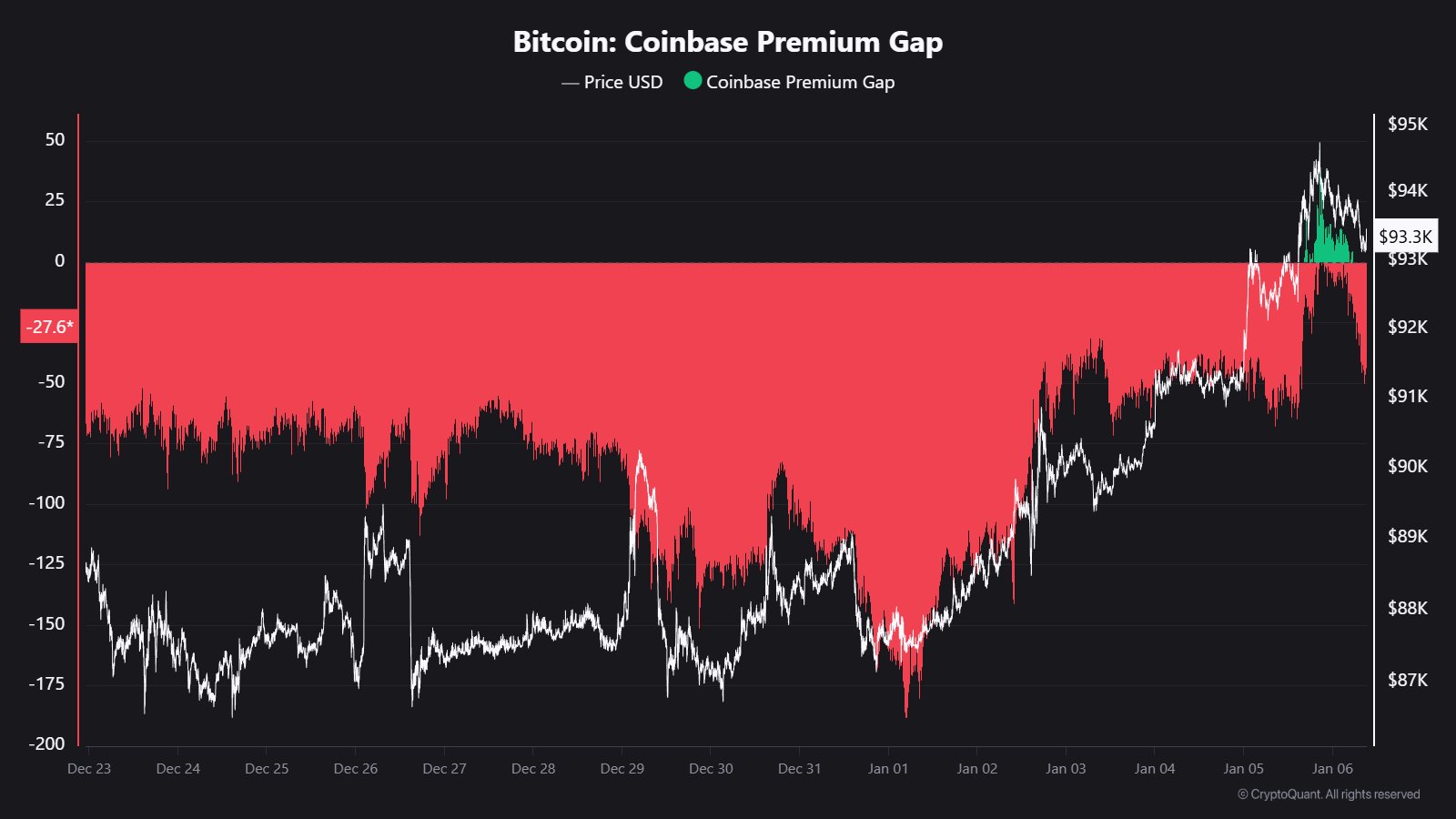

On Friday, one thing modified for Bitcoin, and it was not simply the value of the cryptocurrency however who was behind the rally. After almost two weeks of discounted pricing on Coinbase, the U.S. spot market out of the blue grew to become aggressive, shopping for into energy fairly than weak spot.

For these unfamiliar with it, the Coinbase Premium Hole is a metric that tracks the value distinction between the main U.S. alternate and offshore platforms. It went optimistic for the primary time since Christmas. This means that U.S.-based consumers had been prepared to pay greater than the worldwide common for publicity. They usually weren’t alone.

The shift occurred as Bitcoin lastly made it previous $93,000 and shortly approached $94,000. The premium flip occurred shortly after the U.S. market opened.

Nonetheless, shortly after, the native peak for Bitcoin adopted. The U.S. bid was actual however got here on the finish of a weeklong rally fueled by non-U.S. flows and derivatives-driven publicity. Friday’s candle was totally different; it had U.S. fingerprints throughout it.

Bitcoin’s catch-up play

Maartunn from CryptoQuant was the primary to level this out: when the premium flips after a rally, it’s hardly ever a set off, however fairly a consequence. This type of move marks tops, not breakouts. This doe not imply Bitcoin will reverse instantly.

It means the late bid wants assist to maintain the value elevated. If assist doesn’t come, it begins to unwind quick.

What occurs subsequent is dependent upon the consumers’ means to take care of the value at or above $94,000, which might open the trail to $95,800 per BTC. If it slips beneath $91,000, then $89,400 turns into a magnet. General, the following transfer will rely on whether or not the brand new cash purchased energy or purchased the highest.