Bybit noticed the second-highest buying and selling volumes amongst crypto exchanges final yr, making a “sluggish however regular comeback” after struggling a $1.5 billion hack in February 2025, says CoinGecko.

Bybit‘s buying and selling quantity reached $1.5 trillion in whole throughout 2025, and its share of the market reached 8.1% for the yr, CoinGecko analysis analyst Shaun Paul Lee mentioned in a report on Thursday.

“Regardless of the most important hack Bybit suffered in February, it has clawed its approach again to the highest,” and has “slowly gained again its dominance all through 2025,” he added.

The assault on Bybit is the biggest crypto hack ever, and was carried out by North Korean attackers exploiting a vulnerability within the trade’s chilly pockets infrastructure to make off with $1.5 billion price of Ether (ETH).

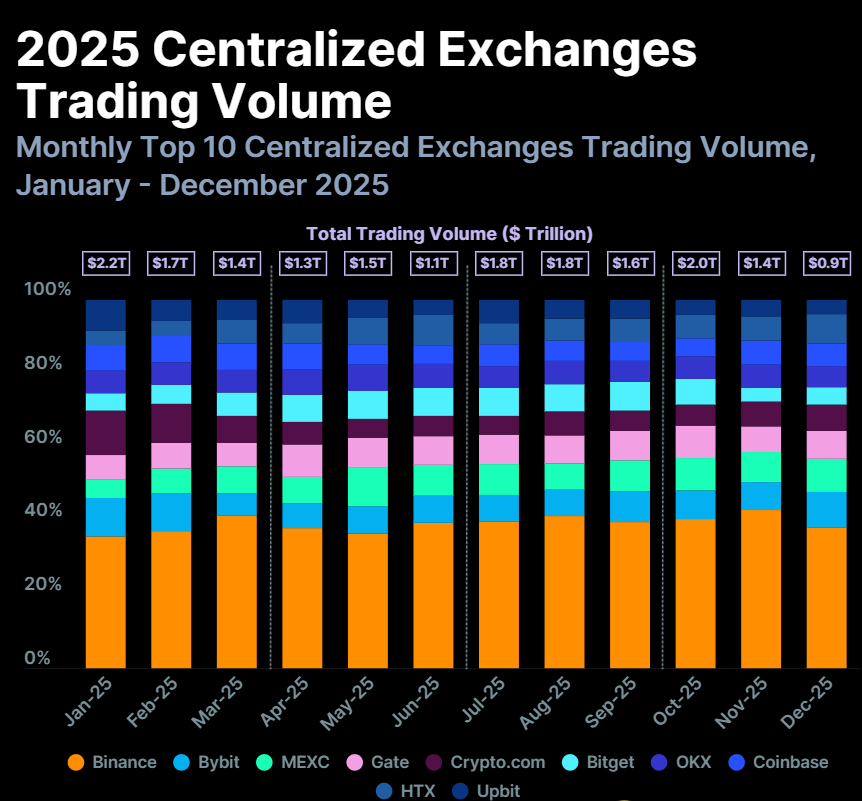

Bybit‘s recorded buying and selling quantity was $1.5 trillion throughout 2025. Supply: CoinGecko

Immunefi CEO Mitchell Amador instructed Cointelegraph earlier this month that almost 80% of tasks that undergo from a hack by no means absolutely get better due to the breakdown in operations and belief throughout the response.

Bybit opted for measures like retaining withdrawals open and honoring all person transactions. Its CEO, Ben Zhou, additionally appeared on digital camera to deal with considerations, assuring customers that the trade had ample funds to cowl all funds and deliberate to safe quick liquidity by exterior help.

Most exchanges noticed quantity climb in 2025

CoinGecko’s report mentioned six out of the highest 10 exchanges by market share noticed their buying and selling volumes climb in 2025, with buying and selling volumes rising by 7.6% on common over the yr for $1.3 trillion in further trades.

4 out of 10 exchanges noticed double-digit share will increase in volumes, with MEXC main because the fastest-growing trade for the yr, with its buying and selling volumes leaping 91% to $1.5 trillion in buying and selling quantity, up from $766.7 billion in 2024.

“MEXC continued its aggressive zero-fee coverage throughout all spot buying and selling pairs, attracting high-frequency merchants and retail customers, and boosting buying and selling quantity,” Lee mentioned.

Regardless of a sluggish finish to the yr, 2025 was a bumper yr for crypto costs, with Bitcoin (BTC) and different cash recording a number of all-time highs.

Binance holds onto prime spot

Binance was nonetheless the market chief amongst crypto exchanges, with CoinGecko estimating it noticed $7.3 trillion in buying and selling quantity.

Nonetheless, it didn’t register a rise in annual buying and selling quantity in comparison with 2024, with its quantity falling by 0.5% year-on-year.

“The hunch in buying and selling quantity will be attributed to the final bearish sentiment within the crypto market after the historic liquidation occasion on Oct. 10,” Shaun Paul Lee mentioned.

In a December open letter final yr, the exchanges’ co-CEOs, Richard Teng and Yi He, introduced the Binance person base had climbed to over 300 million, and the overall buying and selling volumes throughout all merchandise for the yr was $34 trillion.