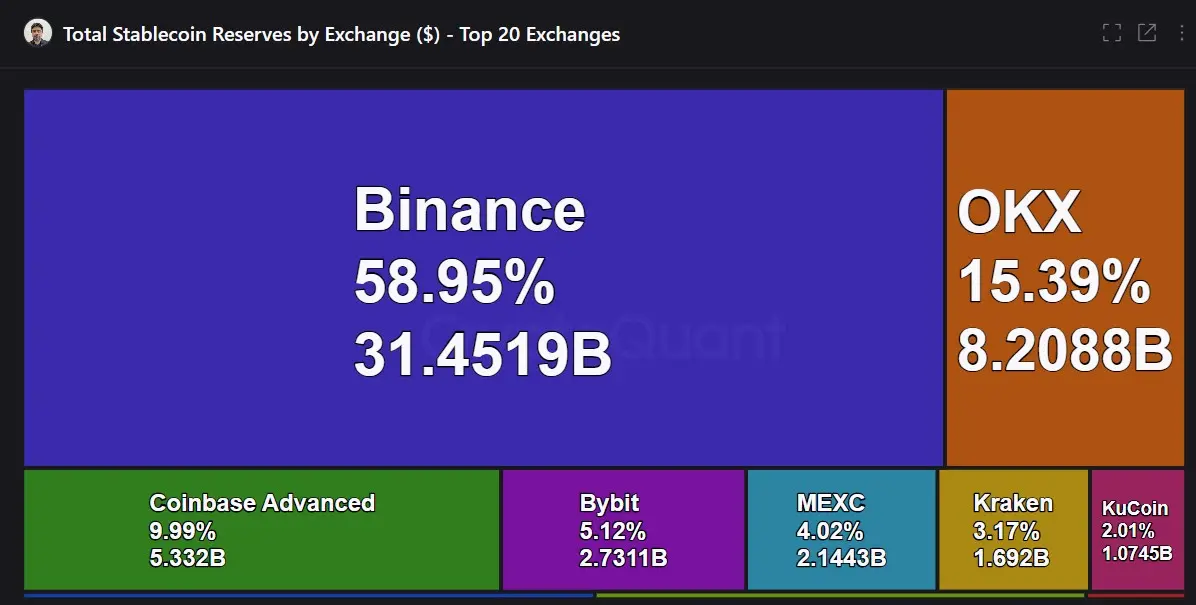

Binance, the largest crypto change by buying and selling quantity, controls 59% of all stablecoin reserves throughout centralized exchanges, in accordance with on-chain knowledge. This accounts for $31.45 billion in USDT and USDC alone. It’s greater than 3 times the subsequent closest competitor, OKX, which holds $8.2 billion (15.39%).

The stablecoin market cap is on a surge as its capitalization breached the $254 billion mark. Tether’s USDT stays the biggest stablecoin with a market cap of greater than $153 billion, whereas USDC stays on the second spot with over $61 billion cap.

Hype for stablecoins is such that even Donald Trump’s World Liberty Monetary launched its dollar-pegged USD1 just lately.

Binance tops Bitcoin inflows

In keeping with the info, Binance dominates in its central position in crypto liquidity, whereas Coinbase leads in complete reserves with $129 billion. Binance stands within the second spot in all reserves, holding $110 billion. Mixed, Coinbase and Binance maintain 60% of the whole reserves held throughout the highest 20 crypto exchanges.

As of Could, Binance acquired $31 billion in USDT/USDC deposits. It stood simply forward of Coinbase’s $30 billion. A report talked about that the largest crypto change by buying and selling quantity has attracted $180 billion in cumulative stablecoin inflows. In the meantime, Coinbase doesn’t present a public Proof-of-Reserves (PoR), however Binance affords clear PoR studies, and this consists of pockets addresses.

It added that Coinbase and Binance bagged the biggest cumulative inflows in USD phrases in 2025. These figures become $344 and $335 billion, respectively. Nevertheless, Binance confirmed the very best common Bitcoin influx.

On Could 22, as Bitcoin hit a brand new all-time excessive of over $111,900, the change noticed a mean BTC deposit measurement of seven BTC, the largest amongst main exchanges.

Supply: CryptoQuant

On the opposite aspect, main exchanges’ common deposits had been decrease. Bitfinex accounted for five, OKX for 1.23, and it was lower than 1 BTC for Kraken and Coinbase.

Stablecoin increase and politics collide

This surge comes because the US Senate is heading into the ultimate stretch of debate on the GENIUS Act. The stablecoin invoice might change into the primary main crypto laws to move the chamber because it seeks to control the issuers of dollar-pegged tokens like USDT and USDC. Nevertheless, it has already cleared the Banking Committee and handed an early ground check with bipartisan assist.

Some Democrats have begun linking the invoice to Donald Trump’s private crypto ventures. This consists of one of many initiatives carefully tied to the president, USD1. Backed by World Liberty Monetary, USD1 has exploded in utilization.

In simply 10 days after its Binance itemizing, the stablecoin recorded over $10.7 billion in switch quantity. Knowledge reveals that from Could 22 to June 1, buying and selling volumes surged previous all prior information. The week of Could 19 alone noticed a 1,300% bounce in switch exercise. It soared from $307M to $4.3 billion, and by June 1, USD1 had already logged one other $6.8 billion, setting a brand new weekly excessive.

That surge follows a fast rise in market cap as USD1 broke into the highest six stablecoins in Could, surpassing $2 billion. For lawmakers, this development complicates the GENIUS Act’s closing steps, as some argue the laws may benefit Trump-linked ventures.