On Saturday morning, bitcoin’s value sits between $68,090 and $69,162 during the last hour, with a $1.36 trillion market cap, $97.38 billion in 24-hour quantity, and a large $66,131 to $71,604 intraday vary, reflecting a market that has stopped panicking however hasn’t discovered conviction.

Bitcoin Chart Outlook

On the day by day chart, bitcoin continues to respect a clearly outlined downtrend that started after the failed push close to the $97,900 peak and culminated in a pointy capitulation wick to $59,930. The next rebound seems to be extra like a reflex than a revival, with quantity surging through the flush and fading on the bounce. That sequence usually indicators panic adopted by stabilization, not development reversal. Till value can reclaim and maintain ranges north of $75,000, the broader construction stays corrective, irrespective of how convincing the short-term enthusiasm tries to sound.

$BTC/USD 1-day chart through Bitstamp on Feb. 7, 2026.

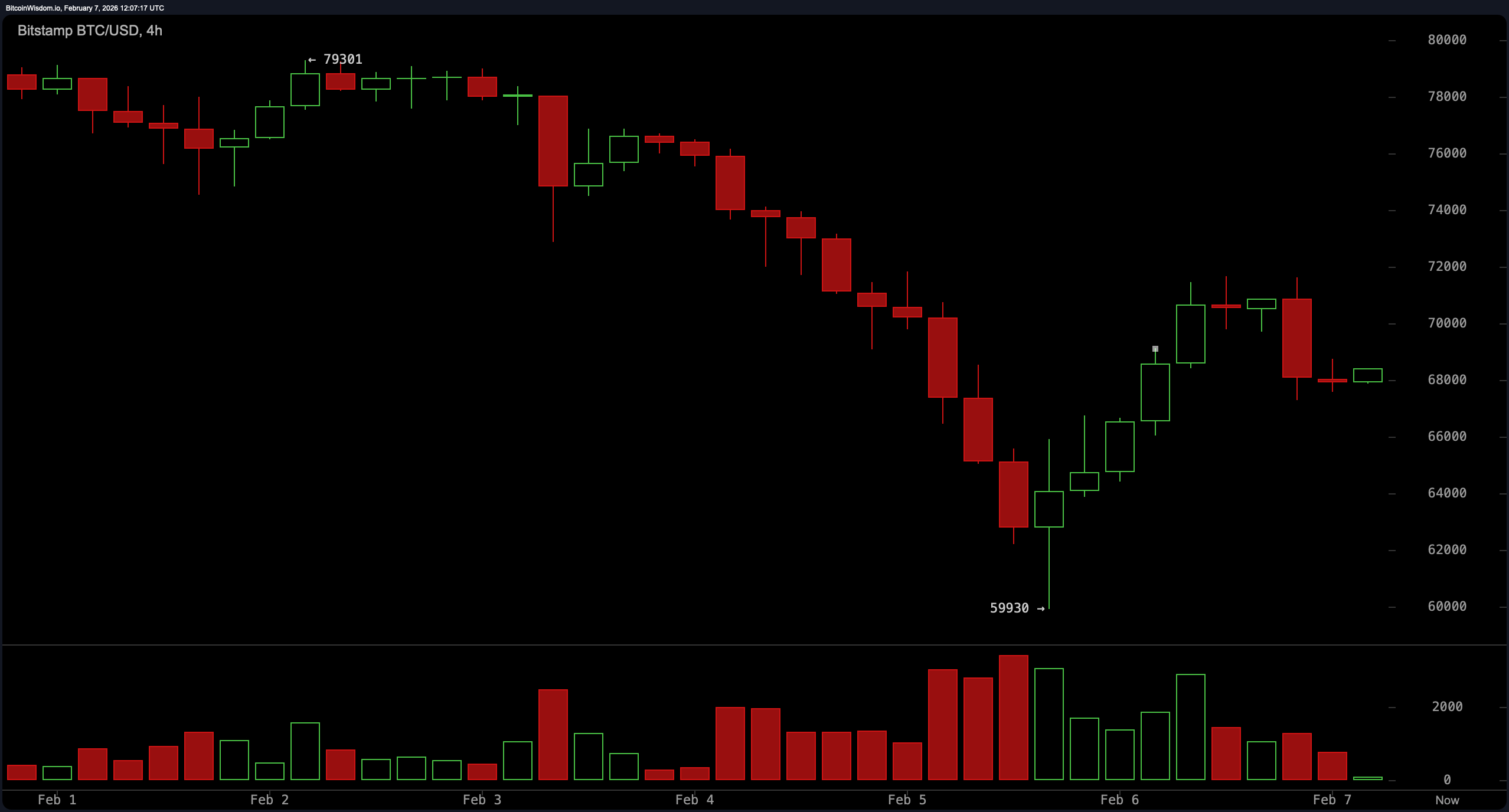

Zooming into the four-hour chart, the market reveals a traditional V-shaped restoration that misplaced steam proper the place it ought to have, within the $71,000 to $72,000 zone. Since then, value motion has compressed into a variety, with help forming close to $66,000 to $67,000 and resistance repeatedly capping upside makes an attempt. This range-bound habits carries a bearish lean, as momentum has not adopted by on the rebound. In different phrases, bitcoin climbed the steps up and took the elevator again down, then determined to tempo the hallway.

$BTC/USD 4-hour chart through Bitstamp on Feb. 7, 2026.

