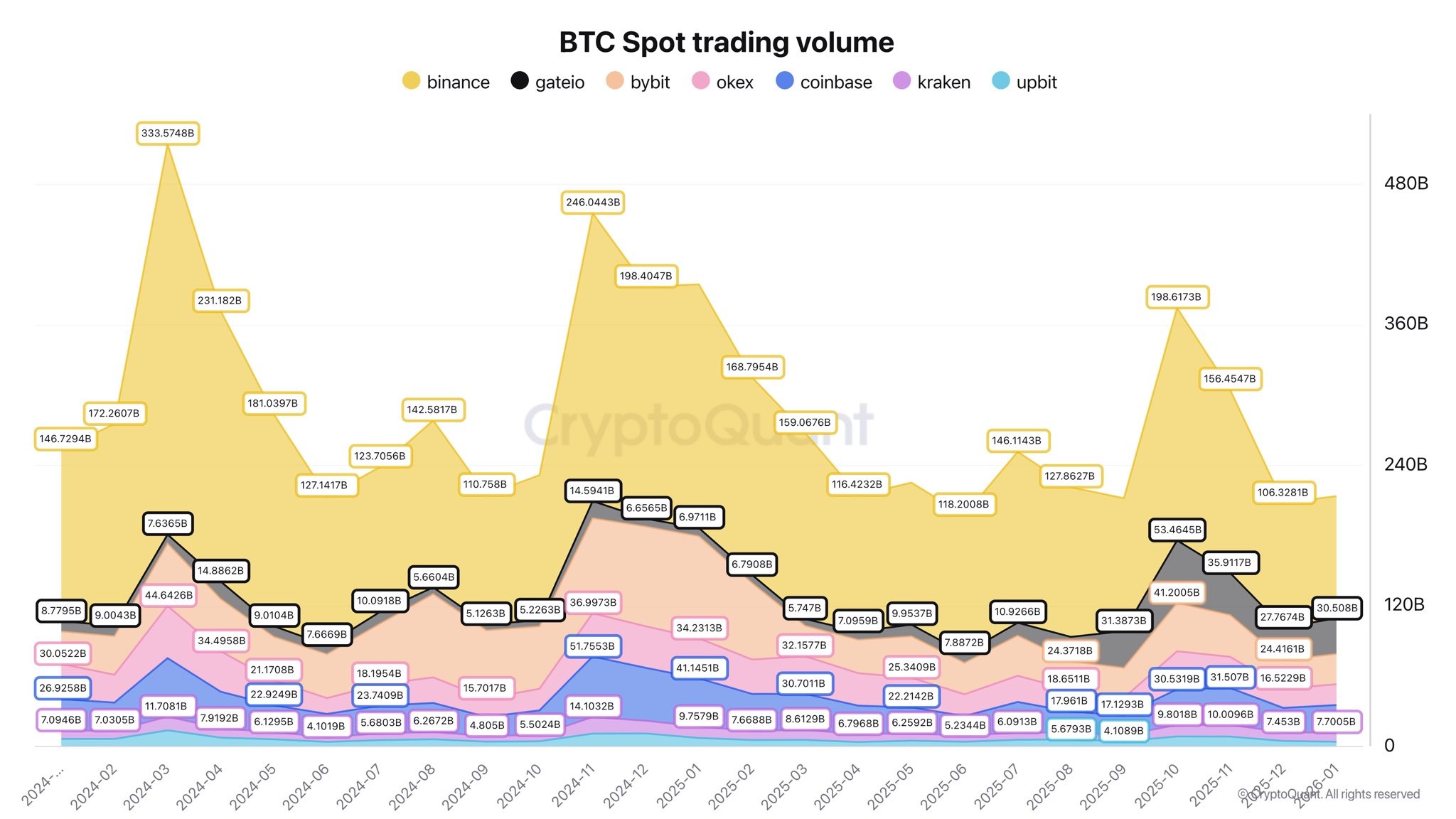

Spot crypto buying and selling volumes on main exchanges have fallen from round $2 trillion in October to $1 trillion on the finish of January, indicating “clear disengagement from traders” and weaker demand, in keeping with analysts.

Bitcoin ($BTC) is at the moment down 37.5% from its October peak amid a liquidity drought and a significant bout of threat aversion, inflicting volumes to contract.

“Spot demand is drying up,” stated CryptoQuant analyst Darkfost on Monday, including that the correction “has been largely pushed by the Oct. 10 liquidation occasion.”

Since October, crypto spot volumes on main exchanges have halved, in keeping with CryptoQuant. Binance, for instance, noticed $200 billion in Bitcoin quantity in October, and that has now fallen to round $104 billion.

“This contraction in volumes has introduced the market again to ranges among the many lowest noticed since 2024, suggesting a transparent disengagement from traders within the crypto market and, consequently, weaker demand.”

Spot Bitcoin quantity on main exchanges falls to 2024 lows. Supply: CryptoQuant

Nevertheless, this isn’t the one issue at play, they stated.

Market liquidity can also be beneath stress, as mirrored by stablecoin outflows from exchanges and round $10 billion in stablecoin market cap declines, they added.

Bitter medication, however a mandatory market transfer

Justin d’Anethan, head of analysis at Arctic Digital, instructed Cointelegraph that the largest short-term dangers for $BTC over the subsequent few months look macro-driven.

