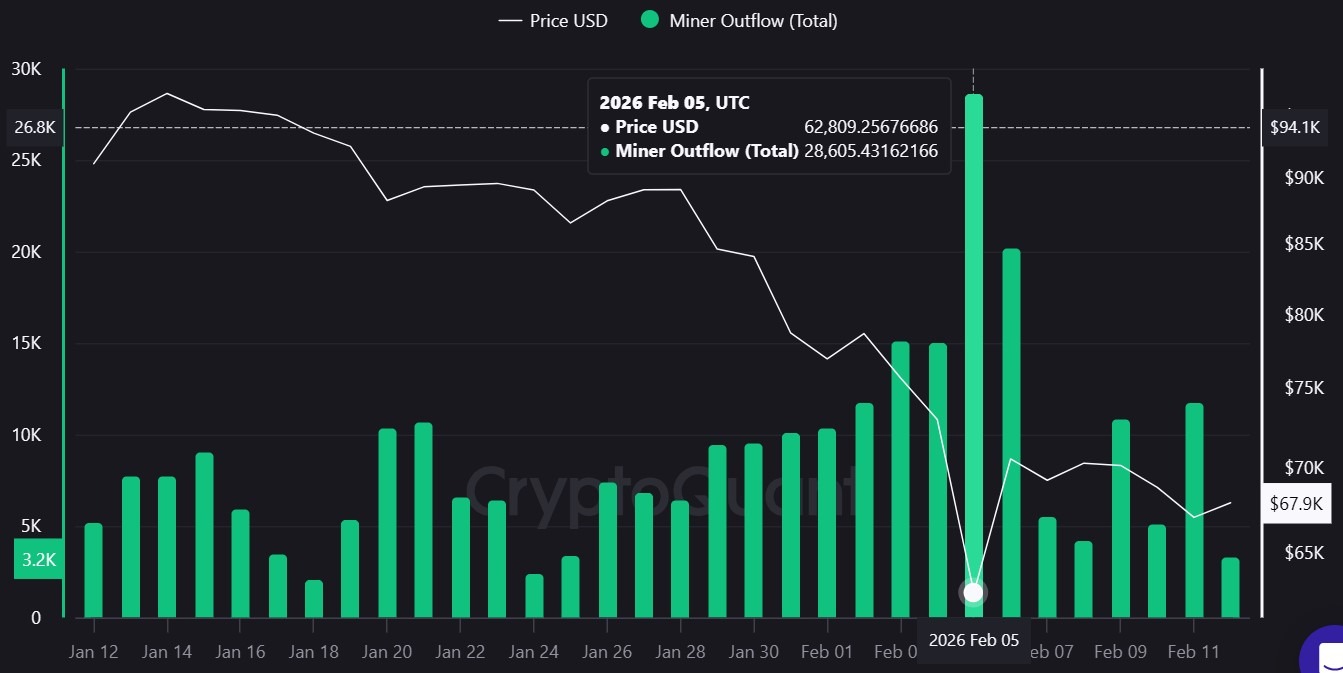

Bitcoin miner outflows jumped to twenty-eight,605 $BTC, value about $1.8 billion, on Feb. 5, one of many largest single-day transfers since November 2024, as costs swung sharply throughout a risky buying and selling session.

One other 20,169 Bitcoin ($BTC), value about $1.4 billion, left miner-linked wallets on Feb. 6, in accordance with knowledge from CryptoQuant. The final comparable spike occurred on Nov. 12, 2024, when outflows reached 30,187 $BTC.

The spike coincided with sharp value swings, with $BTC buying and selling at about $62,809 on Feb. 5 earlier than rebounding to $70,544 a day later. Giant miner pockets transfers throughout risky periods usually draw scrutiny as a result of they will sign potential promoting strain.

