Crypto derivatives exercise picked up sharply in 2025 as merchants more and more turned to onchain perpetual futures, in line with Coinbase researcher David Duong. By late within the yr, decentralized exchanges have been processing greater than $1 trillion in month-to-month perpetual futures quantity, underscoring the rising function of onchain derivatives markets.

In a publish revealed Monday on X, Duong stated the development was pushed partly by the absence of a standard altcoin season, which led merchants to hunt increased returns by leverage fairly than spot markets. He added that the “unprecedented diploma of leverage” out there in perpetual futures allowed merchants to amplify publicity with comparatively small quantities of capital.

Duong famous that the surge in exercise has been pushed primarily by decentralized buying and selling platforms, with onchain venues akin to Aster and Hyperliquid accounting for a lot of the amount.

Supply: David Duong

Perpetual futures, or perps, are crypto derivatives that allow merchants acquire leveraged publicity to cost actions with out an expiration date.

In line with Duong, fairness perpetual futures might emerge as a subsequent space of progress, as tokenized inventory derivatives could mix crypto’s 24/7 entry and leverage with demand for publicity to main US equities outdoors conventional market hours.

“Nonetheless, we expect perpetual futures are evolving past remoted, high-leverage buying and selling automobiles and have gotten core, composable primitives inside DeFi markets,” he stated.

Competitors intensifies amongst onchain perpetual futures platforms

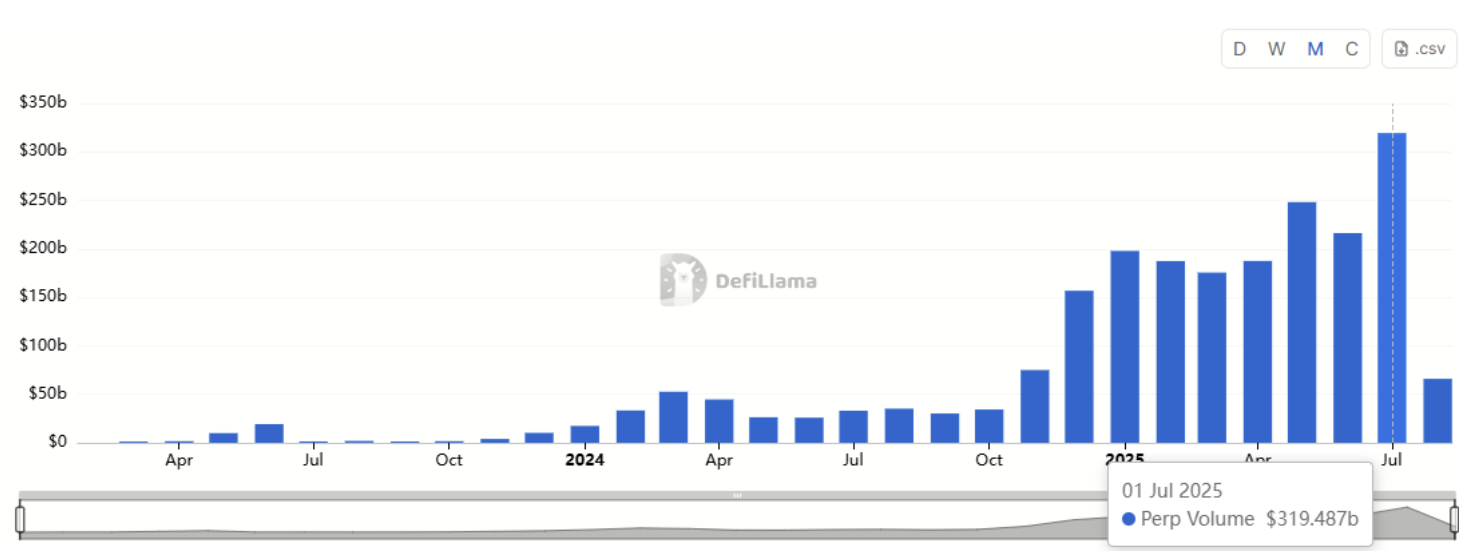

Hyperliquid launched its onchain perpetual futures platform in late 2023 and gained broader traction in 2024 after it added spot buying and selling. In July, the platform posted a document quantity, with knowledge from DeFiLlama exhibiting the change processed about $319 billion in trades over the month.

Hyperliquid buying and selling quantity. Supply: DefiLlama

Competitors within the crypto perpetual futures market has intensified over the previous yr. In September, shortly after its token technology occasion and launch, Aster briefly topped decentralized perpetual futures rankings with almost $36 billion in 24-hour buying and selling quantity, accounting for greater than half of whole perp DEX exercise.

