Digital asset treasuries (DAT) had been touted as a significant unlock in 2025, with struggling firms being acquired and repurposed as crypto allocation automobiles; nevertheless, only one month into 2026, the brand new class of DATs are nearly $20 billion within the gap.

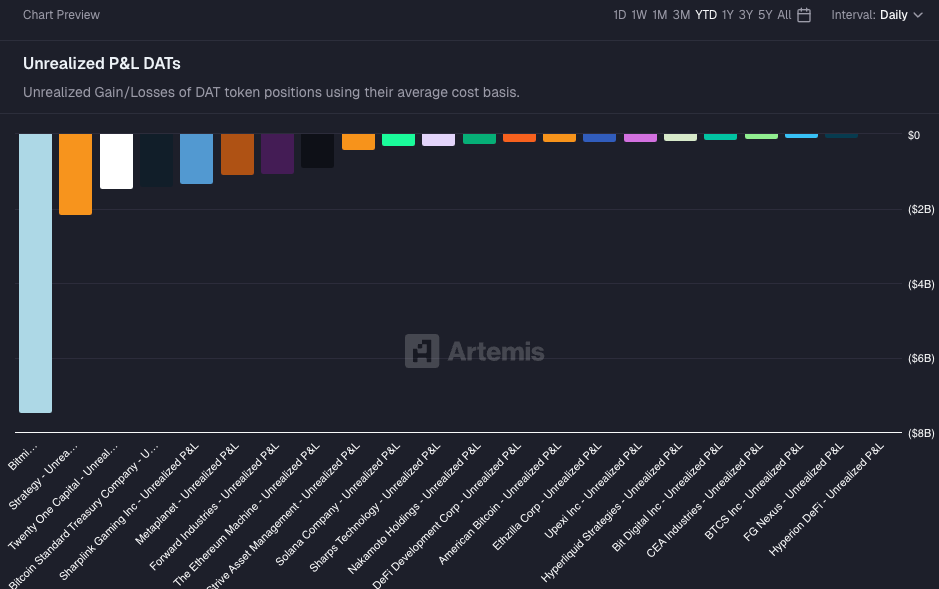

In accordance with Artemis Terminal, the 20 largest DATs are down a cumulative $17 billion because the crypto market continues to fall.

Tom Lee’s Bitmine Immersion stands out, accounting for nearly 44% of that determine with $7.5 billion in unrealized losses on its $ETH holdings, bought at a mean value of $3,900.

Michael Saylor’s Technique is subsequent in line as a result of its large $BTC holdings, and the corporate is down $2.2 billion regardless of Bitcoin solely buying and selling 2.8% under his $76,000 common acquisition value.

DAT Unrealized PnL – Artemis Terminal

The mounting losses are a results of the crypto market’s continued downtrend, with $BTC and $ETH falling under $73,000 and $2,100, respectively, earlier this morning.

Whereas the highest 20 DATs account for almost all of losses, there are greater than 140 firms with crypto treasuries, 76 of which had been fashioned between January and November 2025, in accordance with a report from CoinGecko in This autumn 2025.

Many of those firms haven’t disclosed their actual publicity and leverage, however business specialists have warned that the DAT construction may pose vital dangers to crypto markets.

Because the DAT mannequin started to essentially take off in July 2025, Galaxy Digital’s Mike Novogratz warned that it may create a “structurally fragile” market surroundings.