Valour, a subsidiary of publicly listed digital asset firm DeFi Applied sciences, has obtained approval to launch a Solana exchange-traded product (ETP) in Brazil, providing native buyers regulated publicity to one of many largest cryptocurrencies by market capitalization as institutional curiosity within the area continues to develop.

The product, Valour Solana (VSOL), is scheduled to start buying and selling on Wednesday following approval from Brazil’s major inventory change, Brasil, Bolsa, Balcão (B3 S.A.), DeFi Applied sciences introduced Tuesday.

The Solana (SOL) product will be part of Valour’s increasing lineup of Brazil-listed ETPs, which already present publicity to Bitcoin (BTC), Ether (ETH), XRP (XRP) and Sui (SUI).

Like Valour’s different choices within the nation, VSOL can be denominated in Brazilian reais and designed to trace the efficiency of Solana, one of the vital energetic layer-1 blockchain networks, inside a standard capital markets construction.

The launch displays Valour’s broader technique to increase past its core European markets, with Brazil rising as a key focus for its worldwide progress.

Supply: Valour Funds

Associated: Why Brazil is utilizing Bitcoin as a treasury asset and what different nations can be taught

Brazilian crypto adoption accelerates

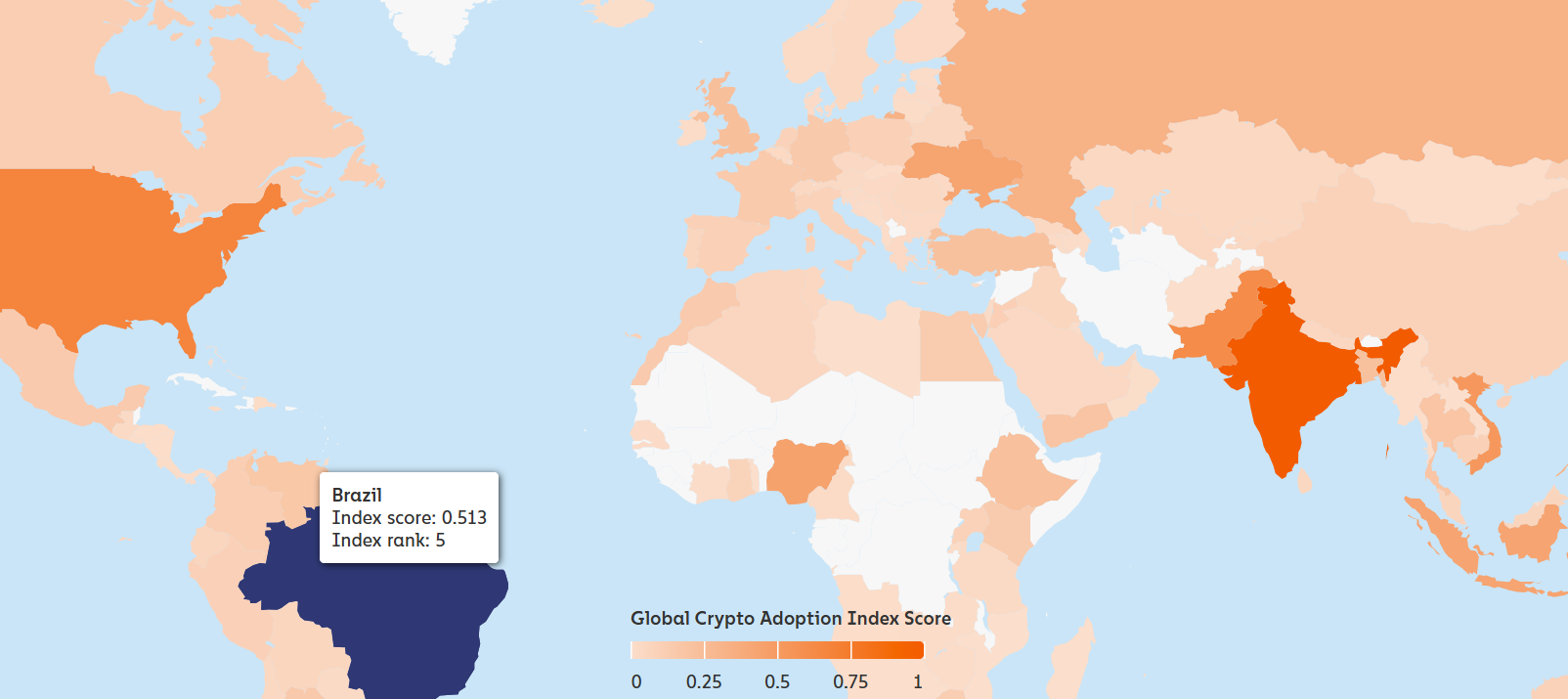

Digital asset adoption in Brazil has been gaining momentum for a number of years, with the nation rating fifth globally in a latest Chainalysis report, behind solely India, the US, Pakistan and Vietnam.

Brazil scored strongly throughout a number of classes, together with retail use of centralized companies, decentralized finance exercise and institutional entry.

Brazil has emerged as a key hub for digital property, pushed by excessive transaction volumes and broad entry to cryptocurrency companies amongst each retail and institutional buyers. Supply: Chainalysis

A key driver of that progress has been the enlargement of stablecoin-based cost rails. Brazil’s central financial institution has acknowledged the widespread use of stablecoins for funds, significantly in cross-border transactions.

As Cointelegraph reported, this development enabled native fintech firm Crown to boost capital for launching a real-denominated stablecoin geared toward institutional buyers searching for publicity to Brazil’s fixed-income market.

Crypto exchanges have additionally contributed to the sector’s enlargement. Mercado Bitcoin, one in every of Latin America’s largest digital asset platforms, has lately expanded its focus towards tokenizing real-world property, positioning itself to fulfill institutional demand for blockchain-based monetary merchandise.

Associated: Brazil classifies stablecoin funds as international change below new guidelines