by way of into elevated demand for crypto, whereas buyers with longer funding horizons usually tend to be open to investing in Bitcoin.”

They added that youthful, extra tech-savvy buyers “will look extra favorably at altcoins and newer crypto tasks, given their higher understanding of know-how and threat tolerance.”

Journal: Bitcoin is ‘humorous web cash’ throughout a disaster: Tezos co-founder