Binance has simply recorded its highest stablecoin influx all through 2025, seeing a report excessive of as a lot as $6.2 billion flowing into the alternate on September 8 alone. What might it imply?

Abstract

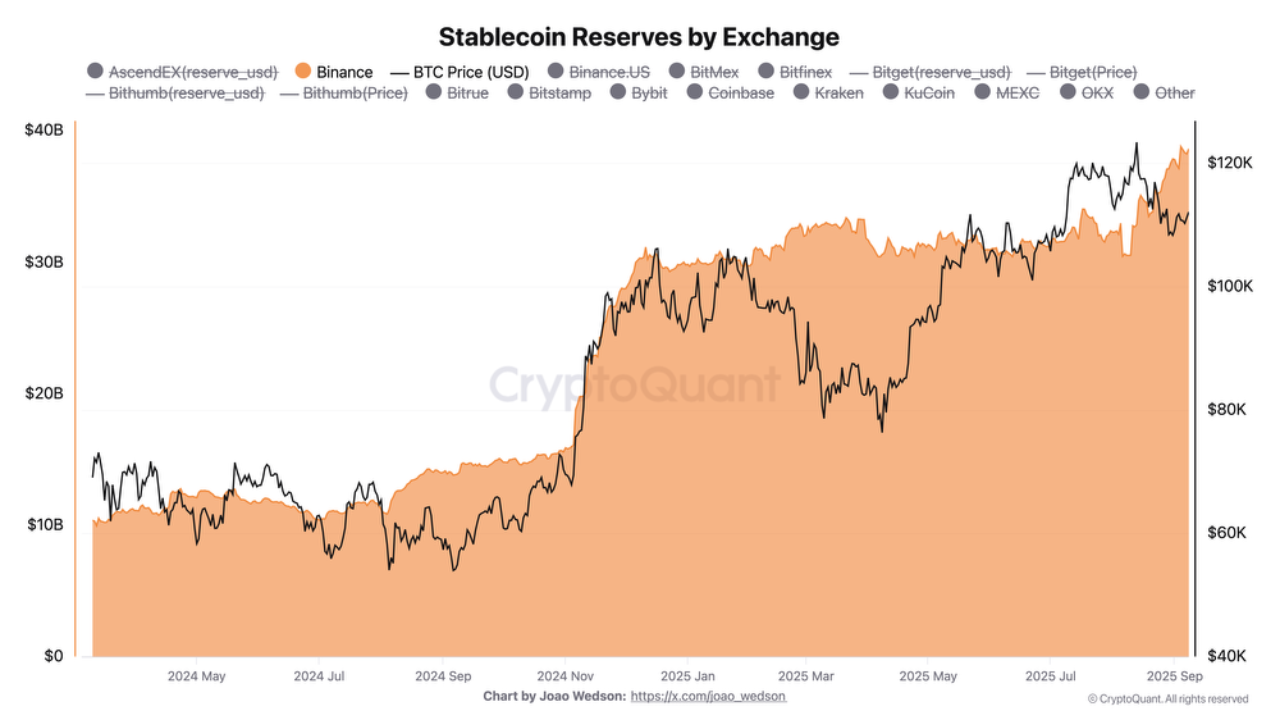

- Binance stablecoin reserves have reached a brand new report excessive at $39 billion, following a major surge.

- A lift in stablecoin reserves might mirror the market bracing itself for the FOMC assembly.

In line with the evaluation by CryptoQuant skilled Darkfost, the enhance in stablecoin influx has pushed Binance’s stablecoin reserves to a brand new all-time excessive. With the addition of $6.2 billion, its web stablecoin inflows have reached not less than $39 billion; nearing the $40 billion threshold.

This stablecoin hype wave comes only a week earlier than the extremely anticipated Federal Open Market Committee or FOMC assembly that’s scheduled for Sept. 16 to Sept. 17. The surge in stablecoin deposits might imply that merchants are transferring extra of their funds onto exchanges, getting ready to deploy them into property like Bitcoin (BTC), Ethereum (ETH) or different altcoins.

“Whereas BTC stays in a corrective part that has lasted for a month, market expectations at the moment are pricing in a 100% likelihood of a charge reduce on the subsequent FOMC assembly,” stated Darkfost in a latest evaluation.

Chart evaluating Binance’s stablecoin reserves with the value motion of Bitcoin | Supply: CryptoQuant

You may additionally like: CZ says stablecoins have defeated CBDCs globally, how come?

Furthermore, Darkfost additionally famous that the expansion of reserves on exchanges like Binance have a tendency to maneuver in parallel to Bitcoin worth motion. That is indicated by the chart that was shared by the analyst, which exhibits BTC transferring in comparable patterns to the alternate’s stablecoin reserves marked in coloration.

What Binance’s stablecoin reserves imply for the market

The rise in stablecoin deposits might develop into a sign of market tendencies, as merchants brace themselves for no matter determination the Federal Reserve will make concerning rates of interest. In line with Darkfost, the rise in stablecoin inflows sign Binance getting ready to satisfy alternate consumer wants.

Alternatively, the analyst stated it might additionally mirror a rise in stablecoin transfers onto the platform as of late.

“This means that liquidity continues to move into the market, with Binance standing out as a main entry level,” stated Darkfost.

Within the crypto market, stablecoins usually act as a bridge between fiat and digital property, giving merchants flexibility amidst unsure macro situations. Whether or not the results of the FOMC assembly sparks a rally or a pullback, the surge of stablecoin reserves on exchanges means that crypto markets are primed for vital motion, reinforcing the narrative that macro coverage stays a core driver of digital asset worth motion.

You may additionally like: Michael Novogratz: AI will dominate stablecoin use