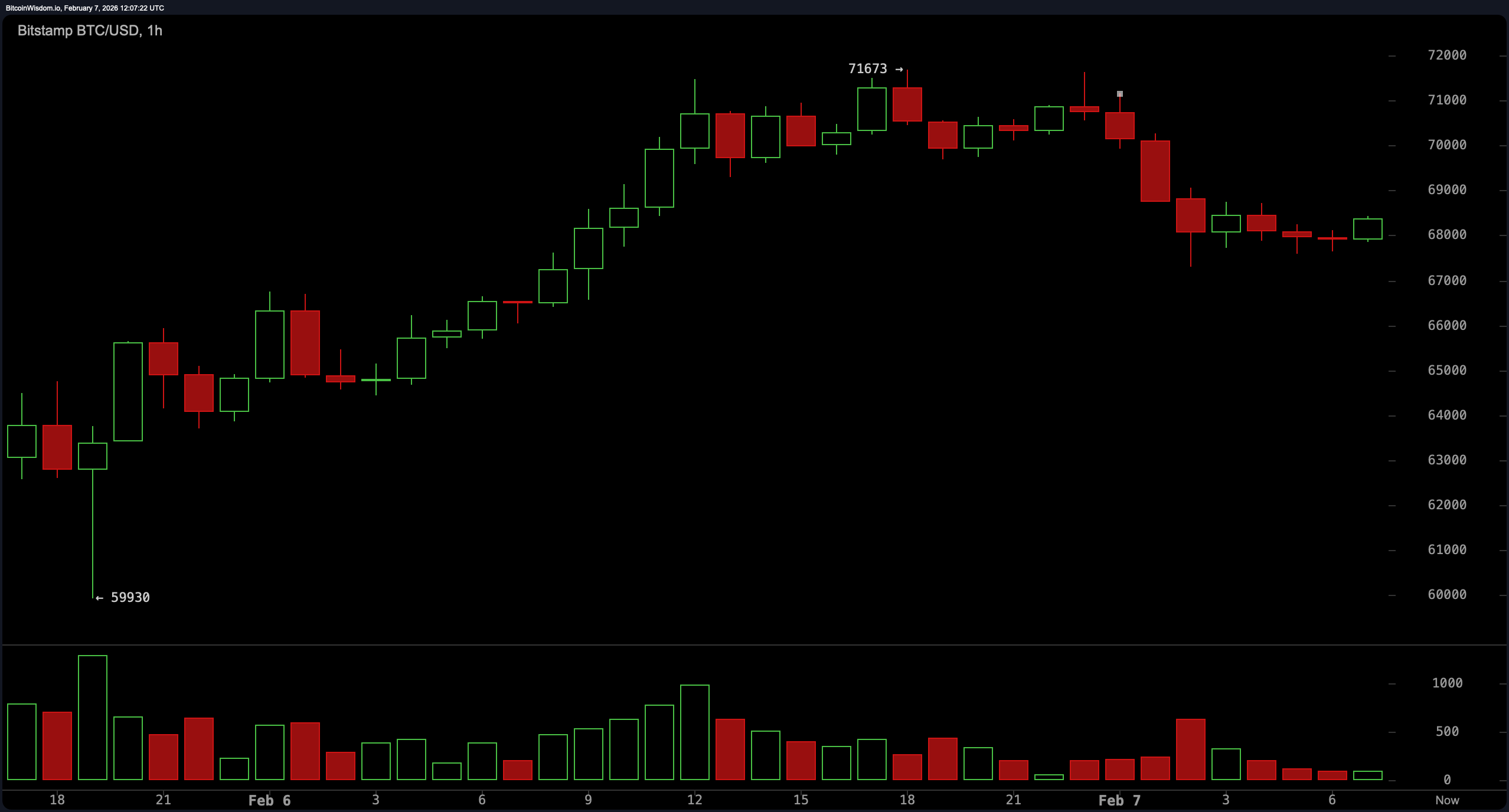

The one-hour chart sharpens that image, exhibiting a short-term uptrend from the capitulation low that stalled at $71,673 earlier than rolling into decrease highs. Worth is now oscillating tightly round $68,000 to $69,000, an indication of intraday steadiness quite than conviction. Assist rests close to $67,500 to $68,000, whereas resistance looms between $70,500 and $71,700. This sort of compression usually precedes growth, and the dearth of quantity suggests merchants are ready, watching, and side-eyeing each tick.

$BTC/USD 1-hour chart through Bitstamp on Feb. 7, 2026.

Oscillators and shifting averages usually are not precisely whispering candy nothings. The relative energy index ( RSI) sits at 31, flirting with oversold territory with out fairly committing. Stochastic reads 21, whereas the commodity channel index (CCI) is deeply damaging at −122. Common directional index (ADX) at 44 confirms development energy, and each momentum and the shifting common convergence divergence ( MACD) stay firmly damaging.

Each main shifting common, from the 10-period exponential shifting common (EMA) by the 200-period easy shifting common (SMA), is positioned nicely above the present value, a stacked ceiling that underscores how a lot technical restore work stays. Bitcoin could also be resilient, however proper now the charts are reminding everybody that resilience isn’t the identical factor as immunity.

Bull Verdict:

