Prediction markets hit report weekly buying and selling volumes final week as merchants more and more transfer to wager on main political occasions, crypto-related outcomes, and sports activities markets.

The rising exercise displays rising curiosity in event-based buying and selling throughout a number of sectors. Nonetheless, this fast enlargement has additionally introduced renewed considerations over market fragmentation and insider buying and selling.

Prediction Markets Break Quantity Data Whereas Dealer Good points and Losses Mount

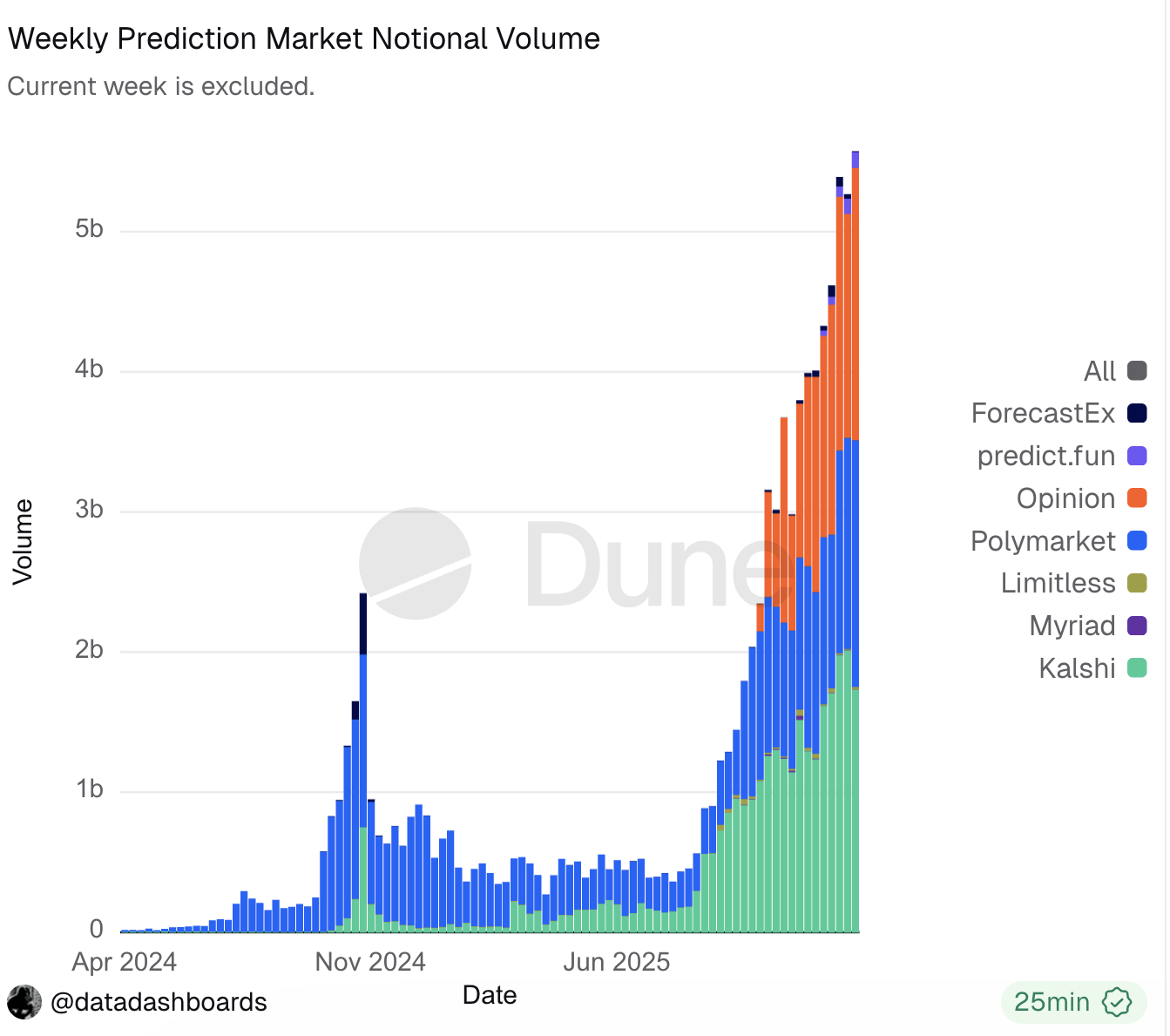

Based on Dune information, prediction markets posted a report $3.7 billion in weekly buying and selling quantity final week, marking an all-time excessive. Weekly notional quantity additionally surged to a brand new report of $5.57 billion.

