Fintech funds supplier Unlimit has launched a non-custodial platform designed to behave as a clearinghouse for main stablecoins and supply direct international off-ramps.

The corporate stated the service will simplify stablecoin swaps by pairing decentralized change mechanics with its current international funds community.

Based on Tuesday’s announcement, the platform will allow customers to swap and money out stablecoins via a single interface, aiming to scale back fragmentation within the stablecoin market beneath “gasless” and zero-commission conversions.

Unlimit describes the service because the “first non-custodial stablecoin clearing home,” providing direct off-ramps in additional than 150 currencies.

Based in 2009 in London, Unlimit offers fee infrastructure to companies throughout 200 jurisdictions worldwide, in keeping with the corporate’s web site.

In an announcement, CEO Kirill Eves stated stablecoins are more and more functioning as a digital “extension of the US greenback” and framed the platform as a solution to “join the world of DeFi with conventional finance.”

The corporate didn’t say which stablecoins the platform will initially assist.

Associated: Coinbase’s x402 provides id checks to energy AI stablecoin funds

Fintechs broaden into stablecoins

A number of international fintech fee corporations have just lately entered the crypto house, notably focusing on the stablecoin sector.

In Might, Stripe launched stablecoin-based accounts that allow prospects ship, obtain and maintain balances in USDC (USDC) and Bridge’s USDB (USDB), functioning very similar to a conventional greenback account. The function, enabled via Stripe’s 2024 acquisition of Bridge, was rolled out to shoppers in additional than 100 international locations.

In October, Revolut launched 1:1 conversions between US {dollars} and main stablecoins, permitting its 65 million customers to change as much as $578,630 each 30 days with no charges or spreads. The replace sought to take away friction between fiat and crypto, in keeping with a LinkedIn publish from Leonid Bashlykov, Revolut’s head of crypto product.

In November, Jack Dorsey’s fintech firm, Block (previously often known as Sq.), introduced plans so as to add stablecoin send-and-receive performance to its Money App platform.

World fee giants like Visa and Mastercard have additionally been getting in on the motion.

In October, Visa disclosed plans so as to add assist for stablecoins throughout 4 blockchains, with CEO Ryan McInerney telling buyers that the corporate will proceed to develop its stablecoin choices after a powerful yr.

In November, Mastercard partnered with Thunes to allow close to real-time payouts to stablecoin wallets via the Mastercard Transfer community.

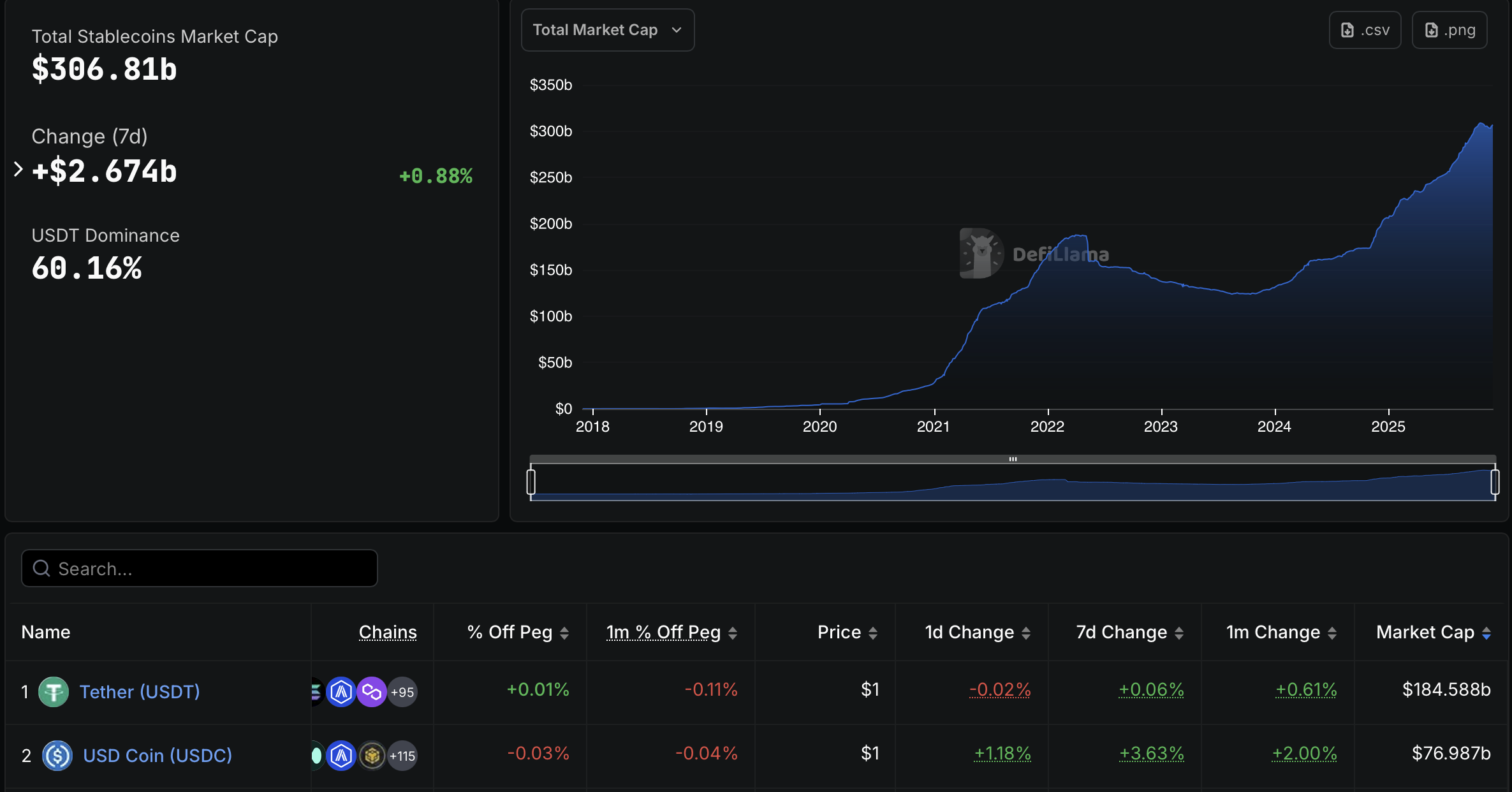

The entire stablecoin market is about $306.8 billion, in keeping with DefiLlama information.

Stablecoin market cap. Supply: DefiLlama

Journal: China formally hates stablecoins, DBS trades Bitcoin choices: Asia Specific