A shock uptick in a key manufacturing unit gauge has merchants rethinking threat, whereas crypto watchers debate whether or not Bitcoin will trip a recent wave larger or keep caught in a drawdown.

The ISM Manufacturing PMI rose into growth territory in January, and that single information level has set off a flurry of takes from market strategists and crypto analysts alike.

ISM Manufacturing Indicators Shift

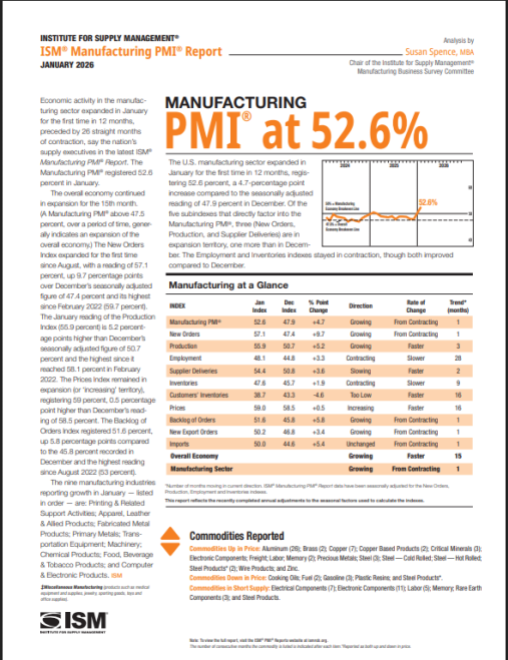

In keeping with the Institute for Provide Administration, the PMI clocked in at 52.6 for January. That quantity crosses the road that separates contraction from progress.

For traders who watch indicators carefully, a transfer like that may imply cash begins flowing again into belongings seen as larger threat.

“Previous breakouts in 2013, 2016, and 2020 served as key catalysts for Bitcoin’s main bull runs,” Try vice chairman of Bitcoin technique, Joe Burnett, mentioned.

The Fed will discover. A stronger manufacturing print modifications the controversy about inflation and price coverage. Merchants worth within the likelihood of tighter coverage when progress appears to be like stable.

On the similar time, some economists level out manufacturing is just one piece of the puzzle. Companies, employment, and shopper demand additionally matter. Reviews observe the index studying was the perfect since August 2022, which makes it notable by itself.

One of many longest ISM Manufacturing PMI contraction durations in U.S. historical past ended this morning with a breakout to 52.6, up 4.7 factors from December.

Previous breakouts in 2013, 2016, and 2020 served as key catalysts for Bitcoin’s main bull runs.

This ends 26 consecutive months of…

— Joe Burnett, MSBA (@IIICapital) February 2, 2026

Bitcoin Value Motion And Market Temper

Bitcoin’s worth has been uneven. After hitting a excessive above $125,000 late final 12 months, it tumbled after which bounced into the $78,000 space. Reviews say the drop adopted a significant liquidation occasion and a string of macro shocks that pushed traders towards secure belongings.

Some consumers are taking the dip as an entry level. Others stay on the sidelines. Correlations with inventory tech names have been robust, which suggests Bitcoin has behaved extra like a threat asset than a digital gold in current months.

Supply: ISM

Just a few merchants argue rising PMI readings typically precede “risk-on” durations, when speculative bets return. Nonetheless, this hyperlink will not be ironclad. Bitcoin’s strikes are formed by liquidity flows, ETF cash out and in, geopolitical flare-ups, and crypto-specific occasions. The market is being pushed from a number of instructions without delay.

Whom To Belief On Forecasts

Institutional voices are splintered. Primarily based on studies from numerous companies, estimates vary from cautious to wildly optimistic. One agency initiatives a post-crash rally that would ship costs properly above present ranges by year-end.

One other analysis home warns of extra retracement earlier than any sustained upswing. A big institutional participant declined to peg a quantity in any respect, calling the surroundings too chaotic to forecast with confidence.

That sort of vary tells a transparent story: uncertainty guidelines. Analysts who tie Bitcoin to macro cycles are gaining followers, whereas those that deal with it as an impartial asset argue for a unique playbook.

Why This Issues

Brief-term merchants will watch financial prints and liquidity information carefully. Longer-term holders will weigh Bitcoin’s position relative to gold and equities. Reviews say market construction—who’s shopping for, who’s promoting, and the place ETFs are seeing flows—will probably matter as a lot as any single financial launch.

The ISM rise stands out as the begin of a more healthy threat tone for international markets, nevertheless it won’t by itself assure a gradual climb for Bitcoin. Threat is again on the desk, in a fashion of talking, and the trail ahead will depend upon how coverage makers, huge traders, and retail merchants react within the subsequent a number of weeks.

Featured picture from unsplash, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.