Liquidity on South Korea’s cryptocurrency exchanges appears to be like deceptively easy on the floor, however Kaiko Analysis finds that beneath the headline volumes lies a much more nuanced—and infrequently unforgiving—market construction.

South Korea’s Crypto Liquidity Is Sophisticated—Kaiko Analysis Explains Why

In its report, “The State of Liquidity on Korean Crypto Markets,” Kaiko Analysis defines liquidity not as uncooked buying and selling exercise, however as the flexibility to execute sizable orders rapidly and near prevailing costs with out distorting the market, an ordinary that calls for greater than a single metric.

Based on the analysts, liquidity should be evaluated throughout time, market regimes, and execution situations relatively than inferred from quantity alone. Kaiko‘s strategists emphasize that no single indicator captures liquidity in full. As a substitute, the agency combines buying and selling quantity, bid-ask spreads, market depth, and slippage to construct a multidimensional framework tailor-made to cryptocurrency markets, significantly these dominated by retail participation like South Korea’s.

Supply: Kaiko’s report known as “The State of Liquidity on Korean Crypto Markets.”

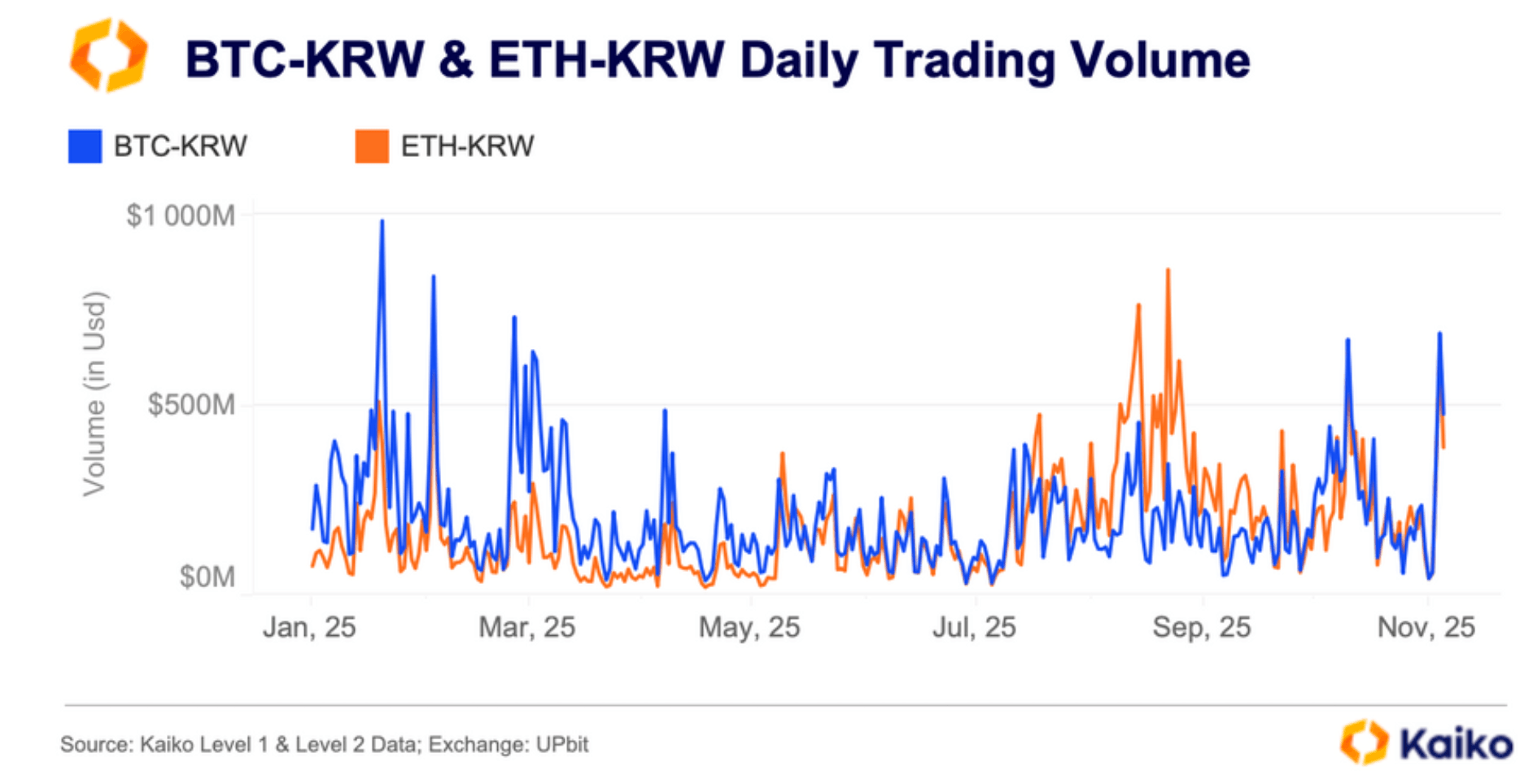

Quantity, whereas helpful, typically spikes throughout stress occasions exactly when execution high quality deteriorates, a dynamic Kaiko statisticians noticed through the Oct. 10, 2025, market dislocation. Spreads, one other cornerstone metric in Kaiko Analysis’s framework, reveal the implicit price of immediacy. Slim spreads sign simpler entry and exit, whereas wider spreads level to heightened threat for market makers, particularly throughout volatility spikes.

The analysts observe that spreads in crypto are formed not solely by volatility, but additionally by order e book depth, platform fragmentation, and tick-size design. Tick sizes play an outsized position in Korea’s crypto ecosystem, based on the market specialists. Main exchanges corresponding to Upbit and Bithumb have traditionally favored bigger tick sizes in KRW markets, prioritizing stability and readability over ultra-fine worth granularity.

Whereas bigger ticks mechanically widen minimal spreads, Kaiko researchers discover they will additionally focus liquidity at fewer worth ranges, supporting seen depth and smoother execution for retail-heavy flows. Market depth, one other key pre-trade metric highlighted by Kaiko Analysis, measures how a lot quantity sits close to the midprice and the way resilient costs are to bigger orders.

Nonetheless, the researchers warn that displayed depth will be deceptive because of quote staleness, fleeting orders, and hidden liquidity, corresponding to iceberg orders, all of which complicate real-world execution outcomes. To bridge the hole between what merchants see and what they really get, Kaiko Analysis depends closely on slippage evaluation. Slippage captures the distinction between anticipated and realized execution costs primarily based on real-time order e book situations, providing an execution-centric view of liquidity prices.

