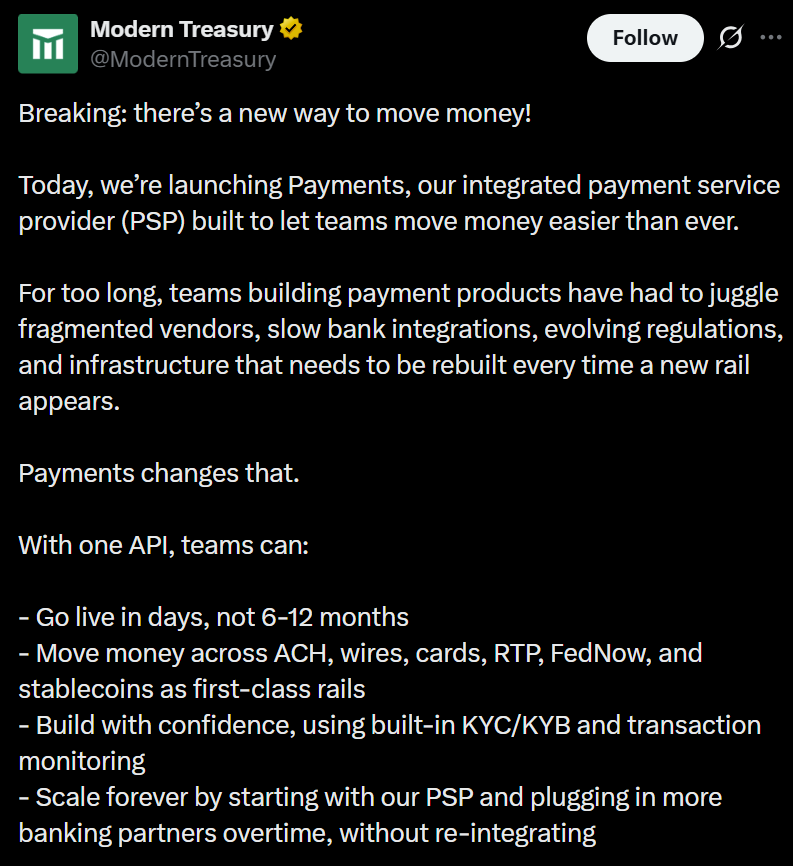

Fashionable Treasury, a funds operations software program supplier that helps firms handle and reconcile cash motion, has launched an built-in cost service supplier (PSP) that helps each conventional fiat rails and stablecoins.

On Wednesday, the corporate introduced that it has added stablecoin settlement to the identical infrastructure that companies already use for ACH transfers, wire funds and real-time cost networks. At launch, the platform helps World Greenback (USDG), Pax Greenback (USDP) and $USDC ($USDC), with USDt (USDT) anticipated to be added sooner or later.

Fashionable Treasure acquired stablecoin and fiat cost platform Beam in October.

The corporate has partnered with Paxos to combine regulated stablecoins and settlement capabilities into its platform and has joined the World Greenback Community. San Francisco-based Fashionable Treasury additionally participates in Circle’s Alliance Program, a accomplice community that helps the broader use of the $USDC stablecoin in funds and monetary providers.

With the transfer, stablecoins are included right into a single compliance framework alongside conventional banking rails. Firms utilizing Fashionable Treasury not want separate distributors or technical integrations to course of crypto-based and fiat funds.

The replace successfully makes stablecoins one other settlement choice inside a standard cost movement, probably decreasing the operational barrier for companies searching for to combine blockchain-based cost rails.

Associated: Crypto’s 2026 funding playbook: Bitcoin, stablecoin infrastructure, tokenized belongings

Stablecoins transfer deeper into mainstream monetary infrastructure

Fashionable Treasury’s newest integration comes as stablecoins see broader uptake throughout the funds trade, significantly following the passage of the US GENIUS Act final July, which established a federal framework for dollar-backed stablecoins.

