Regardless of a weak end to 2025 for digital asset markets, the sector seems to be present process a structural shift, transferring away from retail-led momentum buying and selling towards one more and more formed by institutional capital flows and long-term strategic positioning.

That was a key takeaway from a current macro weekly report by Binance Analysis, which pointed to a “structural pivot” underway throughout digital asset markets. The report highlighted potential drivers together with sovereign accumulation in rising markets and legislative efforts in the US to determine a strategic digital asset reserve.

Following the approval of US spot Bitcoin (BTC) exchange-traded funds in early 2024, the market has now entered what Binance Analysis described as a “second spherical” of institutional adoption, characterised by deeper engagement from conventional monetary establishments.

As proof of this shift, Binance cited current S-1 registrations by Morgan Stanley for Bitcoin and Solana (SOL) ETFs. The transfer means that main Wall Avenue corporations are starting to behave not solely as distribution channels, but additionally as product originators in digital asset markets.

Binance Analysis stated this early positioning might strain rivals resembling Goldman Sachs and J.P. Morgan to observe go well with to keep away from falling behind in an rising asset administration phase.

One other growth highlighted within the report concerned digital asset treasury (DAT) corporations, which confronted the chance of exclusion from the MSCI Index, a state of affairs that might have triggered $10 billion in compelled promoting throughout the sector.

That threat eased final week after MSCI stated it will not take away DAT corporations from its market index, no less than for now.

Supply: Dylan LeClair

Associated: Wall Avenue’s crypto debate is over as banks go all-in on BTC, stablecoins, tokenized money

Macro forces, rotation might assist digital asset markets in 2026

Binance Analysis additionally pointed to the broader macro backdrop as a supportive issue, noting that diversification away from concentrated publicity to large-cap expertise shares might create tailwinds for digital belongings to play a bigger position in diversified funding portfolios.

The rationale is partly rooted in final yr’s elevated valuations among the many so-called Magnificent Seven expertise shares, the place enthusiasm round synthetic intelligence drove a pointy focus of returns.

In 2025, the ten largest corporations within the S&P 500 accounted for about 53% of the index’s whole features, underscoring rising issues about crowding threat in conventional fairness markets.

This degree of focus might encourage buyers to hunt diversification past mega-cap equities, with digital belongings probably benefiting from incremental accumulation.

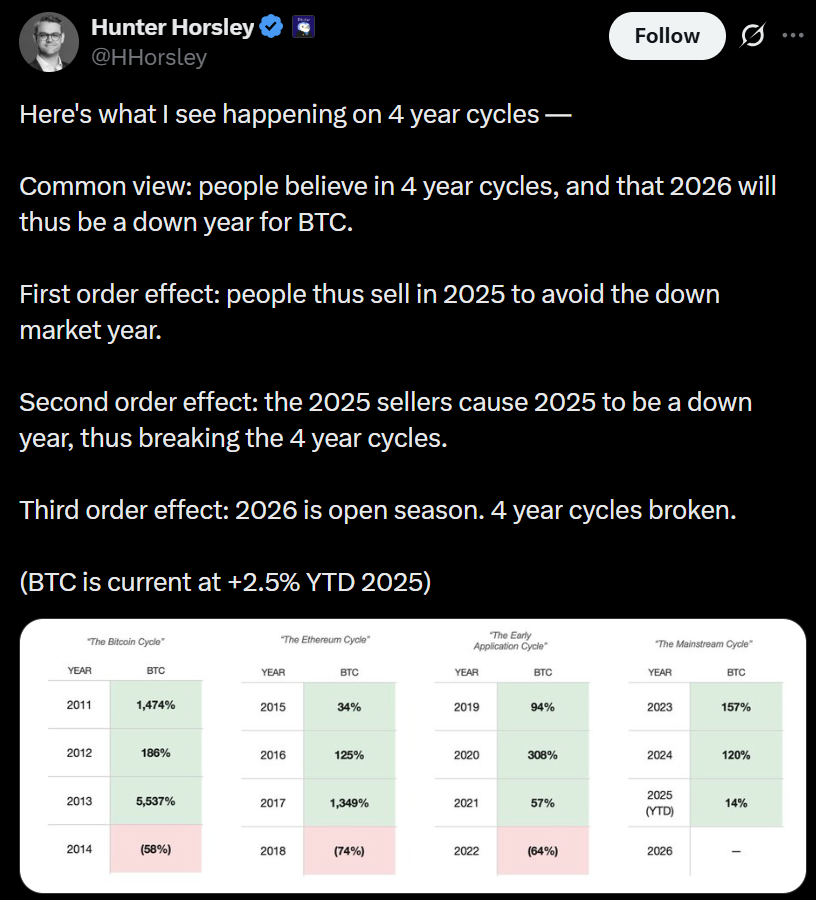

In the meantime, contributors proceed to debate Bitcoin’s trajectory relative to its four-year cycle, with some saying the rally didn’t finish at its October peak of $126,000.

Supply: Hunter Horsley

Associated: Crypto’s 2026 funding playbook: Bitcoin, stablecoin infrastructure, tokenized belongings