Sam “SBF” Bankman-Fried, the founder and former CEO of the bankrupt cryptocurrency change FTX, stated his “largest mistake” through the $8 billion collapse was handing management of the corporate to new administration — a choice he claims value him a last-minute alternative to avoid wasting the agency.

Bankman-Fried, as soon as the chief of the $32 billion FTX change, is at present serving a 25-year jail sentence for seven felony costs associated to the collapse of FTX and Alameda Analysis in November 2022, which resulted in an $8.9 billion lack of investor funds.

Wanting again on the collapse of FTX, Bankman-Fried’s “largest mistake” was handing over the management of the corporate to its present CEO, John J. Ray III, on Nov. 11, 2022.

“The one largest mistake I made by far was handing the corporate over,” SBF advised information outlet Mom Jones in an interview printed on Friday.

Minutes after signing over the crypto change, Bankman-Fried obtained a name a couple of potential exterior funding which will have saved the corporate from chapter, but it surely was too late to revoke his signature, he claimed.

Following his appointment as the brand new CEO, Ray filed for Chapter 11 chapter on Nov. 11, 2022, and employed legislation agency Sullivan & Cromwell (S&C) for authorized help within the proceedings.

Bankman-Fried was arrested within the Bahamas on Dec. 12, 2022, after US prosecutors filed prison costs towards him. He was extradited to the US in January 2023.

FTX collapsed as a consequence of consumer fund misappropriation, leading to billions of {dollars} price of buying and selling losses for its sister firm, Alameda Analysis. The quantitative buying and selling agency used FTX buyer funds that Bankman-Fried transferred with out consent to fund Alameda’s buying and selling losses, now known as the Alameda hole.

Associated: Wall Road’s subsequent crypto play could also be IPO-ready crypto companies, not altcoins

Sullivan & Cromwell really useful Ray as new FTX CEO to SBF

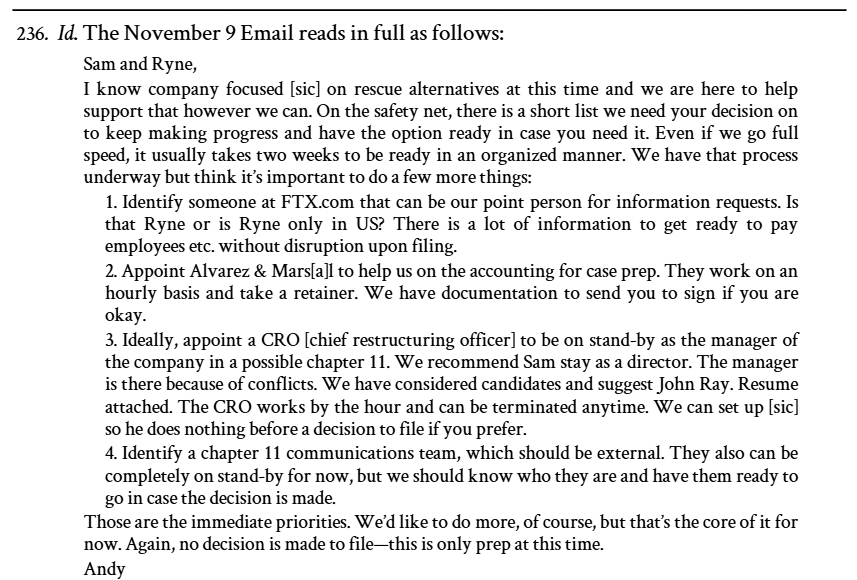

Two days forward of FTX’s chapter submitting on Nov. 9, S&C lawyer Andrew Dietderich emailed Bankman-Fried with a plan proposing to rent Ray as a chief restructuring officer “in a potential Chapter 11.”

Supply: Documentcloud.org

On Feb. 16, 2024, a bunch of FTX collectors sued the legislation agency, alleging that it performed a task in FTX’s multibillion-dollar fraud and that the corporate had financially benefited from it. The lawsuit, which sought damages for aiding and abetting fraud and breach of fiduciary obligation, was voluntarily dismissed in October 2024.

S&C earned over $171.8 million price of authorized charges from the FTX chapter by June 27, 2024, based on authorized filings reviewed by Reuters.

Associated: Melania Trump plugs memecoin amid $10M staff promoting allegations

FTX customers nonetheless await over $4.2 billion in repayments

Almost three years after the change’s collapse, FTX collectors proceed to await full reimbursement.

The FTX property began repaying collectors in February with a $1.2 billion payout, adopted by a $5 billion distribution in Might. With September’s fee, the change has reimbursed a complete of $ $7.8 billion to its collectors.

FTX is estimated to have as much as $16.5 billion price of recovered property obtainable to repay collectors, which means that collectors are set to obtain one other $8.7 billion.

The change plans to repay at the very least 98% of its prospects 118% of the worth of their accounts as of November 2022.

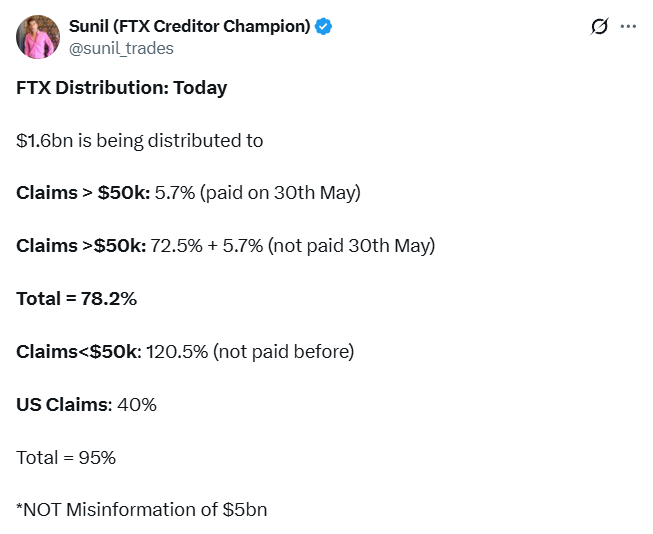

Supply: Sunil

On Sept. 30, FTX distributed its third set of repayments price $1.6 billion to its customers, based on Sunil, FTX creditor and Buyer Advert-Hoc Committee member, in an X submit.

The FTX collapse triggered a wave of bankruptcies throughout the crypto business, ushering in one of many longest bear markets within the sector’s historical past. Bitcoin (BTC) fell to as little as $16,000 following the fallout.

Journal: The $2,500 doco about FTX collapse on Amazon Prime… with assist from mother