Cryptocurrency trade Coinbase has added Binance’s BNB token to its roadmap for listings amid a sequence of on-line exchanges discussing the method.

On Tuesday, Limitless Labs CEO CJ Hetherington posted to X, contrasting what he claimed have been the necessities for a token to be listed on Binance slightly than Coinbase. In accordance with the CEO, Binance’s necessities included a safety deposit of two million BNB (BNB) for a spot itemizing, whereas Coinbase’s have been restricted to “construct[ing] one thing significant on Base.”

The web trade sparked debate, which solely appeared to accentuate when Coinbase’s head of Base, Jesse Pollak, chimed in to say “it ought to price 0% to be listed on an trade.”

Binance initially responded to Hetherington with a since-deleted X put up, threatening authorized motion in opposition to the CEO and calling a few of his claims “false and defamatory.” The trade claimed that it didn’t settle for charges for itemizing tokens.

“Whereas we stand by our place, the way in which we communicated was extreme and we sincerely apologize to our customers, companions, and the broader trade,” stated Binance in a follow-up to the deleted put up on Wednesday.

Associated: Bybit denies $1.4M itemizing payment, faculty promo accusations on X

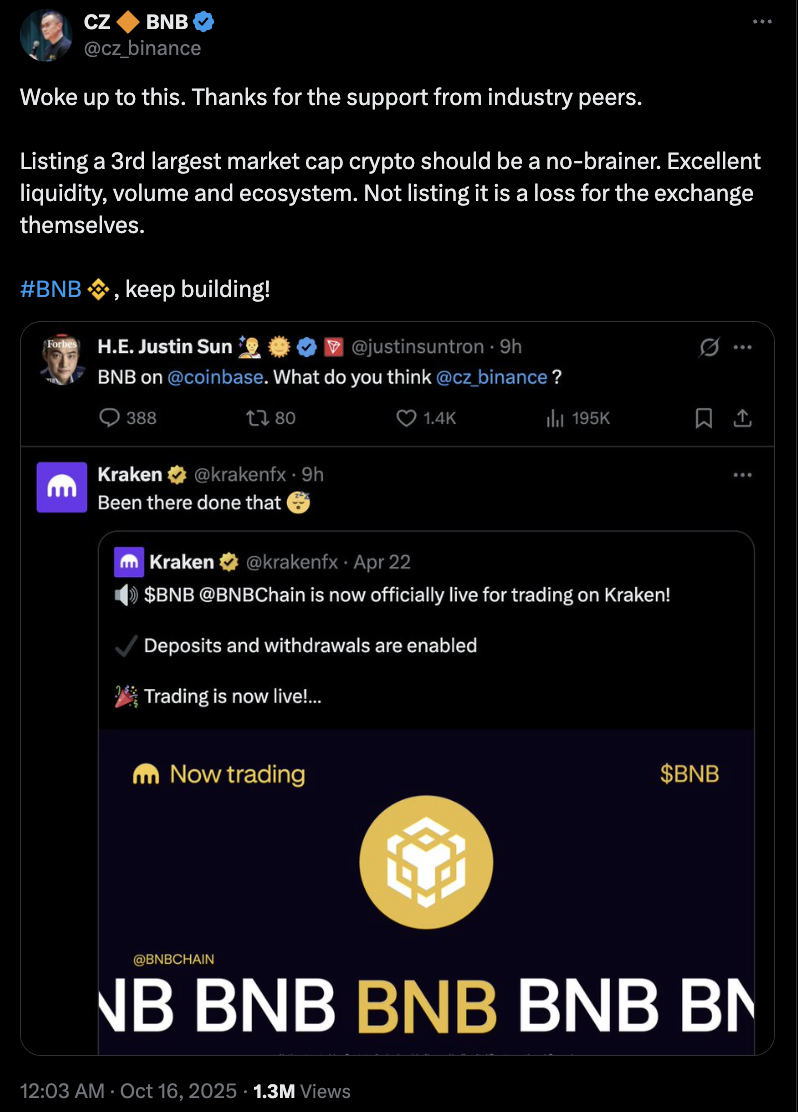

Whether or not influenced by the social media debate or not, Coinbase adopted by including BNB to its roadmap on Wednesday, indicating that it was planning to checklist the token. Former Binance CEO Changpeng “CZ” Zhao praised the transfer but in addition later urged Coinbase to “checklist extra BNB Chain tasks.”

Supply: Changpeng Zhao

CZ is Binance’s largest shareholder however now not in a managing or operational position following a cope with US authorities that had him step down as CEO in 2023. Nonetheless, he nonetheless reportedly managed 64% of the circulating provide of BNB at about 94 million tokens as of June 2024.

Growing transparency for exchanges’ listings

Crypto merchants know the worth that having any token listed on a top-tier trade can have in inflicting the worth to surge instantly following the information or slowly via larger adoption. Each Coinbase and Binance have taken steps to implement new adjustments to the token itemizing course of because the variety of cryptocurrencies will increase.

In March, Binance launched a group co-governance construction, permitting customers to vote to checklist or delist tokens. The announcement got here just a few weeks after CZ posted on X, claiming the trade’s course of was “a bit damaged” as a result of time between asserting a brand new token and itemizing it.

Coinbase CEO Brian Armstrong made comparable remarks in January, saying the corporate wanted to rethink its itemizing course of, given there have been about “1 million tokens per week being created now, and rising.” The trade launched a information in September saying each token utility was “free and merit-based,” and included a enterprise analysis and authorized assessment.

As of Thursday, BNB was the third-largest cryptocurrency with a market capitalization of about $160 billion. In accordance with information from Nansen, the BNB worth was $1,149 on the time of publication.

Journal: Again to Ethereum: How Synthetix, Ronin and Celo noticed the sunshine