Market watchers are labeling Andrew Tate as one of many worst merchants in crypto after he was fully liquidated on Hyperliquid, dropping over $800,000.

He joins a rising checklist of high-profile merchants who’ve seen their fortunes evaporate on the platform. Tate’s repeated liquidations underscore the cruel actuality of using excessive leverage.

Andrew Tate’s Crypto Buying and selling Ends in Complete Liquidation on Hyperliquid

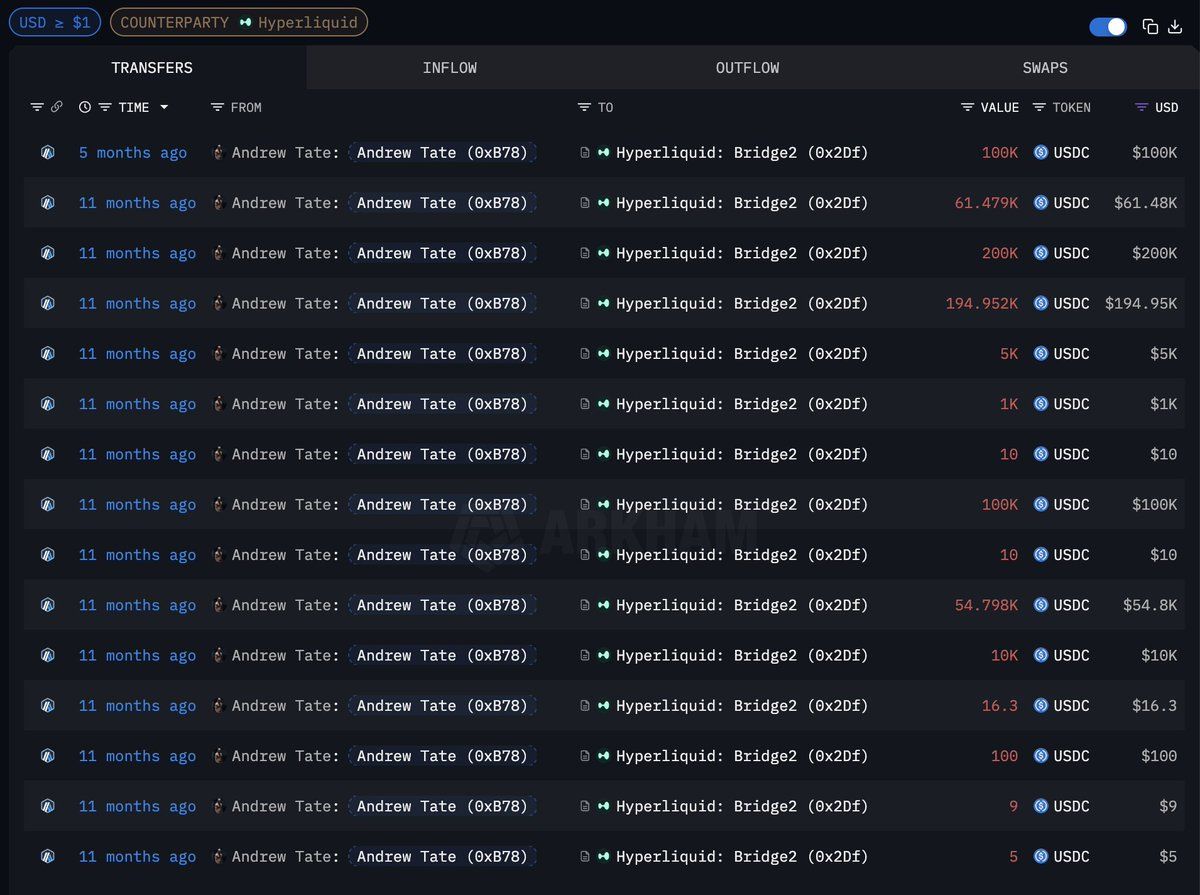

Arkham’s blockchain evaluation uncovered the extent of Tate’s buying and selling losses. The previous kickboxer deposited $727,000 into Hyperliquid, a decentralized perpetual change.

All his funds remained on the change, locked into dropping trades till they have been absolutely liquidated.

Andrew Tate’s Hyperliquid Deposits. Supply: Arkham

Tate tried to recuperate by buying and selling with referral revenue. He acquired $75,000 from customers becoming a member of by means of his referral hyperlink. As an alternative of withdrawing these rewards, he used them in additional trades. All $75,000 disappeared by means of the identical cycle of liquidations.

“Andrew Tate is now absolutely liquidated on Hyperliquid. He has solely $984 left. Some folks thought he had been liquidated many occasions earlier than. However he earned the cash by means of referrals and traded that cash on HL repeatedly,” analyst Param added.

Sample of Failed Trades

Tate’s buying and selling historical past is sort of risky. In June 2025, he misplaced $597,000 on Hyperliquid. Issues didn’t enhance afterward. Analyst StarPlatinum highlighted that in September, Tate opened a protracted place on the World Liberty Monetary (WLFI) token. Nonetheless, this resulted in a lack of $67,500. He opened a brand new place minutes later and was hit with one other loss.

His streak continued into this month. On November 14, he was liquidated once more — this time whereas holding a BTC lengthy at 40× leverage. The wipeout price him $235,000.

August introduced his solely second of success. A small quick on YZY that earned him $16,000. Even that temporary victory disappeared, worn out by a contemporary dropping commerce.

Total, Tate has executed greater than 80 trades with a win price of simply 35.5%. His cumulative loss stands at $699,000 in just a few months, reflecting a sample of aggressive risk-taking and constantly poor timing.

Crypto analysts have known as him “one of many worst merchants in crypto” as a result of his dropping streak.

“Based mostly on this buying and selling document, Andrew Tate could be one of many worst merchants in crypto. And folks nonetheless pay him for recommendation,” a market watcher wrote.

Tate isn’t the one one taking heavy losses from leveraged buying and selling. Different well-known merchants have gone by means of related conditions. James Wynn, for instance, misplaced greater than $23 million on Hyperliquid. His account fell from tens of millions to solely $6,010.

In July, Qwatio took a $25.8 million hit after a market rally liquidated his quick positions, wiping out the positive aspects he had made earlier. One other whale, often called 0xa523, had an excellent rougher time. He misplaced $43.4 million on Hyperliquid in a single month.

The experiences of Tate, Wynn, Qwatio, and 0xa523 spotlight the inherent dangers related to buying and selling with excessive leverage on decentralized perpetual exchanges. Whereas some merchants have achieved vital positive aspects on these platforms, the speedy liquidations seen in these instances display how shortly positions can transfer in opposition to customers.

Their outcomes function a reminder that leverage can amplify each earnings and losses, and that even well-known market contributors are usually not proof against the volatility of crypto derivatives.

The publish Andrew Tate Known as “One of many Worst Merchants in Crypto” After Dropping Over $800,000 appeared first on BeInCrypto.