In November, Lighter, an onchain perpetual futures change based by tech entrepreneur Vladimir Novakovski in 2022, raised $68 million in a funding spherical following the launch of its public mainnet.

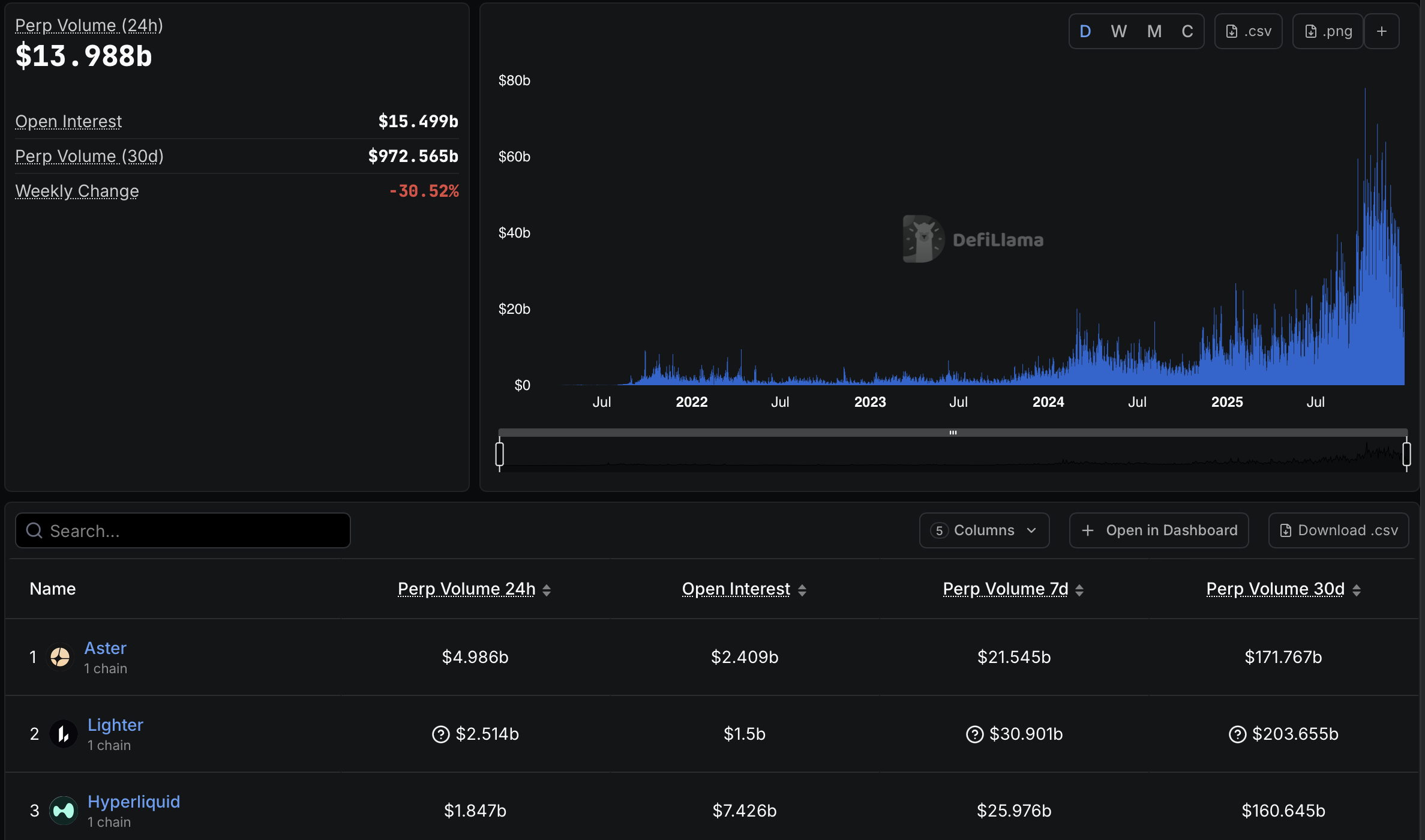

Over the previous 30 days, knowledge from DeFiLlama reveals onchain perpetual futures generated about $972 billion in buying and selling quantity. Throughout the identical interval, Lighter led buying and selling with about $203 billion in quantity, adopted by Aster at roughly $171.8 billion and Hyperliquid with about $160.6 billion.

Onchain perpetual change volumes. Supply: DefiLlama

Journal: Meet the onchain crypto detectives preventing crime higher than the cops