Bybit recovered its Bitcoin (BTC) market depth to ranges since earlier than this February’s hack. The assault principally affected Ethereum (ETH), but it surely led to an outflow of merchants and liquidity.

The Bybit trade recovered its Bitcoin (BTC) market liquidity, step by step bettering market depth since February’s hack.

Knowledge collected by Kaito Analysis reveals the market’s resilience and the present state of reserves. The market operator grew to become a case examine for crypto resilience in rebuilding the market depth to manage slippage, whereas regaining the belief of merchants.

Bybit continues to be providing its particular liquidity depth for retail orders, making a deeper pool of matchable costs for small-scale merchants. The characteristic could additional rebuild the belief of retail merchants.

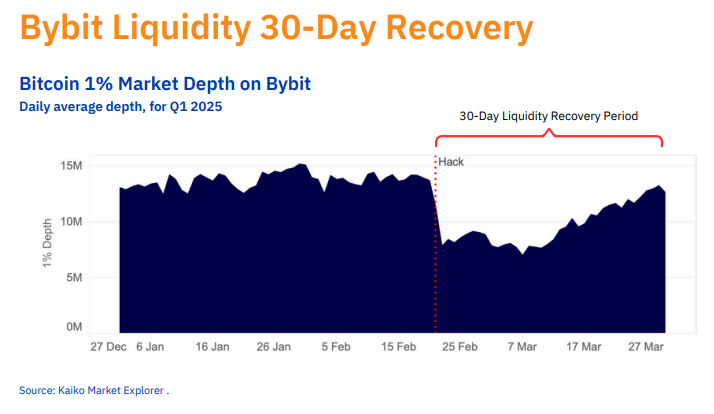

Bybit recovered most of its liquidity in 30 days

Kaito famous that the primary 30 days after the hack have been crucial for rebuilding liquidity and market depth.

Bybit had its most important liquidity issues within the first month after the hack. | Supply: Kaito Analysis

The BTC market additionally crashed, whereas Bybit negotiated mortgage phrases to make sure all withdrawal claims have been fulfilled. Kaito Analysis identified that the trade dealt with over 350K withdrawal requests.

As of Could 7, Bybit carried $2.8B in each day buying and selling volumes, with BTC nonetheless the dominant asset making up over 39% of buying and selling exercise. The BTC market has $2.8M market depth for two% slippage based mostly on Coingecko information.

In accordance with Kaito’s report, the each day common market depth is as excessive as $13M. Regardless of this, Bybit is taken into account one of many extra liquid centralized markets.

The trade misplaced a few of its market share following the exploit, and is at the moment making an attempt to draw customers with new buying and selling merchandise. The trade then needed to face the general market droop linked to US tariffs negotiations and threats of a commerce conflict.

The hack occurred at a time of typically worsening market sentiment. Virtually all main exchanges misplaced a few of their liquidity. Bybit’s organized strategy to discovering sources of liquidity led to the quickest restoration amongst different exchanges. Some exchanges, corresponding to HTX, Bithumb, and MEXC, noticed double-digit slide in liquidity within the month following the Bybit hack.

Kaito identified that main occasions disrupt trade liquidity. Even Binance misplaced as much as 80% of its liquidity in the course of the 2023 bear market, following the June 2023 SEC lawsuit. A number of the misplaced liquidity is but to be recovered. This makes Bybit’s feat much more notable, following the biggest trade hack within the historical past of crypto.

Altcoins recuperate liquidity at a slower tempo

Bybit can also be a key marketplace for altcoins and area of interest property. Following the hack, liquidity regenerated extra slowly. A few month after the hack, the trade had recovered 80% of the standard market depth.

Bybit targeted on the highest 30 altcoins, that are but to return to pre-hack market depths. The altcoin market can also be affected by bearish sentiment.

The altcoin market restoration benefited from Official Trump (TRUMP), which was among the many most liquid new tokens on the trade. Established cash and tokens like UNI, ONDO, and LTC elevated their liquidity by 50% quickly after the exploit.