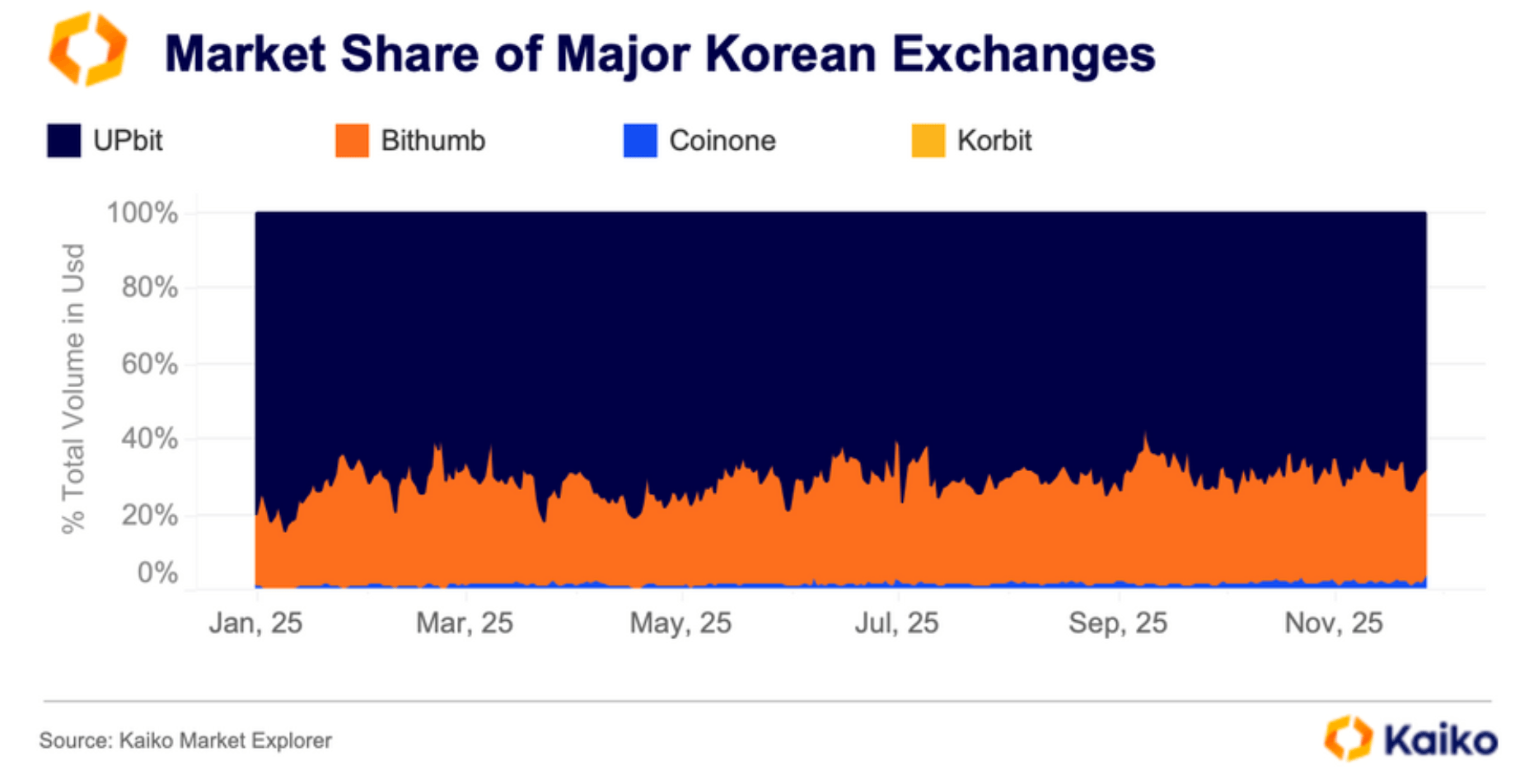

Even then, Kaiko stresses that slippage stays path-dependent and varies sharply by change, asset, and time of day. When evaluating Korean exchanges, the report finds that liquidity is overwhelmingly targeting Upbit. All through 2025, Upbit accounted for roughly 70% of complete buying and selling quantity, with considerably deeper order books and decrease execution friction than rivals corresponding to Bithumb, Coinone, and Korbit.

Commerce depend information for main KRW pairs like BTC-KRW and XRP-KRW additional reinforces Upbit’s central position. Price constructions add one other layer to the liquidity equation, based on Kaiko Analysis. Whereas zero-fee buying and selling fashions seem enticing, the report’s authors warning that eliminating specific charges typically shifts prices into wider spreads as market makers search to recuperate misplaced income. Liquidity improves provided that elevated participation offsets the misplaced revenue.

Supply: Kaiko’s report known as “The State of Liquidity on Korean Crypto Markets.”

Token-specific dynamics additionally form liquidity outcomes. Kaiko Analysis highlights the recurring “Kimchi premium,” the place localized demand quickly pushes Korean crypto costs above world benchmarks, attracting arbitrage flows that ultimately realign costs. These episodes illustrate how regulatory constraints and capital controls fragment liquidity throughout jurisdictions.

Macroeconomic shocks present a good starker stress take a look at. Kaiko’s evaluation of South Korea’s temporary December 2024 martial legislation declaration reveals how headline threat can set off explosive quantity alongside thinner depth and wider spreads, a reminder that top turnover doesn’t equal simple execution.

