The crypto sector is coming into a brand new part of maturity, with illicit transaction volumes on centralized exchanges falling to historic lows. That is based on a brand new evaluation printed by Binance, which makes use of impartial knowledge from Chainalysis and TRM Labs.

Notably, the findings present that criminal activity now accounts for less than a tiny fraction of world change quantity. This marks one of the crucial evident indicators but that the {industry}’s compliance requirements and detection methods have strengthened over the previous two years.

Illicit Exercise Drops to 0.018–0.023% Throughout Main Exchanges

Throughout the seven largest centralized exchanges by quantity, solely 0.018% to 0.023% of complete transactions as of June 2025 have been immediately linked to illicit blockchain addresses. The determine represents a dramatic enchancment from 2023 ranges. It follows nearer collaboration amongst exchanges, analytics companies, and legislation enforcement businesses.

The report highlights Binance because the strongest performer. Chainalysis knowledge reveals that solely 0.007% of Binance’s 2025 transaction quantity was tied to illicit sources, lower than half the common of the subsequent six largest exchanges.

TRM Labs’ knowledge aligns with that pattern, inserting Binance at 0.016%, in comparison with the 0.023% common for opponents.

Notably, Binance processes day by day volumes corresponding to the mixed exercise of the six next-largest platforms. The report burdened that holding illicit publicity this low at such a magnitude highlights superior monitoring capabilities and disciplined compliance practices.

Associated: Binance Soaks Up 90% Of ERC-20 Stablecoin Deposits, Pushing ETH Greater On Spot

A 96–98% Discount Since 2023

Each analytics companies present that Binance decreased its illicit publicity by 96% (Chainalysis) to 98% (TRM Labs) between January 2023 and June 2025, outpacing enhancements by different main exchanges by 4–5 proportion factors.

In 2025 alone, Binance processed greater than $90 billion in day by day quantity throughout roughly 217 million trades, but maintained industry-leading security ratios.

How Binance Achieved These Outcomes

Binance attributes the development to a multilayered strategy that mixes folks, expertise, and collaboration:

- 1,280+ compliance and threat specialists, representing 22% of the corporate’s world workforce

- Tons of of thousands and thousands of {dollars} invested yearly into KYC, transaction monitoring, and anti-fraud instruments

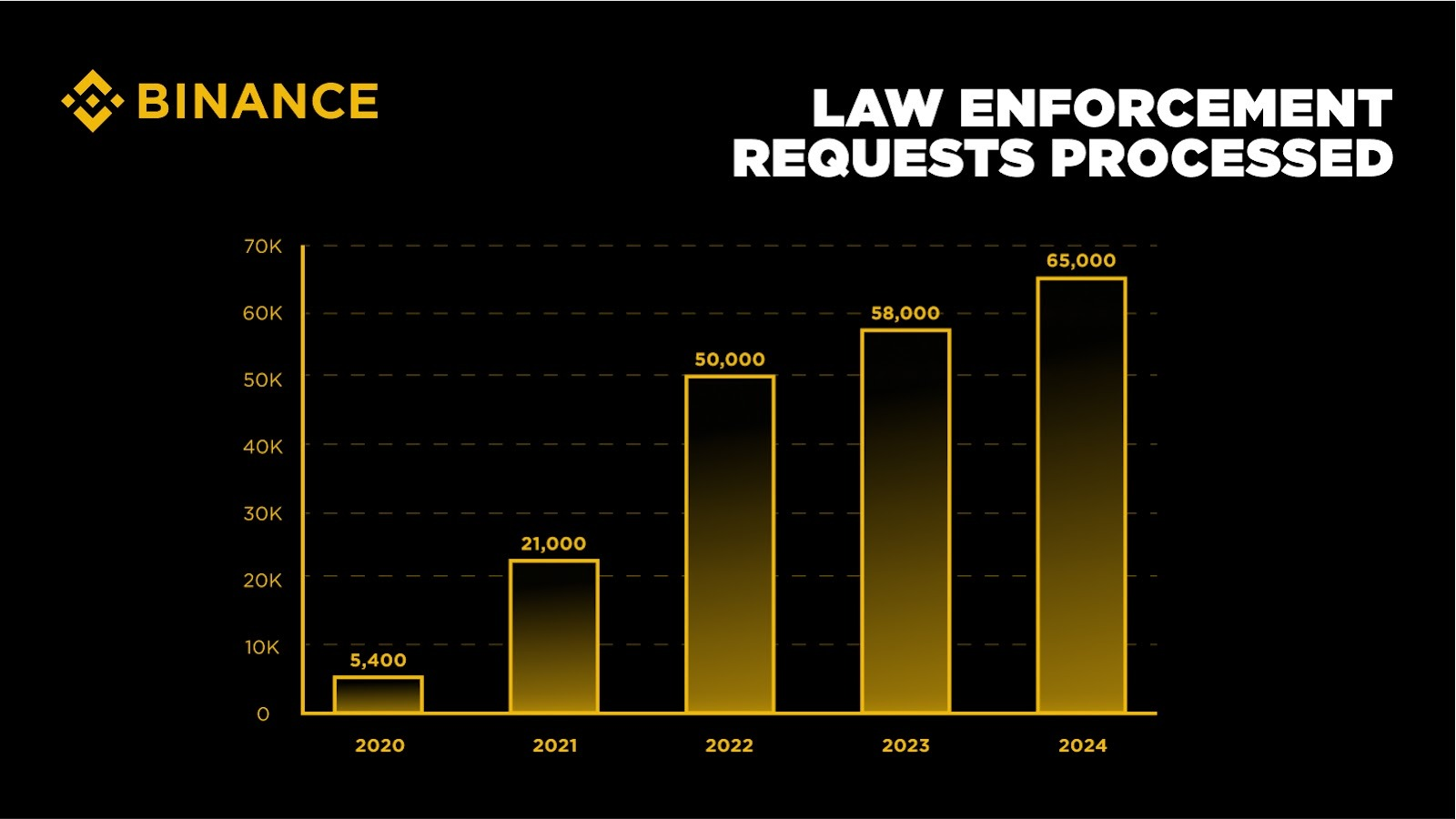

- 240,000+ legislation enforcement requests dealt with and 400+ coaching classes for investigators worldwide

- Participation in collective motion networks just like the Beacon Community and T3+ program with Tether, TRON, and TRM Labs

- Enhanced transaction-monitoring powered by AI and machine-learning fashions.

Crypto Now Cleaner Than Conventional Finance, Information Suggests

The report additionally locations crypto in a broader monetary context. World illicit finance by way of conventional channels nonetheless reaches trillions of {dollars} yearly.

In the meantime, blockchain-tracked illicit flows throughout the highest seven exchanges stay within the low billions. They’re even “properly beneath” the degrees seen in conventional banking, based on a 2025 White Home report cited by Binance.

As a result of blockchain transactions are publicly traceable, regulators and investigators can observe worth flows in methods unimaginable in fiat methods. Mixed with fashionable compliance frameworks, this transparency is pushing illicit crypto utilization towards near-negligible ranges.

Binance argues that the pattern reveals an {industry} transformation. Crypto exchanges immediately function below strict requirements, setting benchmarks that rival or surpass these of conventional finance. As adoption grows, the information indicators that digital belongings can scale globally with out sacrificing consumer security.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.