Centralized exchanges elevated spot volumes in October, additional demonstrating the development of abandoning the risk-heavy spinoff markets. Exchanges additionally noticed a basic improve in site visitors.

Spot quantity on centralized exchanges expanded by 36% in October towards the earlier month. Spot exercise grew at a sooner tempo in comparison with spinoff buying and selling. Spinoff buying and selling quantity additionally grew, however solely by 27% for the previous month.

The centralized exercise mirrored a mixture of components, together with the bullish expectation for “Uptober”. Through the October 10-11 crash, Binance and different markets have been additionally extraordinarily lively in absorbing each retail and whale volumes.

Beforehand, Cryptopolitan reported that BTC had achieved its second-highest month by way of spot buying and selling. The development additionally unfold to different belongings represented on exchanges.

KuCoin leads spot development, derivatives amongst all centralized exchanges

The current market turbulence redistributed exercise on exchanges. Regardless of the general slowdown on South Korean markets, KuCoin noticed 240% development in spot volumes in October, after months of slowing down.

Bitfinex expanded its spot buying and selling by 67%, whereas Gate added 45%. The return to identify exchanges adopted the current abandonment of meme platforms. Upbit, Bitget, and Bybit noticed slower spot exercise development, although nonetheless with a slight growth for the previous month.

KuCoin spinoff development reached 185% for the month, with 66% growth on Deribit and 41% on Crypto.com. Binance expanded its spinoff volumes by 26%, although ranging from a powerful foundation. The current volumes don’t exclude suspected wash buying and selling or bot-generated volumes.

As an entire, site visitors redirected to Gate, Bitfinex, and Upbit, whereas HTX misplaced 32% of its visits prior to now month. The growth of exercise additionally mirrored the anomalous rush to exchanges through the October 10-11 liquidations.

Throughout that point, among the markets have been inaccessible, whereas others acquired complaints of non-transparent liquidations. Centralized exchanges absorbed inflows from each whale wallets and short-term retail sellers. Together with net utilization and volumes, exchanges additionally noticed peak stablecoin deposits, in addition to elevated actions of BTC from exterior wallets.

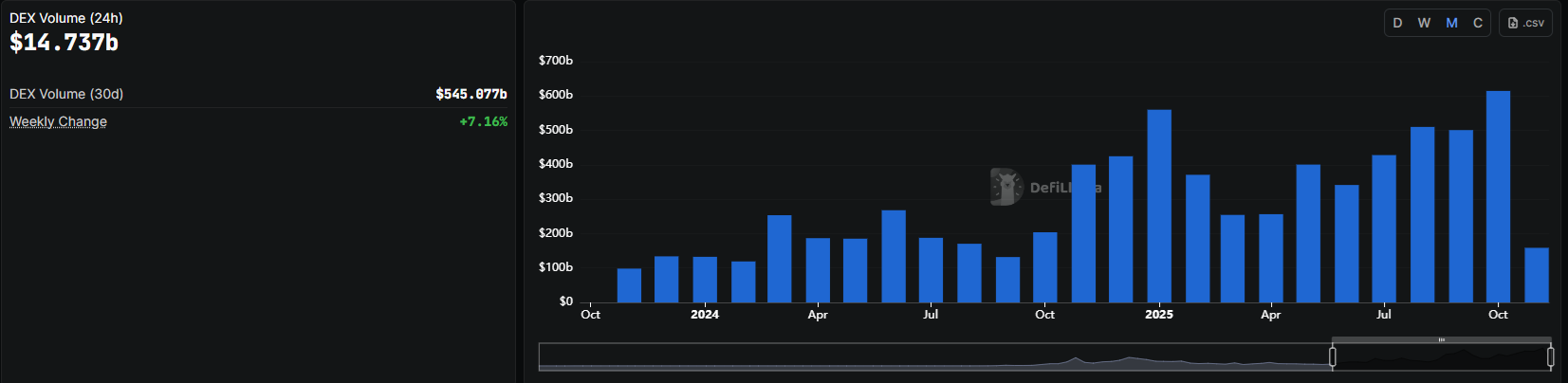

DEX exercise peaked prior to now month

The ratio of DEX to CEX remained unchanged, whereas each varieties of exchanges noticed important development in October.

Over 19% of all change exercise is on decentralized markets. In October, DEX achieved over $614B in complete exercise. Every day buying and selling volumes now attain over $14B, because the development continued in November.

DEX exercise additionally elevated in October, a mixture of spot volumes and perpetual DEX buying and selling. | Supply: DeFi Llama

Solana was among the many main chains, with over $148B in DEX quantity for the previous month. The chain surpassed Ethereum’s end result, which got here in shut at $143B.

DEX exercise remained excessive in 2025, principally pushed by retail adoption and higher integrations. Whereas meme token buying and selling slowed down, DEX was a key element for swapping altcoins or wrapped BTC and ETH.

The combo of rising CEX and DEX exercise confirmed the crypto market had excessive inside exercise, pushed by a document provide of stablecoins. Whereas exterior inflows are slowing down, the crypto market now has extra instruments for shifting liquidity internally, to new varieties of tasks or platforms.