It is a phase from the Lightspeed publication. To learn full editions, subscribe.

Not a lot of crypto’s prime 15 tokens by market capitalization had been first issued after FTX’s collapse. Two exceptions are SUI, which started buying and selling in mid-2023, and HYPE — which has risen to over $11 billion in market capitalization since being airdropped in November 2024.

HYPE, which is the native token of the Hyperliquid layer-1, has greater than tripled in worth since a neighborhood backside on April 6, outpacing SOL’s roughly 70% achieve over that point span. For crypto buyers looking for the subsequent layer-1 token that might seize Solana-like returns, HYPE is producing a variety of hype. Even Galaxy’s Mike Novogratz is on board.

Hyperliquid’s core layer-1 appchain, known as HyperCore, is purpose-built for Hyperliquid’s order guide trade, which generates charges and results in token buybacks. This product may be very widespread: Hyperliquid accounted for 77% of onchain perpetuals buying and selling quantity in April, in keeping with information from Artemis. Hyperliquid additionally has an Ethereum Digital Machine community known as the HyperEVM, however its adoption is so much more muted than HyperCore.

So, there’s some confusion on HYPE: Ought to it’s valued like a perps DEX that’s maxing out demand within the perps DEX market, or like a layer-1 that might compete with the likes of Ethereum and Solana?

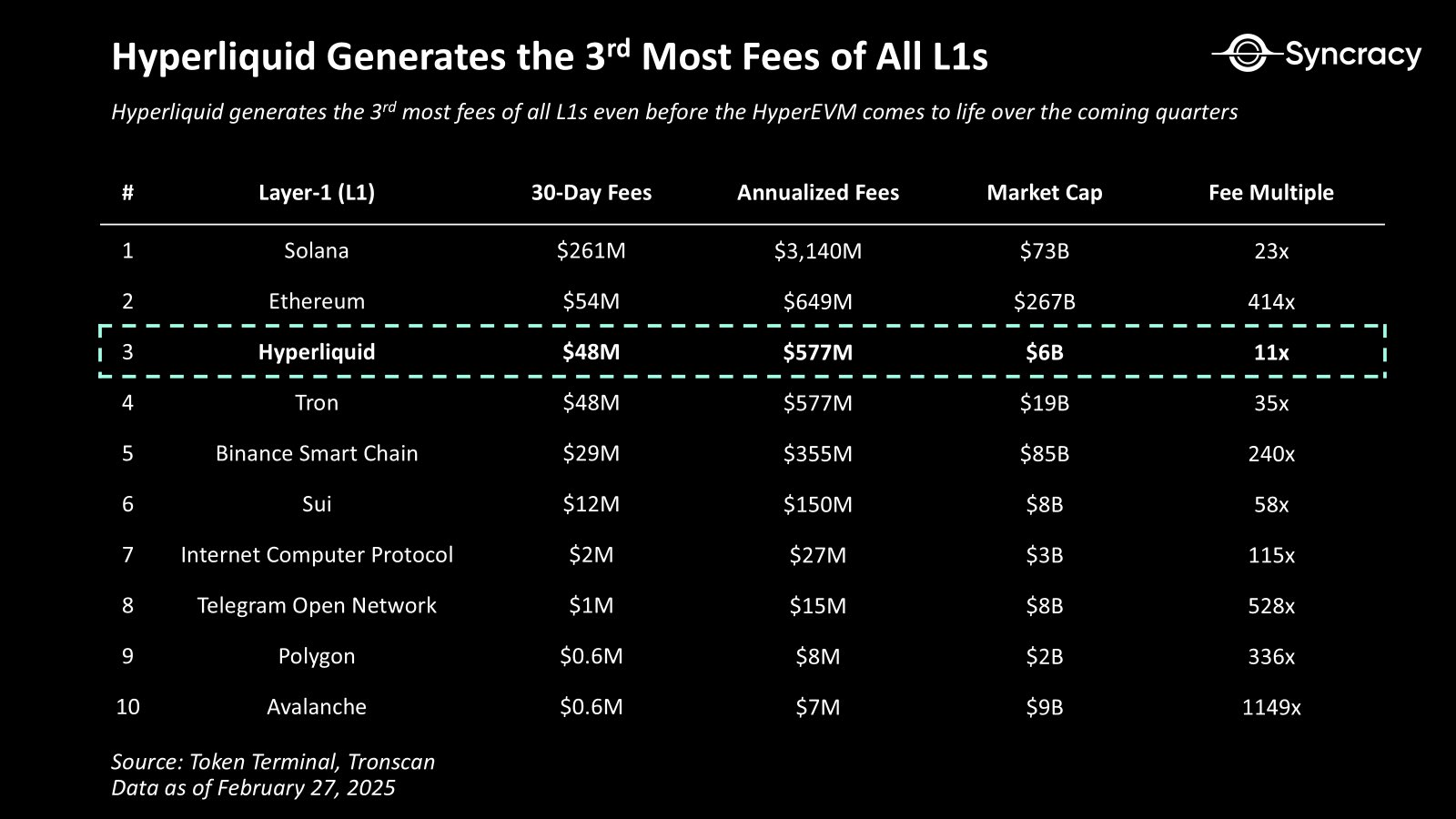

HYPE is priced someplace within the center. Ryan Watkins of Syncracy Capital — which has positions in each HYPE and SOL — posted a chart exhibiting in early March how Hyperliquid was buying and selling at a decrease charge a number of than different L1s, together with Solana.

Supply: Ryan Watkins on X.

However as Blockworks Analysis analyst Boccaccio has identified, Hyperliquid trades at the next totally diluted valuation (FDV) to charges ratio relative to competitor perps DEXs in Drift and dYdX, indicating it’s extra invaluable to buyers in comparison with easy perps DEXs.

Bitwise Analysis analyst Danny Nelson mentioned Hyperliquid goals to create a vibrant blockchain financial system like Solana’s, but it surely’s “not fairly there but.”