Hyperliquid hit one other milestone in establishing its place as a key $BTC buying and selling hub. The perpetual futures and spot market surpassed Binance’s depth on $BTC pairs.

Hyperliquid achieved the largest top-of-book market depth, bringing essentially the most favorable bid and ask costs for $BTC. The 1 foundation level from mid depth on Hyperliquid reached $3.1M on Hyperliquid, versus $2.3M on Binance, which means the Hyperliquid market might take in extra promoting with out slippage.

Over time, the Hyperliquid market turned essentially the most liquid venue for crypto worth discovery amongst each centralized and decentralized markets. Binance perpetual futures got here second, regardless of the trade’s increased volumes, famous Jeff Yan, Hyperliquid’s founder and technical chief.

Hyperliquid takes over extra of Binance’s market share

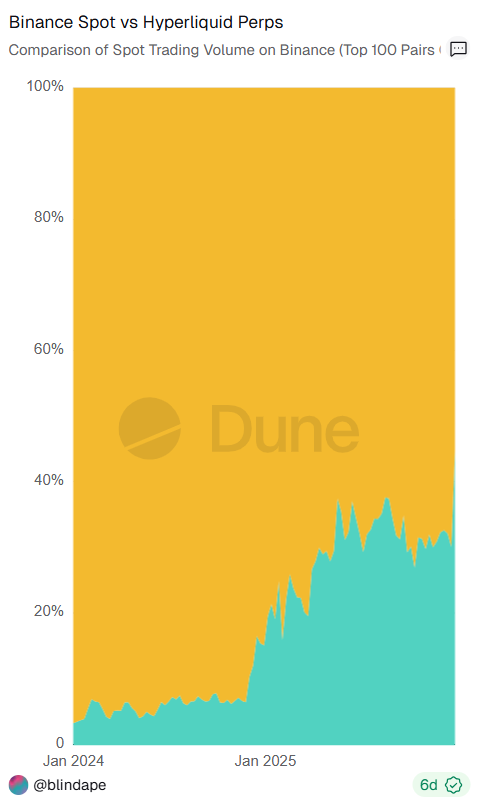

The elevated market depth is simply one of many markers within the competitors between Binance and Hyperliquid. The 2 buying and selling venues have been tracked for months, indicating a shift in dealer conduct.

Hyperliquid is gaining market share, and is already catching up with Binance’s spot market. Binance remains to be the chief in centralized perpetual futures buying and selling. | Supply: Dune Analytics

Hyperliquid remained the chief in perpetual futures buying and selling, nonetheless forward of Aster, a Binance-backed competing trade. Just lately, Hyperliquid additionally gained market share towards Binance’s spot market as a benchmark for crypto exercise.

Binance nonetheless carries 86% of the perpetual futures quantity towards 13.9% for Hyperliquid. Nonetheless, Hyperliquid’s quantity is similar to the highest 100 pairs on the Binance spot market.

For now, Hyperliquid remains to be the smallest trade, however it’s nonetheless present process sturdy development. The market carries $7.9B in open curiosity, attempting to recuperate from the October 2025 deleveraging.

Past a basic buying and selling venue, Hyperliquid remains to be the trade utilized by high-profile whales, with positions seen as an indicator of market sentiment. The latest market restoration additionally led the trade’s native token HYPE to rise to a one-month excessive at $33.55.

HIP-3 quantity information increase Hyperliquid’s place

Liquidity on the perpetual futures DEX is just not restricted to $BTC. The HIP-3 platform, which carries user-generated pairs, confirmed its capabilities in constructing liquid markets with important depth.

In response to researcher Shaunda Devens, HIP-3 has a extra sturdy marketplace for silver in comparison with Binance. The HIP-3 pair affords $33K in liquidity simply days after launching, in comparison with $24K for Binance’s buying and selling pair.

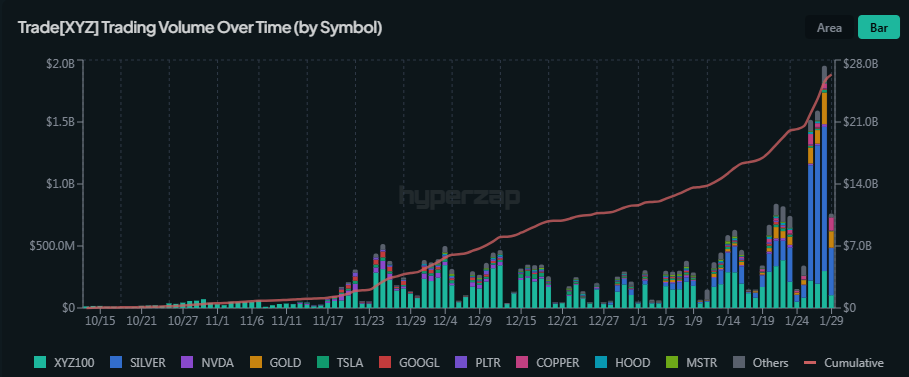

Just lately, HIP-3 set information for buying and selling quantity and open curiosity. The platform had $29.35B in buying and selling volumes, reaching a document prior to now day. The platform invited greater than 72K each day energetic merchants.

HIP-3 reached peak buying and selling volumes pushed by the sudden curiosity in a brand new silver-based perpetual futures pair. | Supply: HIP-3

The most recent enlargement in HIP-3 liquidity was tied to the launch of silver buying and selling pairs, reaching document affect prior to now day.

Commerce XYZ is essentially the most energetic deployer of buying and selling pairs, just lately increasing its affect in buying and selling metals and inventory positions. Total, HIP-3 expanded its affect to make up over 35% of whole volumes within the Hyperliquid ecosystem. The competitors between deployers is simply heating up, attempting to open in-demand markets and appeal to liquidity.