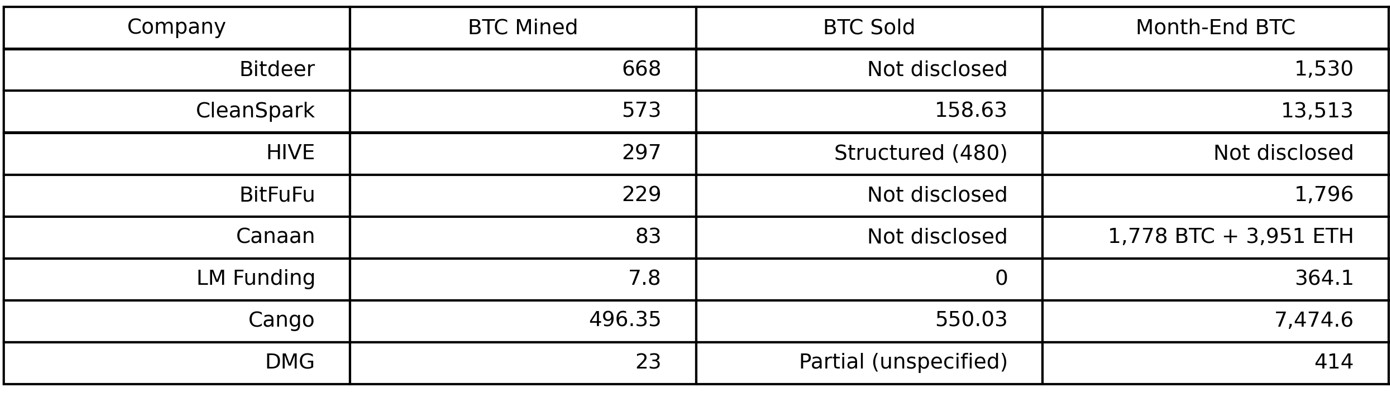

Eight miners disclosed January figures thus far: CleanSpark, Bitdeer, Hive Digital Applied sciences, BitFuFu, Canaan, LM Funding America, Cango and DMG Blockchain Options. They reported a mixed manufacturing of roughly 2,377 $BTC for the month. That complete is much beneath the 28,605 $BTC transferred in a single day on Feb. 5.

Outflows doubtless replicate broader ecosystem flows

The size of the Feb. 5 and Feb. 6 outflows exceeds the January manufacturing of the publicly reporting corporations reviewed by Cointelegraph.

Even combining disclosed January gross sales from CleanSpark, Cango and DMG, confirmed promoting quantities stay a fraction of the 28,605 $BTC transferred in a single day.

Nevertheless, miner outflows don’t routinely equate to capitulation or speedy spot-market promoting.

Based on CryptoQuant, miner outflow contains transfers to exchanges in addition to inside pockets actions and transfers to different entities, which means the metric doesn’t by itself affirm that cash had been bought on the open market.

Given the dimensions of the transfers relative to disclosed public miner gross sales, the actions could replicate exercise past massive, listed corporations.

Bitcoin Miner Outflow 30-day chart. Supply: CryptoQuant

Public miner disclosures present blended treasury strikes

CleanSpark reported mining 573 $BTC and promoting 158.63 $BTC throughout the month, ending January with 13,513 $BTC on its steadiness sheet.

Cango mined 496.35 $BTC and disclosed promoting 550.03 $BTC, stating it could proceed to promote newly mined Bitcoin to help the growth of its synthetic intelligence and inference platform.

On Feb. 9, the corporate bought a further 4,451 $BTC for about $305 million to partially repay a Bitcoin-collateralized mortgage and fund its AI pivot.

Associated: Bitcoin issue drops by over 11%, sharpest drop since 2021 China ban

Different corporations took a distinct method. Canaan mined 83 $BTC and elevated its reserves to 1,778 $BTC and three,951 ETH. LM Funding mined 7.8 $BTC and reported no gross sales, lifting its treasury to 364.1 $BTC.

