- Injective has revealed new analysis that positions its blockchain as a full-stack platform for regulated real-world asset tokenization.

- The adoption is rising, with rising tokenized RWA volumes and constant on-chain exercise all through Injective’s ecosystem.

Injective has launched new analysis outlining how its blockchain is structured to assist real-world asset tokenization at an institutional degree. The report frames tokenization as a direct evolution of conventional securitization, the place possession claims on belongings corresponding to equities, bonds, treasuries, actual property, and fiat devices are moved onto programmable blockchain rails.

Based on the analysis, tokenization is a extra superior model of typical securitization fashions that integrates programmability with sooner settlement and near-instant settlement, whereas decreasing the necessity for intermediaries. Consequently, issuers can automate company motion and compliance logic on-chain. Buyers, in flip, profit from immutable information and clear settlement flows.

As well as, Injective brings again the structural good thing about liquidity. Fractional possession permits for smaller capital investments, and 24/7 buying and selling eliminates time zone restrictions which can be prevalent in conventional markets.

Based on the report, these options allow the extra environment friendly circulation of belongings with out compromising overviews by auditors and regulators. Injective argues that these options remedy actual frictions which have existed within the capital markets for a very long time, somewhat than merely placing present techniques on blockchain rails.

Permissioned Token Requirements Embed Compliance At Issuance

As per the report, the permissioned token customary is on the coronary heart of the Injective mannequin as a result of the usual inherently inscribes entry guidelines inside sensible contracts. Issuers are in a position to implement allowlists and switch restrictions with out off-chain enforcement. The examine observes that such a technique has a number of asset courses and is versatile throughout jurisdictions.

Injective additionally supplies direct integration with custody and compliance suppliers. That design selection is supposed to reduce onboarding friction for banks, asset managers, and different regulated entities getting into tokenization markets.

As soon as issued, belongings can circulation into completely different liquidity environments. Public liquidity networks make the most of automated sensible contracts, whereas institutional networks make use of skilled market makers that facilitate higher quantity buying and selling.

Tokenized Asset Demand Rises

Injective’s analysis cites its operational historical past as an indication of institutional readiness. Injective has processed over 1.1 billion transactions for the reason that mainnet launch in 2021 and has but to expertise downtime or safety breaches. In 2024, the ecosystem broadened with extra stablecoin integrations and tokenized monetary merchandise., which the report views as indicators of institutional readiness.

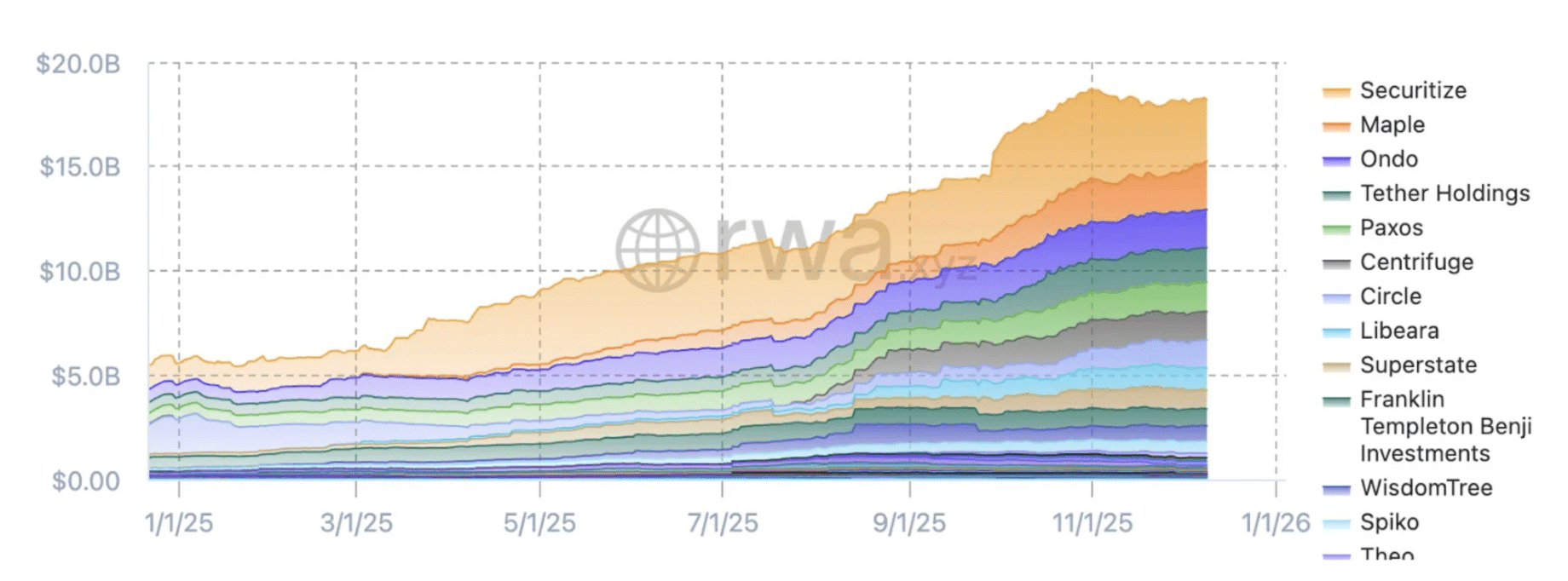

Based on Securitize, tokenized real-world belongings have handed the $20 billion mark for cumulative asset worth. Excluding stablecoins, the sector grew to $18.2 billion by the tip of 2025, up from about $5.5 billion firstly of the 12 months. Tokenized treasuries went from $4 billion to $9 billion in the identical interval.

Supply: Securitize

Individually, Messari reported that Injective hit $6 billion in perpetual real-world asset buying and selling quantity. As of press time, INJ is buying and selling at round $5.64, up 9.74% within the final 24 hours and a pair of% within the final seven days.