“Uncertainty round Kevin Warsh’s hawkish stance as Fed chair may imply fewer or slower fee cuts, a stronger greenback, and better actual yields, which all stress threat property, together with crypto,” he stated.

Associated: Crypto selloff is probably going because of US liquidity drought: Analyst

“I don’t suppose the narrative of $BTC as a debasement/inflation hedge is over — Bitcoin was constructed to hedge in opposition to reckless financial insurance policies and really long-term forex debasement,” he stated as a contrarian take.

“The resumption of robust ETF inflows, clearer pro-crypto laws, or softer financial knowledge that forces the Fed again towards simpler coverage” may spark a significant rally, d’Anethan stated.

“It could be a bitter medication, however the current transfer feels in the end mandatory and wholesome to filter out leverage, tone down hypothesis, and pressure traders to rethink valuations.”

Not near the Bitcoin value backside but

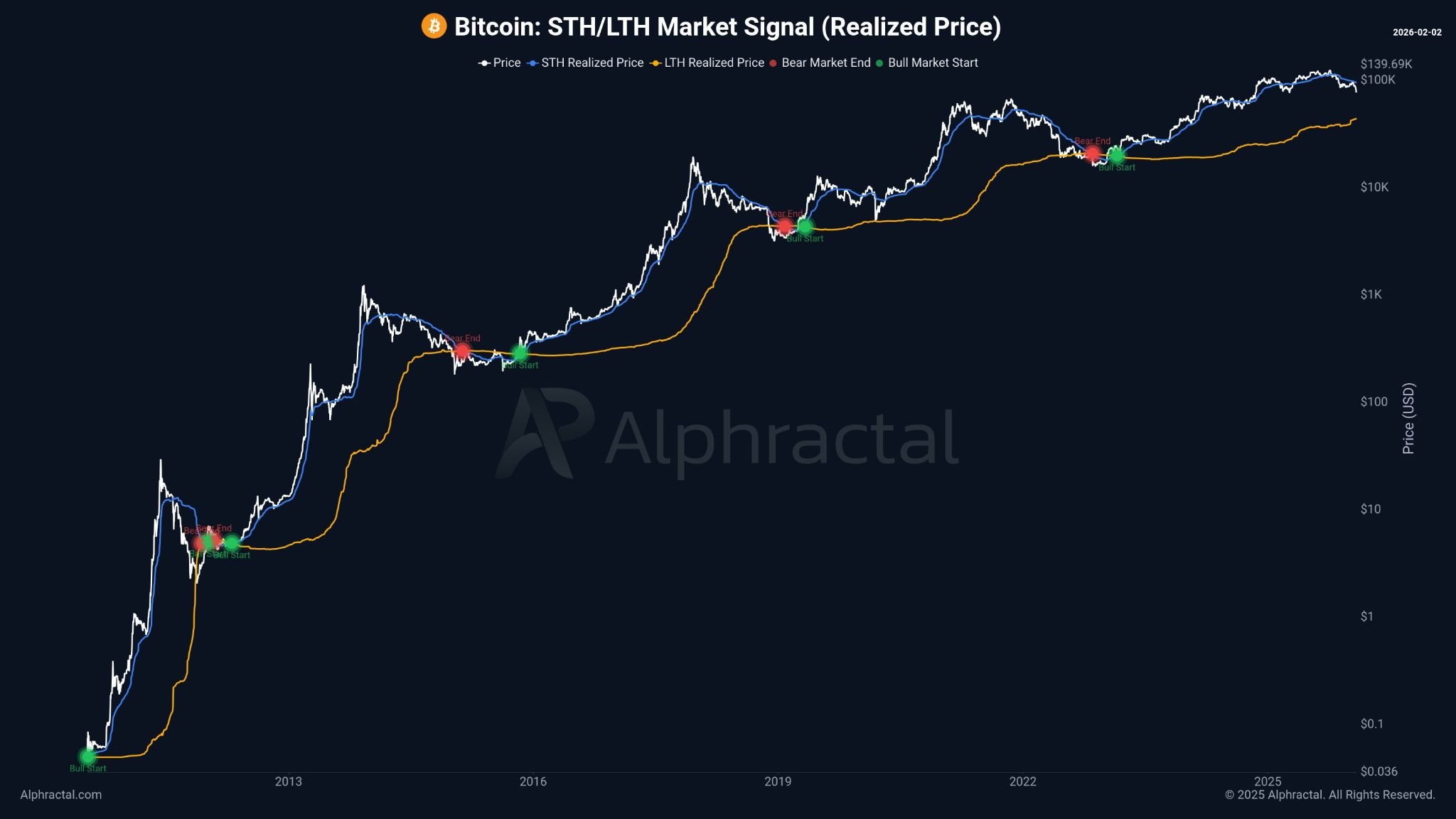

Alphractal founder and CEO Joao Wedson identified that two issues have to occur for a Bitcoin value backside.

Quick-term holders (STH) must be underwater, which is the present state of affairs, and long-term holders (LTH) “begin carrying losses,” which has not occurred but.

He added that bear markets solely finish when the STH realized value falls beneath the LTH realized value, and bull markets start when it crosses again above.

Presently, STH realized value remains to be above LTH, although a fall beneath key help at $74,000 may see $BTC enter bear market territory.

Bull and bear market indicators from STH/LTH realized value. Supply: Alphractal

Journal: DAT panic dumps 73,000 ETH, India’s crypto tax stays: Asia Categorical