Bybit despatched out a number of transactions of XAUT tokens, underscoring rising demand for tokenized gold. A whale gathered a rising XAUT portfolio valued at over $7M.

Bybit grew to become a part of the growing demand for Tether’s tokenized gold, XAUT. The alternate’s sizzling pockets began sending out XAUT transactions previously day, resulting in a whale handle accumulating tokenized gold.

The latest shift in narratives led crypto buyers to modify to metals. Since XAUT is essentially the most simply obtainable token, it has discovered renewed demand and buying and selling volumes. The whale’s portfolio rose to $6.95M after the latest information of gold on conventional markets.

The whale’s newest buy was for 450 XAUT, every representing one ounce of gold, instantly transferred from Bybit’s sizzling pockets. The recipient pockets was newly created and solely funded with sufficient ETH to facilitate the transfers with gasoline charges.

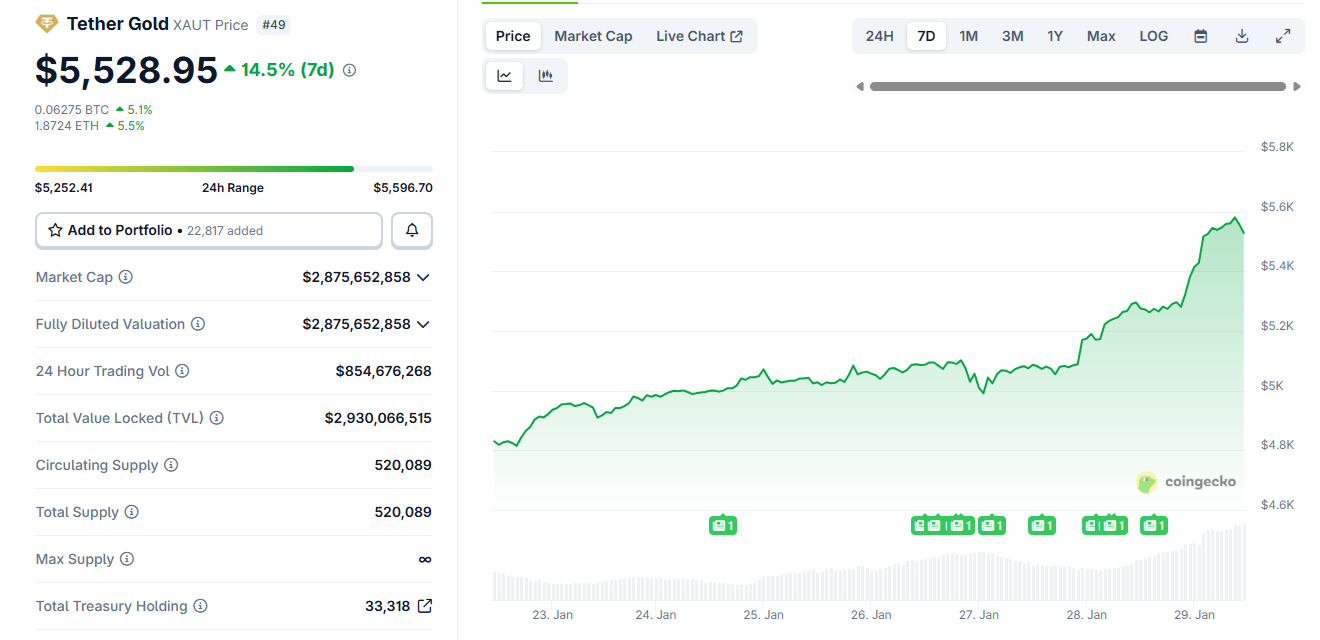

XAUT volumes improve to a one-month excessive

Up to now month, XAUT volumes progressively grew as gold set a sequence of worth information. Volumes expanded to $854M, solely surpassed by an anomalous spike in November. Curiosity in XAUT coincided with slower efficiency for $BTC and even main altcoins.

Curiosity in XAUT rose on spot exchanges, as Tether recalled its dedication to storing bodily gold, increasing the gold shares, and shifting into mining.

XAUT traded at a slight premium to identify gold, at $5,542.07, reflecting the final demand for simple on-chain entry. Spot gold reached $5,537.78, boosted by a mixture of hypothesis and a hedge-against-inflation narrative.

The buildup of XAUT additionally indicators that crypto merchants nonetheless search a market promising development and a decrease danger of drawdowns. The latest XAUT shopping for and speculative buying and selling of different gold-backed tokens adopted a chronic $BTC drawdown. The main coin has gone for 115 days with no new all-time excessive, and is almost 30% down from its cycle peak.

XAUT open curiosity rises to all-time highs

XAUT goes past spot demand, not too long ago increasing its spinoff open curiosity. Bybit stays the primary venue for XAUT hypothesis, carrying $177.9M in open curiosity. In whole, XAUT positions expanded to a document of $194M.

Till not too long ago, metal-backed tokens in crypto had been comparatively area of interest and a take a look at case for tokenization. Silver nonetheless doesn’t have a metal-backed token, though worth hypothesis has emerged on spinoff exchanges, together with Hyperliquid.

XAUT is predominantly longed by merchants, who count on the gold rally to proceed past hypothesis into full repricing.

XAUT briefly traded at a premium to identify gold, as crypto merchants expanded volumes to a one-month excessive. | Supply: CoinGecko.

Hyperliquid helps hypothesis for PAXG, one other main gold-backed token by Paxos. Whales carry over 85% in lengthy positions, anticipating gold’s enlargement.

At the moment, gold-backed tokens are a small fraction of the crypto market, and their upside is dependent upon the final TradFi buying and selling of gold futures and spot markets. Nevertheless, searches are accelerating for the ticker, in line with CoinGecko knowledge.

Mindshare for XAUT additionally rallied by 164% previously day. The token nonetheless has a restricted presence on social media, however a brand new development could also be rising as merchants search the safety of metals in tokenized type.