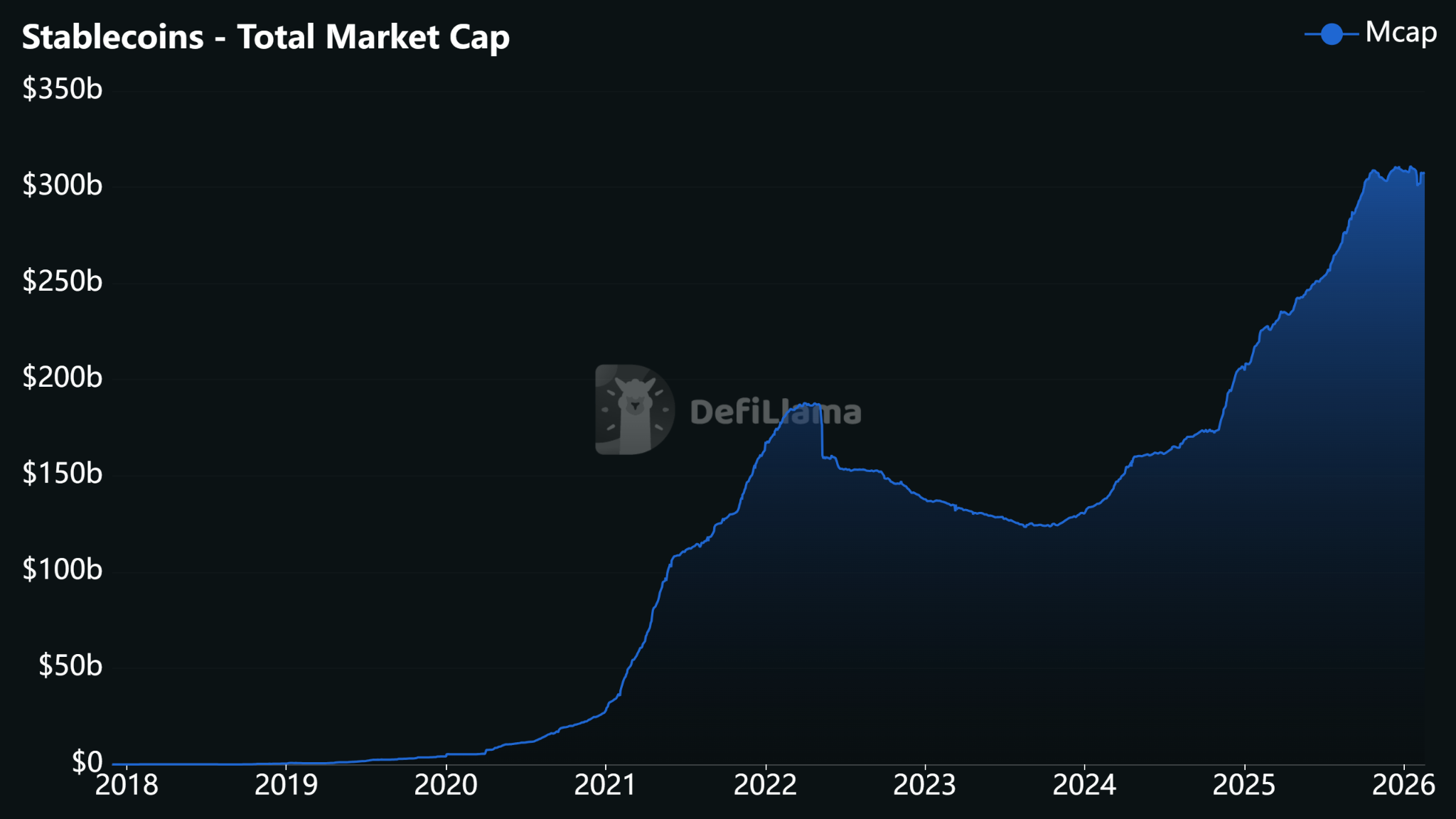

The overall worth of stablecoins in circulation grew by practically 50% final 12 months, surpassing $300 billion for the primary time. Progress has slowed in latest months, with provide hovering round that degree amid tighter liquidity circumstances and a cooling crypto market.

Nonetheless, issuance stays close to file highs, reflecting sustained demand for dollar-pegged digital belongings in buying and selling, cross-border transfers and settlement.

The stablecoin market has expanded quickly since 2020. Supply: DeFiLlama

America’s largest banks have additionally signaled curiosity in stablecoins and associated expertise. JPMorgan Chase, Financial institution of America, Citigroup and Wells Fargo have been reported to be in early discussions a few collectively operated stablecoin initiative, although the plans are nonetheless at a conceptual stage.

Final month, Constancy Investments introduced plans to difficulty a brand new stablecoin referred to as the Constancy Digital Greenback. Constancy Digital Property president Mike O’Reilly described stablecoins as “foundational cost and settlement providers.”

Associated: How TradFi banks are advancing new stablecoin fashions