Additionally learn: Korea College Blockchain Institute Companions With Injective as Validator in International Ecosystem

In distinction, Kaiko Analysis observes that bullish phases and new all-time highs have a tendency to attract contemporary capital into order books, compressing spreads and replenishing depth. Liquidity, in different phrases, is cyclical, contextual, and deeply delicate to each sentiment and construction.

In the end, the report concludes that liquidity on Korean crypto exchanges is a shifting goal, formed by market design decisions, price incentives, and investor habits. For merchants and analysts alike, the message is evident: liquidity shouldn’t be a headline quantity—it’s a system, and it calls for scrutiny.

FAQ 🇰🇷

- What does Kaiko Analysis imply by liquidity in crypto markets?Kaiko Analysis defines liquidity as the flexibility to execute massive trades rapidly and close to market costs with out important worth affect.

- Why is quantity alone deceptive when assessing liquidity?Based on Kaiko Analysis, quantity typically spikes throughout stress occasions when execution high quality worsens, making it an incomplete indicator.

- Which Korean change has the deepest liquidity?Kaiko Analysis finds that UPbit dominates Korean crypto liquidity, accounting for about 70% of complete buying and selling quantity in 2025.

- How do tick sizes have an effect on liquidity on Korean exchanges?Kaiko Analysis explains that bigger tick sizes enhance stability and visual depth however enhance minimal spreads and execution prices.