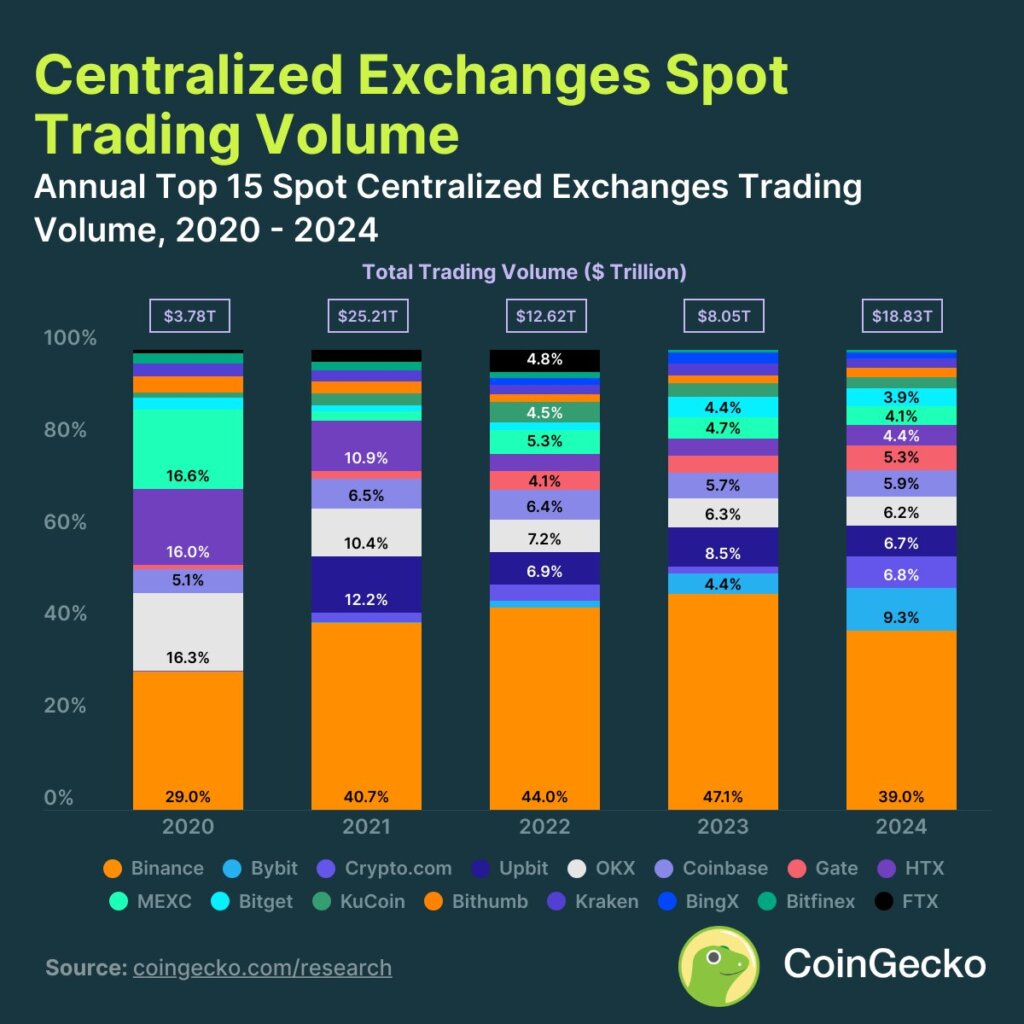

Crypto buying and selling volumes throughout centralized exchanges reached $18.83 trillion in 2024, in line with a brand new CoinGecko report. The examine examined the annual cumulative spot buying and selling quantity of the main centralized crypto exchanges from January 2020 by means of December 2024, revealing shifts in market share and buying and selling exercise over the interval.

Per CoinGecko, Binance accounted for 39.0% of the amount with $7.35 trillion in transactions, whereas Bybit and Crypto.com recorded $1.75 trillion and $1.29 trillion in buying and selling quantity, representing market shares of 9.3% and 6.8%, respectively.

The report highlights that, regardless of a 134.0% improve from 2023’s $8.05 trillion, 2024’s complete stays beneath the all-time excessive of $25.21 trillion in 2021. That peak marked a 566.8% leap from 2020’s $3.78 trillion, pushed by market situations that included a record-breaking bull cycle, heightened retail participation, and the debut of main corporations on public markets. The 2021 interval noticed Bitcoin surge previous earlier limits and a flurry of exercise round stablecoins, altcoins, and non-fungible tokens, contributing to unprecedented buying and selling volumes.

Smaller exchanges see development all through 2024

CoinGecko’s knowledge additional illustrates that Crypto.com skilled essentially the most dramatic development amongst centralized exchanges, with its annual buying and selling quantity rising from $120.6 billion in 2023 to $1.29 trillion in 2024—a 969.7% improve that pushed it over the $1 trillion threshold for the primary time.

Bybit additionally recorded vital positive factors, with buying and selling volumes increasing 397.8% from $351.2 billion in 2023 to $1.75 trillion in 2024. Gate.io, whereas smaller in scale, Gate.io reported a development charge of 241.5%, growing its quantity from $294.5 billion in 2023 to $1.01 trillion in 2024.

The shifting hierarchy amongst exchanges displays a market in flux, as established platforms like Binance preserve their dominant place regardless of a slight dip in market share in comparison with earlier years.

In distinction, exchanges that when held bigger parts of the market, together with OKX, HTX, and MEXC, have seen their shares contract—from double-digit percentages in 2020 to single digits by the top of 2024. The report additionally notes that early entrants corresponding to FTX, which had represented 2.6% of quantity in 2021 and 4.8% in 2022, are now not an element within the present panorama as a result of their eventual collapse.

Examine methodology and general findings

CoinGecko’s methodology concerned monitoring the annual cumulative spot buying and selling volumes of the highest 15 centralized exchanges, together with longstanding entities and comparatively new market gamers like Crypto.com and Bybit.

The evaluation illustrates that whereas general exercise in 2024 has rebounded from the declines noticed in 2022 and 2023, it has not recaptured the frenetic tempo of 2021. The information signifies that new exchanges have steadily eroded the market share of earlier leaders, suggesting a consolidation of buying and selling exercise amongst platforms that proceed to adapt to shifting regulatory, technological, and user-driven forces.

Binance’s constant efficiency amid these shifts and Crypto.com’s breakthrough in surpassing the $1 trillion quantity mark displays the continuing restructuring of market share. The examine in the end reveals that whereas buying and selling exercise in 2024 marked a notable restoration from latest downturns, the amount nonetheless lags behind the bull market peak witnessed in 2021.