Bitcoin mining exercise has taken its greatest hit since late 2021 after a extreme winter storm in america compelled a number of massive mining companies to curtail operations, triggering a pointy drop in community hashrate, manufacturing and income.

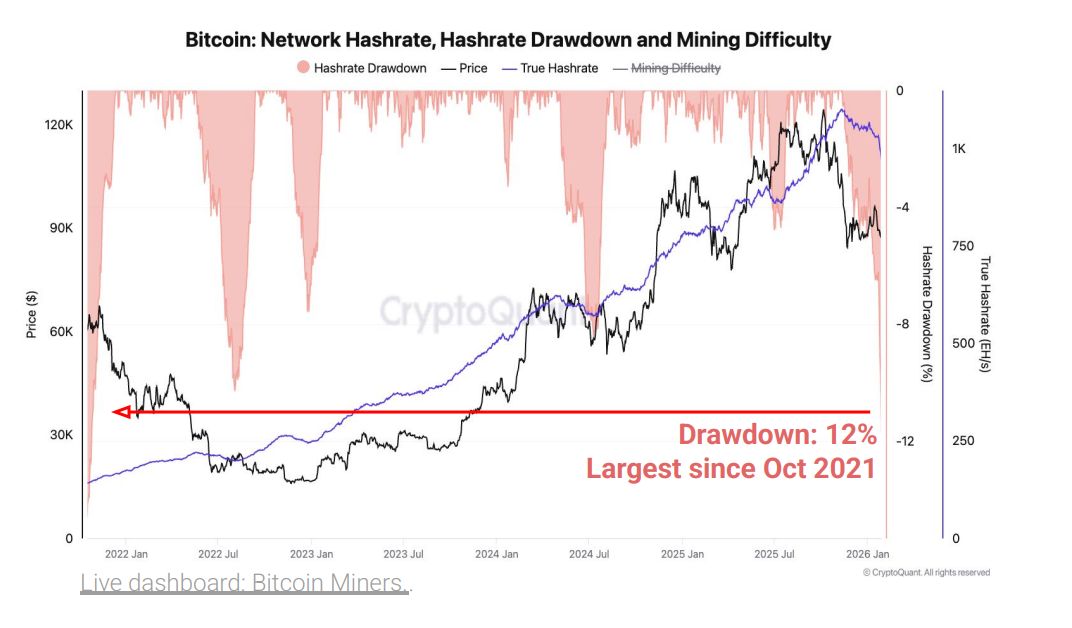

Bitcoin’s whole community hashrate has fallen about 12% since November 11, marking the biggest drawdown since October 2021, when the community was nonetheless recovering from China’s sweeping mining ban.

The hashrate now sits close to 970 exahashes per second, its lowest stage since September 2025, in line with CryptoQuant information.

The decline accelerated this week as excessive climate disrupted energy provide throughout key US mining hubs.

A number of publicly listed miners quickly shut down machines to guard infrastructure and adjust to grid curtailment requests, amplifying an already softening development that started as bitcoin pulled again from its $126,000 all time excessive towards the $100,000 stage late final yr.

The hashrate shock rapidly fed into miner economics. Every day bitcoin mining income dropped from roughly $45 million on January 22 to a yearly low of $28 million simply two days later. Whereas income has since rebounded modestly to round $34 million, it stays nicely under latest averages, reflecting each decrease community exercise and weaker bitcoin costs.

Manufacturing figures present an equally sharp contraction. Output from the biggest publicly traded miners fell from 77 bitcoin per day to simply 28 bitcoin over the identical interval. Manufacturing from different miners declined from 403 bitcoin to 209 bitcoin, bringing whole community output down sharply.

On a 30-day rolling foundation, publicly listed miners recorded a 48 bitcoin decline in manufacturing, the steepest since Could 2024, shortly after the final halving. Output from non public miners dropped by 215 bitcoin, the biggest fall since July 2024.