The acceleration extends a pattern that started in 2025, when prediction market exercise began to outpace buying and selling volumes in meme cash and non-fungible tokens (NFTs).

Prediction Market Weekly Notional Quantity. Supply: Dune

Person engagement has additionally risen. Weekly lively customers peaked at 335,583 within the first week of January, whereas transaction counts adopted an identical upward trajectory.

Knowledge exhibits that exercise stays fairly concentrated, with three classes accounting for almost all of weekly notional quantity. On Polymarket, buying and selling is primarily pushed by political occasions, sports activities, and crypto-related markets. Kalshi has exhibited a comparable sample.

This focus can also be mirrored on the particular person dealer stage. Lookonchain reported {that a} Polymarket dealer “beachboy4” staged a dramatic turnaround, transferring from greater than $6.8 million in losses to roughly $395,000 in revenue after betting on sports activities outcomes.

Over the previous two days alone, the dealer reportedly profited greater than $10.5 million throughout 5 profitable predictions, totally recovering earlier losses.

“That stated, his wager sizes have surged — from a number of hundred thousand per wager earlier than to over $3 million on a single wager now” the publish added.

Nonetheless, not all merchants have seen related outcomes. On Polymarket, 2 customers misplaced almost $10 million in lower than a month, highlighting the dangers related to event-based markets.

“2 Polymarket merchants wager closely on sports activities markets at 48¢–57¢, and misplaced almost $10M in lower than a month. 0x4924: 346 predictions, 46.24% win charge, -$5.96M in 24 days. bossoskil1: 65 predictions, 41.54% win charge, -$4.04M in 11 days At ~50¢ odds, you’re mainly flipping a coin. Betting large simply means shedding quicker,” Lookonchain famous.

Past retail customers, main business gamers are additionally transferring to capitalize on the pattern. Coinbase is reportedly making ready to launch its personal prediction markets. Furthermore, a Gemini affiliate has secured regulatory approval to start providing prediction markets to US clients.

Trump Media & Know-how Group has likewise signaled intentions to enter the house. In December, Fanatics, a sports activities platform, introduced the launch of a fan-led prediction market platform via a strategic partnership with Crypto.com.

Rising Issues Encompass Prediction Markets

Nonetheless, some specialists have raised considerations relating to the surge in markets, calling it the “endgame” for the sector.

the endgame for prediction markets:

– anybody can create a market

– creators earn charges from the quantity they generatetotally customized and permissionless

— nairolf (@0xNairolf) January 17, 2026

Others argue that the variety of markets just isn’t the core problem. As an alternative, liquidity stays the most important problem dealing with prediction markets.

“All this can incentivize is only a ton of 0 liquidity markets persons are spamming to make 5 cents of creator charges,” Alex Finn acknowledged.

Past fragmentation, insider buying and selling has emerged as one other urgent concern for prediction markets. A collection of latest episodes has raised questions on whether or not private info is shaping market outcomes.

In a single case, three wallets collectively recorded income of greater than $630,000 on Polymarket after wagering on the removing of Nicolás Maduro earlier than his arrest was introduced. Elsewhere, a dealer reportedly generated near $1 million from bets tied to Google’s 2025 “Yr in Search” outcomes.

Comparable patterns have been noticed round leisure occasions. On Polymarket, customers positioned 27 wagers on Golden Globe Award outcomes, with 26 settling within the cash. These unusually correct outcomes have fueled rising considerations that insider data could also be influencing exercise on prediction platforms.

The publish Prediction Markets Hit File Buying and selling Quantity as Fragmentation Issues Mount appeared first on BeInCrypto.