Revolut, a London-based digital banking and funds firm, has utilized for a full banking license in Peru as a part of its growth throughout Latin America, Bloomberg reported on Monday.

If permitted, the license will permit the corporate to function as a regulated financial institution within the nation, including Peru to a listing of regional markets alongside Mexico, Colombia and Brazil. Bloomberg mentioned Revolut plans to compete primarily with incumbent banks reasonably than newer fintech rivals.

Revolut has recognized remittances and cross-border funds as key components of its native technique, noting that about 1 million folks in Peru depend on cash despatched from overseas.

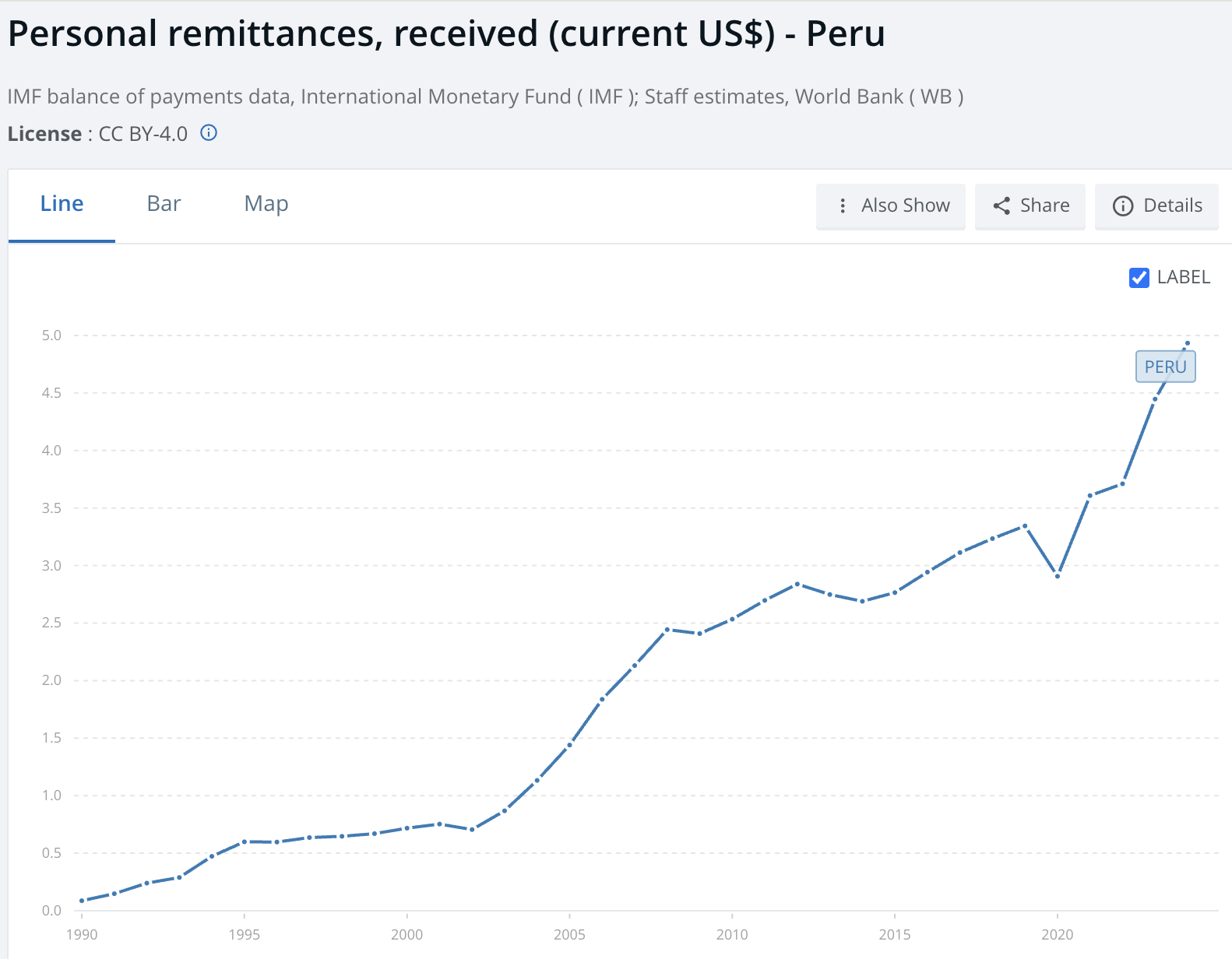

In line with World Financial institution information, private remittances to Peru totaled $4.93 billion in 2024. Julien Labrot, Revolut’s Peru CEO, mentioned the growth is geared toward rising competitors and enhancing entry to monetary providers within the native market.

Private remittances to Peru. Supply: World Financial institution

Revolut, a neobank based in 2015, has not too long ago expanded its crypto choices alongside broader progress throughout its platform. In April 2025, the corporate reported a report 12 months, with 2024 internet revenue rising 130% to 790 million kilos ($1.06 million) year-on-year, fueled by sturdy buyer progress and a rebound in cryptocurrency buying and selling exercise.

In October 2025 Revolut launched 1:1 USD conversion for stablecoins, permitting customers to trade {dollars} for USDC (USDC) and USDt (USDT).