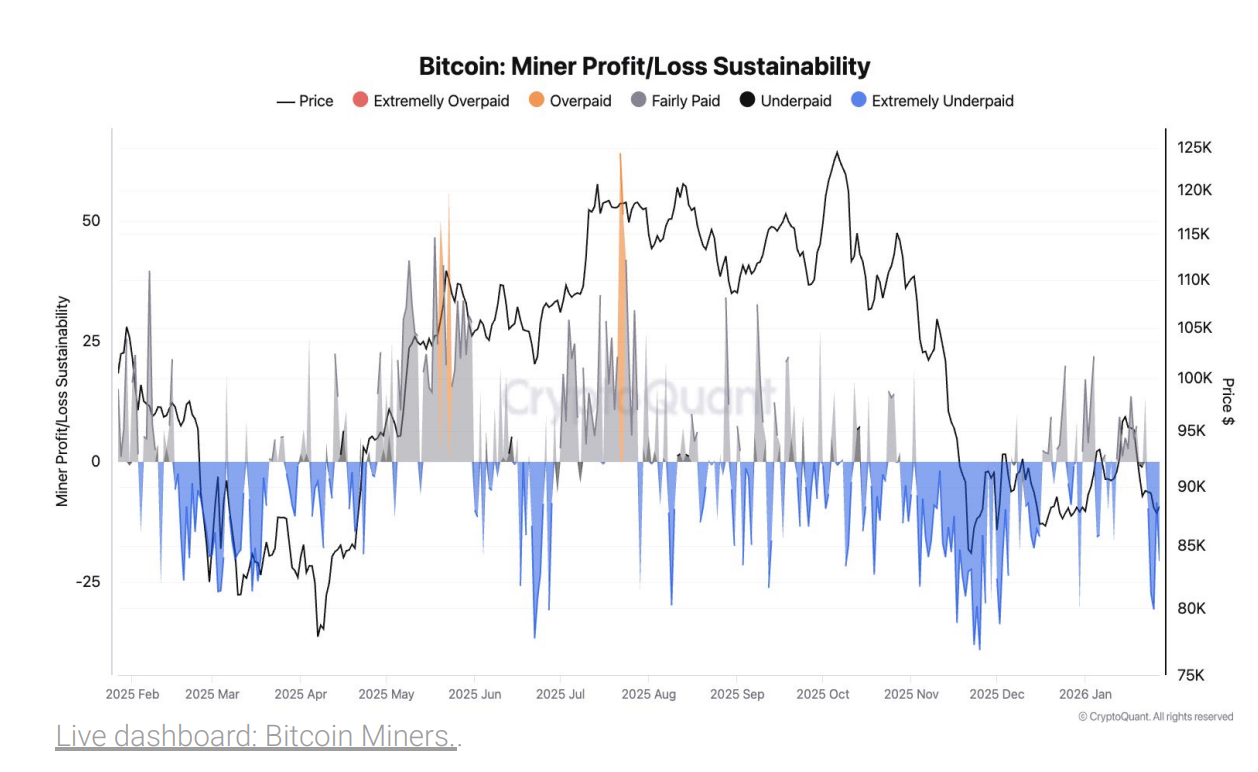

Profitability has additionally deteriorated, additional pressuring the energy-intensive enterprise.

CryptoQuant’s Miner Revenue and Loss Sustainability Index has fallen to 21, its lowest studying since November 2024. The extent indicators that miners are working in deeply pressured situations, with revenues failing to cowl prices for a rising share of the community regardless of a number of downward issue changes over latest epochs.

Whereas issue has eased as machines went offline, the reduction has not been sufficient to offset falling costs and operational disruptions. If hashrate stays suppressed, the community might see additional issue cuts in coming weeks, providing some margin reduction.

For now, the information factors to one of the crucial difficult stretches for bitcoin miners for the reason that submit China ban reset greater than 4 years in the past.