Coinbase will discontinue help for wrapped Bitcoin (WBTC) on December 19, 2024, throughout its platforms, together with Coinbase.com, Coinbase Alternate, and Coinbase Prime, the alternate shared in a press release.

The particular causes for the delisting weren’t disclosed. Nevertheless, Coinbase stated its choice was primarily based on its “most up-to-date assessment,” suggesting that WBTC would possibly not meet its itemizing requirements.

We usually monitor the property on our alternate to make sure they meet our itemizing requirements. Based mostly on our most up-to-date assessment, Coinbase will droop buying and selling for wBTC (wBTC) on December 19, 2024, on or round 12pm ET.

— Coinbase Property 🛡️ (@CoinbaseAssets) November 19, 2024

The alternate has additionally moved WBTC order books to limit-only mode, permitting customers to position and cancel restrict orders. Customers will retain entry to their wBTC funds and preserve withdrawal capabilities after suspension.

We have now moved our wBTC order books to limit-only mode. Restrict orders will be positioned and canceled, and matches might happen.

When you’ve got any questions concerning this replace, please go to: https://t.co/aZsdyDqkAS

— Coinbase Property 🛡️ (@CoinbaseAssets) November 19, 2024

The delisting of WBTC comes after Coinbase launched its personal wrapped Bitcoin token, Coinbase Wrapped BTC (cbBTC), in September. Coinbase’s cbBTC is an ERC-20 token backed 1:1 by Bitcoin held in Coinbase custody and goals to offer customers with a extra trusted and built-in possibility for accessing dApps.

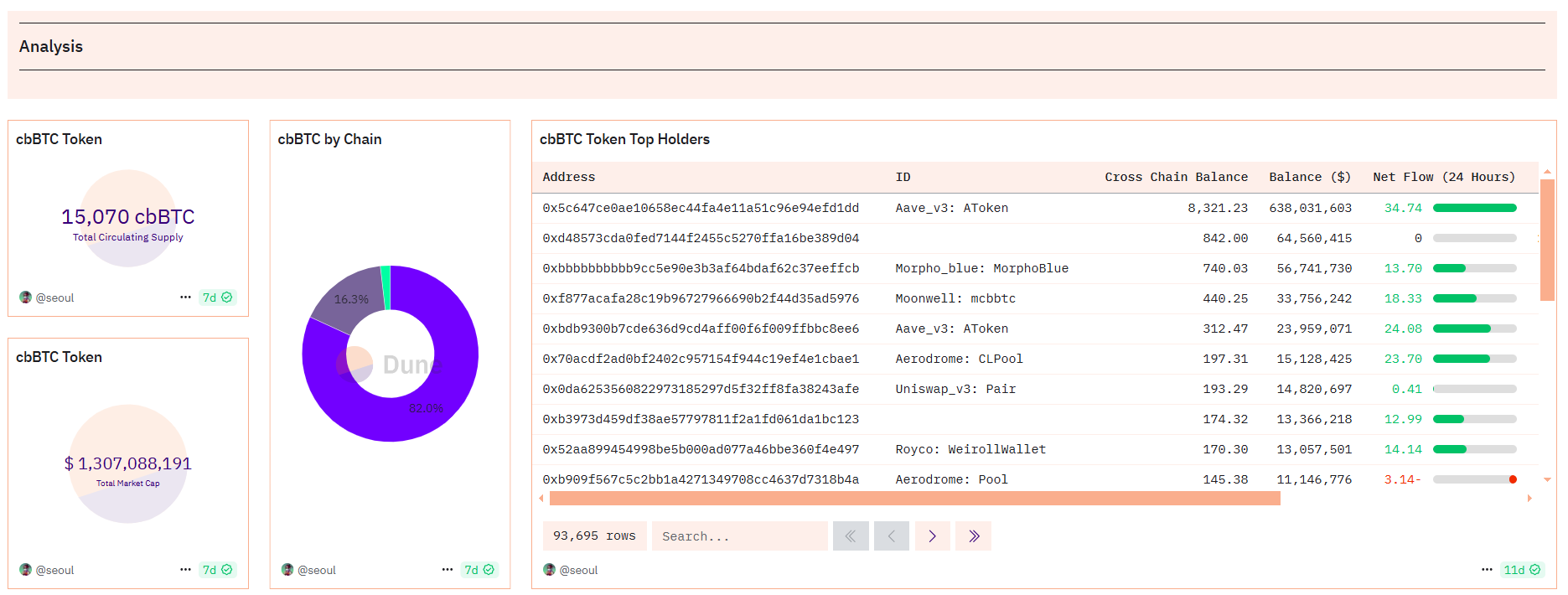

CbBTC has a $1.3 billion market capitalization as of November 19, in response to Dune Analytics. The token has reached a circulating provide of 15,070 tokens, with 82% on Base, 16% on Ethereum, and the rest on Solana.

Launched by means of a collaboration between BitGo, Kyber Community, and Ren, WBTC permits Bitcoin holders to interact with quite a few DeFi protocols on Ethereum. WBTC is at present essentially the most extensively used wrapped Bitcoin token in DeFi, however cbBTC might quickly problem its dominance.