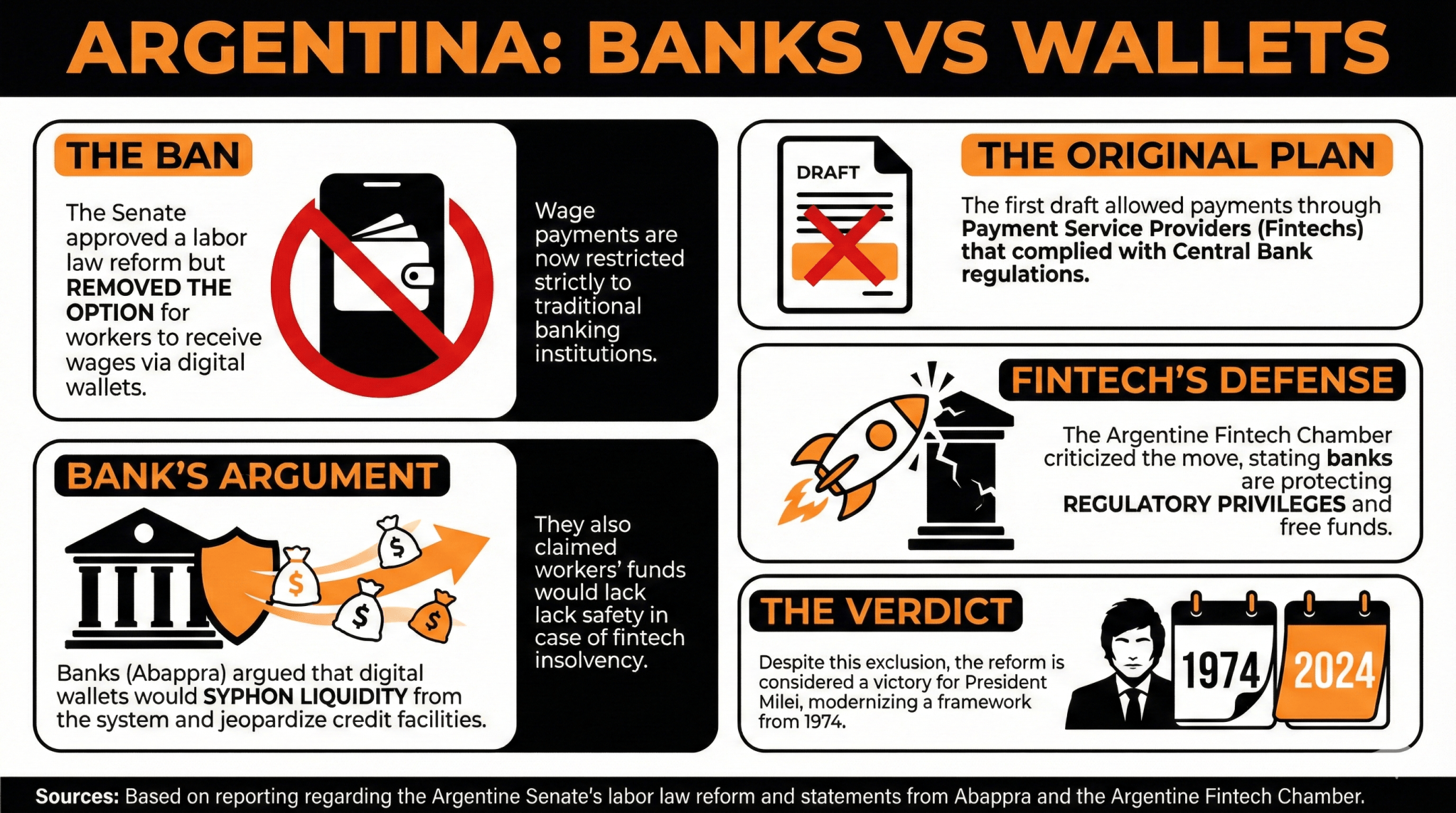

A proposal that may have allowed staff to obtain wages in digital wallets managed by fee suppliers was defeated after banks pressured lawmakers to exclude that possibility throughout debates over Argentina’s new labor regulation reform.

No Selection: Digital Wallets Left Out as Eligible Fee Choices in Labor Legislation Reform

Argentina has didn’t advance in offering extra decisions for staff to obtain their wages.

The choice of receiving wage funds through digital wallets managed by fee suppliers was lastly faraway from the labor regulation reform textual content authorized by the Senate. The textual content, strongly contested by opposition events, solely permits wage funds by way of conventional banking establishments, leaving fintech corporations out of the loop.

The primary draft included an article that declared as follows:

“Remuneration in money owed to the employee have to be paid, beneath penalty of nullity, solely by way of credit score to an account opened in his title in a financial institution or official financial savings establishment, or by way of Fee Service Suppliers that adjust to the regulatory necessities established by the Central Financial institution of the Argentine Republic (BCRA) for such exercise.”

Nonetheless, banks opposed this, stressing that it might syphon the liquidity from the banking system to fund their actions. Marcelo Mazzon, govt supervisor of the Affiliation of Public and Personal Banks (Abappra), confused that this measure would “jeopardize the liquidity of the system and the existence of productive credit score services.”

As well as, Abappra alleged that approving this text would improve the dangers to customers, provided that they don’t have the identical protections as banks concerning the security of those funds. “Within the occasion of insolvency, staff’ funds could be included within the chapter property with out precedence,” it declared.

The Argentine Fintech Chamber criticized the result of this measure, warning that this knee-jerk response doesn’t defend the safety of customers’ funds, however the availability of those free funds to finance banks’ enterprise mannequin.

“Their enterprise mannequin depends on sustaining regulatory privileges somewhat than providing higher providers than fintech corporations,” the chamber concluded.

Even so, the approval of this reform is taken into account a victory for President Javier Milei’s Administration, provided that it modernizes a framework established in 1974.

FAQ

What current choice did Argentina make concerning wage fee choices?

Argentina’s Senate eliminated the choice for staff to obtain wages through digital wallets, limiting funds to conventional banking establishments.What was initially proposed within the labor regulation reform draft?

The draft included provisions permitting wage funds by way of compliance-authorized Fee Service Suppliers alongside financial institution accounts, however this was in the end eradicated.What issues did banks increase concerning the proposed inclusion of fintech corporations?

Banks argued that together with fintech would drain liquidity from the banking system and expose customers to elevated dangers with out the identical protections as conventional establishments.How does the Argentine Fintech Chamber view the result of the reform?

The chamber criticized the choice, arguing it favors banks’ pursuits over person safety and limits competitors from fintech corporations.