Stablecoin cost volumes on Revolut’s platform have been estimated to have climbed 156% year-on-year in 2025 to about $10.5 billion, based on an unbiased evaluation by researcher Alex Obchakevich.

Associated: Belief Pockets faucets Revolut for crypto purchases in Europe

Latin American fintechs push deeper into stablecoins

Revolut’s stablecoin push displays a broader development amongst fintech firms transferring into stablecoins and crypto-based providers throughout Latin America.

In August 2024, Mercado Libre launched a US greenback–pegged stablecoin in Brazil by way of its monetary providers arm, Mercado Pago. The token, referred to as Meli Greenback, is out there for buying and selling throughout the Mercado Pago app in Brazil, the corporate’s largest market.

Nubank, Latin America’s largest digital financial institution, can be creating dollar-pegged stablecoin funds tied to its bank card merchandise.

In Argentina, crypto pockets and funds firm Lemon raised $20 million in a Collection B funding spherical in October to fund its growth throughout the area. The corporate already operates in Peru, the place it says it has issued greater than 1 million wallets in lower than a 12 months.

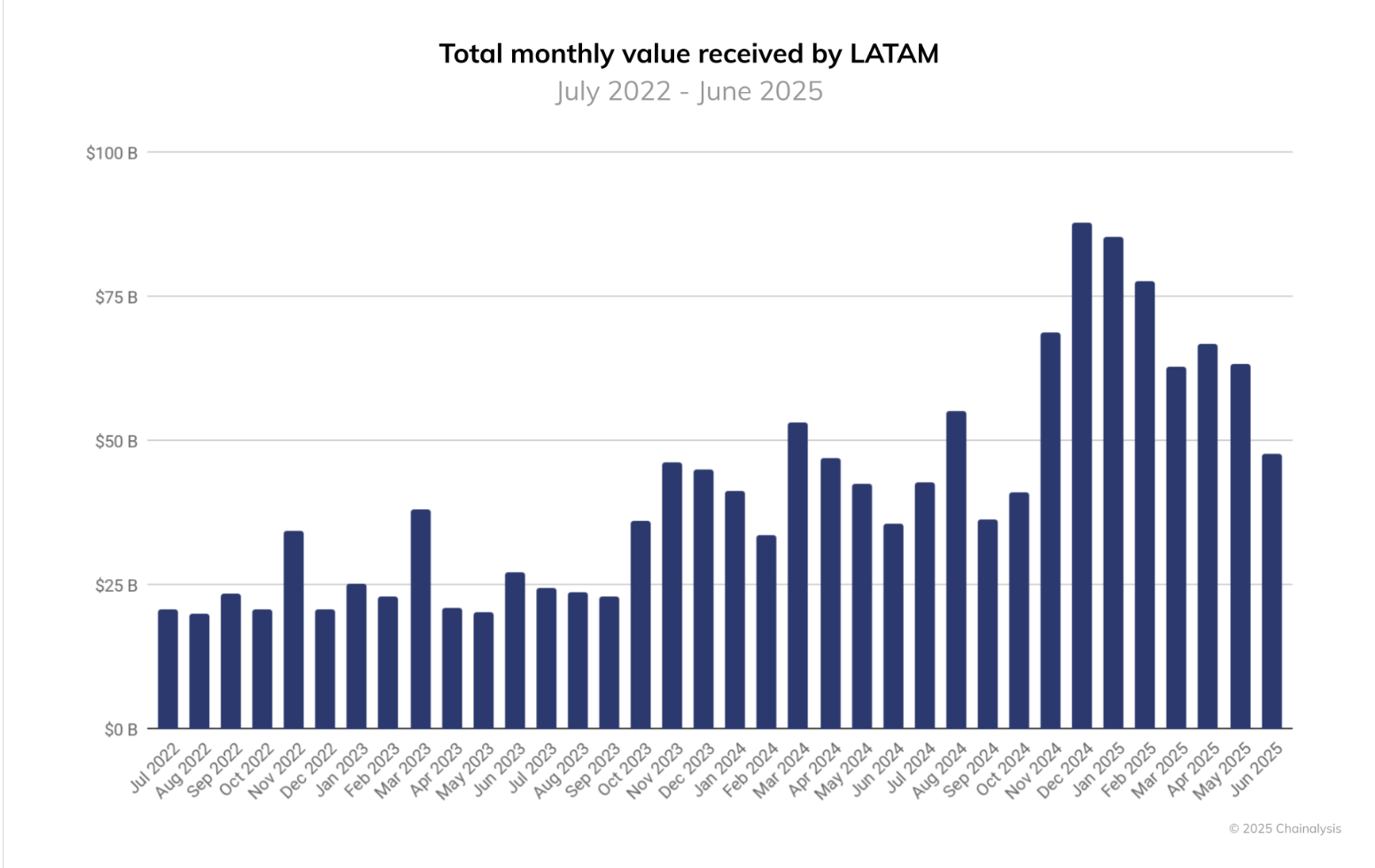

In line with a report revealed by Chainalysis, Latin America generated virtually $1.5 trillion in cryptocurrency transaction quantity from July 2022 to June 2025.

Latin America crypto adoption 2025 report. Supply: Chainalysis

Journal: Right here’s why crypto is transferring to Dubai and Abu Dhabi