Bitcoin has slipped beneath the $70,000 degree, a transfer that displays rising promoting strain and rising market nervousness. The break of this psychological threshold has intensified volatility, with short-term individuals reacting shortly to draw back momentum. Analysts be aware that the present atmosphere is outlined much less by macro headlines and extra by inside market construction, notably the habits of long-term holders.

In accordance with insights shared by On-chain Thoughts, Bitcoin worth alone hardly ever defines a market backside. As a substitute, the important thing sign tends to return from holder habits — particularly, whether or not long-term buyers start to point out indicators of stress. Traditionally, these individuals are the least reactive cohort, typically absorbing volatility relatively than amplifying it by speedy promoting.

When long-term holders transfer into widespread unrealized losses, nonetheless, the dynamic adjustments. Such situations have incessantly coincided with the late phases of bear markets, when conviction weakens and broader capitulation turns into doable. This part doesn’t assure a direct reversal, however it typically indicators that structural exhaustion is creating.

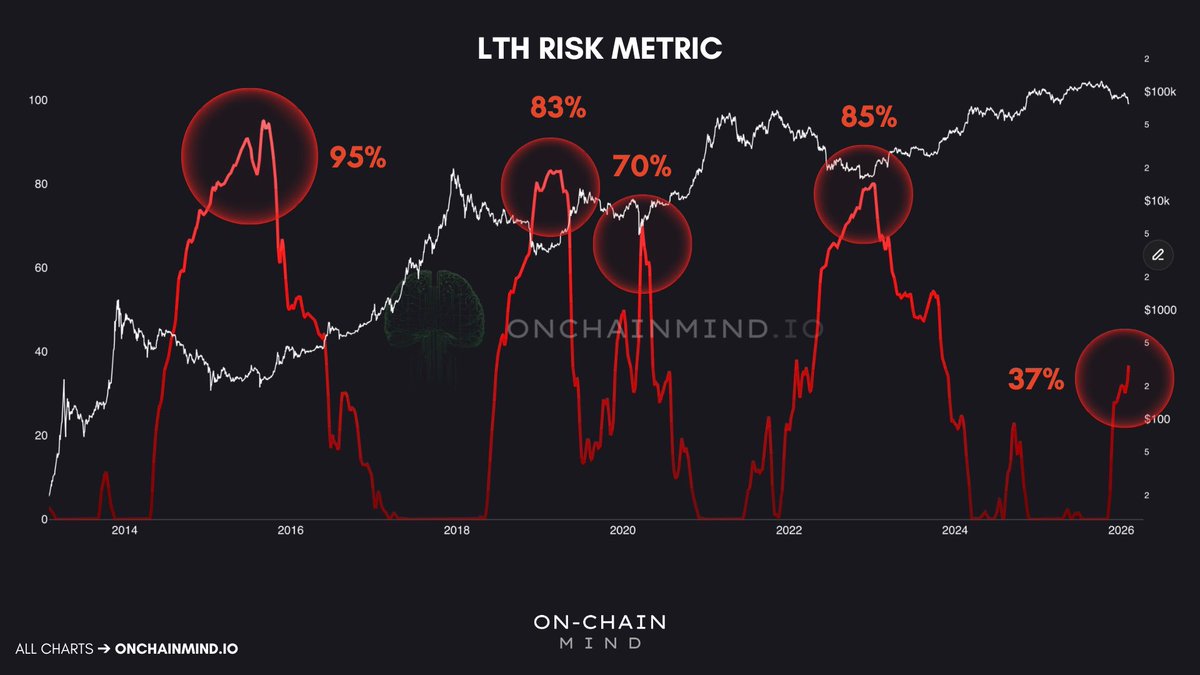

On-chain Thoughts additional highlights that long-term holder threat has traditionally performed a decisive position in figuring out late-stage bear market situations. Earlier cycles present clear peaks on this metric: roughly 95% in 2015, about 83% in 2019, close to 70% through the COVID crash, and round 85% within the 2022 downturn. These spikes usually mirrored widespread unrealized losses amongst long-term buyers, signaling deep structural stress throughout the community.

Traditionally, as soon as this indicator rises above the 55–60% vary, the bottoming course of tends to speed up. At these ranges, even essentially the most affected person holders start to expertise significant strain, typically coinciding with the ultimate phases of capitulation. This doesn’t essentially mark the precise worth low, however it has incessantly preceded stabilization and eventual restoration.

At present, nonetheless, the metric sits nearer to 37%, properly beneath prior capitulation thresholds. This means that whereas market stress is obvious, situations could not but replicate the full-scale exhaustion usually related to sturdy cycle bottoms. If the sample of diminishing peaks continues, a transfer towards the 70% area would point out that even robust palms are underneath substantial strain — traditionally a prerequisite for a extra structural and lasting market low.

Bitcoin’s weekly construction exhibits a transparent deterioration in momentum after the rejection from the $120K–$125K area, with worth now buying and selling close to the $69K zone. The newest breakdown pushed Bitcoin decisively beneath the 50-week transferring common (blue) and the 100-week common (inexperienced), ranges that had beforehand acted as dynamic help all through the prior uptrend. Shedding each indicators a shift from a corrective pullback to a extra structural downtrend part.

The 200-week transferring common (purple) stays properly beneath the present worth, suggesting the broader macro pattern shouldn’t be but in deep bear-market territory. Nonetheless, the pace of the decline and increasing bearish candles point out aggressive distribution relatively than orderly consolidation. Quantity spikes accompanying latest draw back strikes reinforce the interpretation of pressured promoting and liquidation exercise.

From a technical standpoint, the $70K area has transitioned from help into resistance after the breakdown. Failure to shortly reclaim this degree would enhance the likelihood of additional draw back exploration, doubtlessly towards historic demand zones within the low-$60K space. Conversely, stabilization above this area with declining promote quantity might sign exhaustion amongst sellers.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.