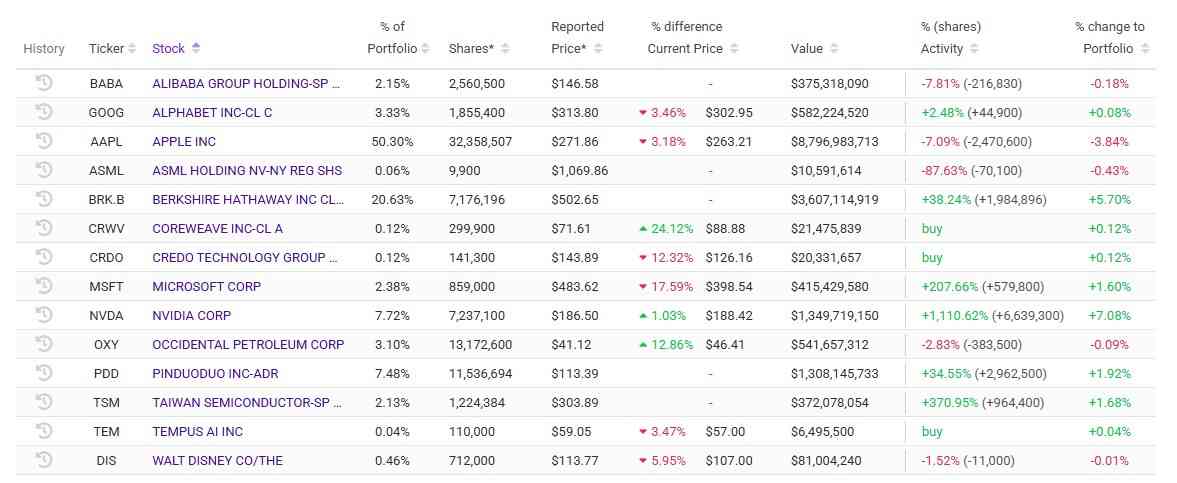

Duan Yongping, a famend investor and entrepreneur referred to as ‘the Chinese language Warren Buffett,’ has submitted his fourth-quarter 2025 13F submitting, providing an in depth snapshot of his most up-to-date portfolio.

The disclosure exhibits an attention-grabbing mixture of aggressive place will increase and selective trims, illustrating specifically Yongping’s conviction in synthetic intelligence (AI) and blue-chip names.

A reasonably notable was the dramatic improve in Nvidia (NASDAQ: NVDA), because the H&H Worldwide Funding supervisor had added at least 6,639,300 NVDA shares to his portfolio, lifting his complete stake to 7,237,100 shares (round 7% of the portfolio).

This marked a 1,110.62% surge within the total share rely and the worth of the place to roughly $1.35 billion.

Duan Yongping’s portfolio replace

In terms of contemporary stakes, the most important new purchase was CoreWeave (NASDAQ: CRWV), the place Yongping bought 299,900 shares valued at roughly $21.48 million.

Likewise, the buyers opened a place in Credo Know-how Group Holding (NASDAQ: CRDO), buying 141,300 shares value roughly $20.33 million.

The third largest addition was Tempus AI (NASDAQ: TEM), with 110,000 shares valued at $6.50 million.

Main place will increase included Berkshire Hathaway’s (NYSE: BRK), including 1,984,896 shares. That brings his complete holdings to 7,176,196 shares, marking a 38.24% improve and a place valued at roughly $3.61 billion.

H&H Worldwide Funding inventory holding reductions

Duan trimmed publicity to a number of holdings, most notably Apple (NASDAQ: AAPL). He lowered the place by 2,470,600 shares, a 7.09% decline in share rely that had a 4.29% impression on the general portfolio.

He additionally sharply reduce his stake in ASML Holding NV (NASDAQ: ASML), promoting 70,100 shares, an 87.63% discount.

Featured picture by way of Shutterstock