A constructive case hinges on stabilization holding above the $66,000–$68,000 help band, the place intraday steadiness has repeatedly shaped, and promoting strain has didn’t speed up. The deeply compressed construction on the one-hour chart suggests a volatility growth is brewing, and a sustained push by the $71,000–$72,000 resistance zone would enhance short-term construction and trace that the latest capitulation low close to $59,930 might have marked a significant exhaustion level quite than a pause.

Bear Verdict:

The dominant narrative stays outlined by a day by day downtrend, bolstered by uniformly bearish shifting averages and damaging momentum readings. Worth continues to be buying and selling nicely beneath each main development gauge, with rallies stalling exactly at prior breakdown zones. Except bitcoin can reclaim and maintain above $75,000 on greater time frames, rebounds proceed to look corrective, leaving the market susceptible to renewed draw back strain ought to help close to $66,000 give means.

FAQ ❓

- What’s bitcoin’s value as we speak?

Bitcoin is buying and selling between $68,090 and $69,162 over the previous hour, shifting inside a 24-hour vary of $66,131 to $71,604 as volatility stays elevated. - Is bitcoin bullish or bearish proper now?

Bitcoin stays technically bearish on the day by day chart, with value buying and selling beneath all main shifting averages. - What ranges matter most for bitcoin value motion?

Key help sits close to $66,000, whereas resistance is concentrated between $71,000 and $75,000. - What’s driving bitcoin market sentiment as we speak?

Market sentiment is formed by heavy buying and selling quantity, weak momentum indicators, and consolidation following a latest capitulation transfer.