In the meantime, Hive used structured pledge mechanics tied to 480 $BTC to protect liquidity whereas sustaining operations.

Whereas some miners report month-to-month manufacturing outcomes persistently, others solely report intermittently or have shifted to quarterly disclosures.

January miner knowledge compiled by Cointelegraph. Supply: Cointelegraph

Associated: Bitcoin miners IREN, CleanSpark shares plunge as earnings fall quick

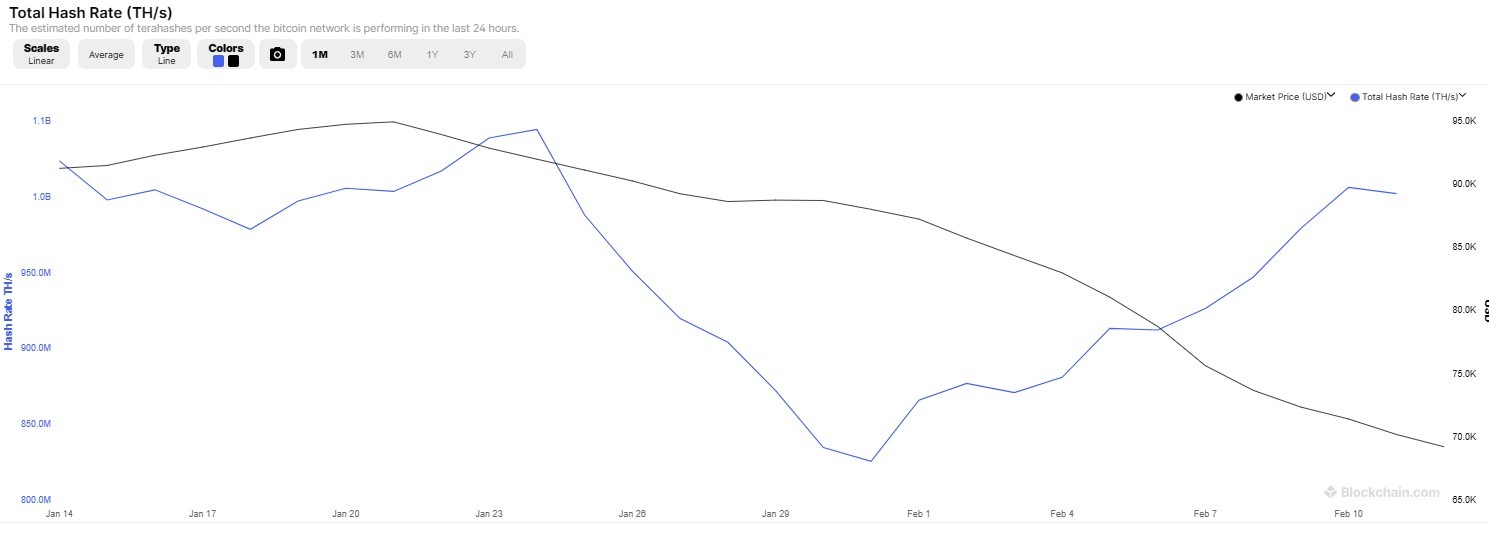

Winter storms have an effect on US miner hashrates

Community hashrate additionally fluctuated sharply in late January as extreme winter storms hit elements of the USA. On Jan. 27, Bitcoin’s hashrate fell to 663 exahashes per second over two days, marking a greater than 40% drop.

Complete mining hashrate. Supply: Blockchain.com

The short-term decline got here as miners curtailed operations to stabilize regional energy grids throughout excessive chilly and surging power demand. US-based corporations reported decreased uptime, together with Marathon Digital Holdings and Iren, which noticed sharp short-term drops in every day manufacturing.

Blockchain.com knowledge confirmed that hashrate recovered in early February after the drop over the last week of January.

Journal: 6 weirdest units folks have used to mine Bitcoin and crypto