As 2025 winds down, stablecoins like USDC are getting used for extra than simply buying and selling. They’re more and more a part of funds, enterprise transfers, and routine motion of funds, not solely exercise tied to market cycles. As extra money strikes extra usually, the best way these transfers settle has began to matter way over it used to.

That change has put strain on present blockchain networks. Exercise picked up over the second half of the 12 months, and through busy intervals this confirmed up via increased charges, slower confirmations, and fewer predictable switch prices.

On Ethereum, for instance, sending USDC late in 2025 has usually value wherever from a number of {dollars} to properly over ten {dollars} during times of congestion, which means even a fundamental switch can find yourself costing greater than anticipated.

By the second half of the 12 months, payment volatility had turn out to be one other acquainted subject. Fuel-based pricing means the price of a stablecoin switch can change shortly relying on community circumstances, making routine funds more durable to plan for merchants, companies, and treasury groups. In observe, as soon as trade and switch charges are factored in, the price benefit of utilizing stablecoins can slim greater than many customers anticipate.

That’s the place Bybit’s determination so as to add USDC help on the XDC Community matches in. As stablecoin transfers turn out to be a part of on a regular basis exercise, exchanges are below strain to supply routes which are simpler to handle and extra predictable. How shortly and cheaply funds can transfer now issues as a lot as entry itself.

“Most customers don’t care about blockchain labels anymore. They care about whether or not a switch clears shortly and what it prices them ultimately,” mentioned Angus O’Callaghan, head of buying and selling and markets at XDC Community. “If stablecoins are going to operate as on a regular basis monetary instruments, the infrastructure beneath them has to really feel dependable, not irritating.”

Bybit Waives USDC Charges on XDC and Launches $200,000 Reward Program

For many stablecoin customers, entry isn’t the issue anymore. USDC is already obtainable on almost each main trade. What folks care about now could be whether or not shifting funds really works the best way they want it to: shortly, recurrently, and with out having to suppose twice about the price.

Bybit’s latest adjustments make sense inside this context. Alongside opening one other route for USDC transfers, the trade is waiving withdrawal charges on XDC from December 1, 2025 via January 1, 2026, and providing a 200,000 USDC reward pool for brand new customers who register and make qualifying deposits.

From a consumer perspective, that is much less about options and extra about comfort. When transfers begin to really feel costly or unpredictable, folks naturally change how they transfer cash. Some wait longer to switch, others batch funds, and a few keep away from smaller transactions altogether. Having an alternative choice obtainable makes these selections simpler.

For Bybit customers, USDC on XDC merely provides flexibility. It provides them one other solution to transfer funds when the standard routes don’t really feel like your best option, with out altering what they’re utilizing or how they consider stablecoins.

What This Indicators for Exchanges

Bybit’s latest transfer round USDC transfers displays a change that’s beginning to present up throughout the trade panorama. Whereas Bybit has taken a transparent step in increasing how customers can transfer funds, it’s additionally a part of a wider sample enjoying out over the previous few weeks.

BTSE, KuCoin, MEXC, Gate.io, Bitrue, and Pionex have additionally expanded help for XDC, enabling deposits, withdrawals, and buying and selling. Taken collectively, these strikes level to rising curiosity amongst exchanges in settlement networks that may deal with common switch exercise with out the payment swings seen on extra congested chains.

For exchanges, the reasoning is essentially sensible. As stablecoin flows enhance, counting on a small set of networks could make platforms extra uncovered to sudden value adjustments and slower settlement throughout peak intervals. Including different routes provides exchanges extra flexibility, helps easy out these pressures, and gives customers extra constant methods to maneuver funds with out altering the property they already use.

All of that is additionally occurring as stablecoins begin to be handled extra like actual fee instruments. Within the U.S., proposals such because the GENIUS Act are targeted on placing clearer guidelines round how stablecoins are issued and used, particularly for funds and institutional exercise. As that occurs, the best way stablecoins transfer between platforms and networks turns into greater than a technical element and a part of what customers and establishments anticipate by default.

“When stablecoins begin getting used outdoors of buying and selling, the dialog adjustments,” O’Callaghan added. “As soon as there are clearer guidelines round how they’re meant to work, like what’s being mentioned with the GENIUS Act, folks cease treating transfers as experiments. They anticipate them to behave like common funds: to undergo on time, at a value they’ll perceive, and while not having to second-guess each transfer.”

XDC in Follow

XDC Community is usually used for sensible, behind-the-scenes work moderately than consumer-facing crypto exercise. It’s been utilized in areas like commerce finance, real-world asset tokenization, and settlement processes the place methods have to work persistently and with out surprises.

That very same setup additionally works properly for shifting stablecoins. Transfers on XDC are likely to undergo shortly and often value little or no, which issues extra now that stablecoin transfers grew to become extra frequent. For folks or companies sending USDC usually, decrease and extra predictable prices make these transfers simpler to handle over time.

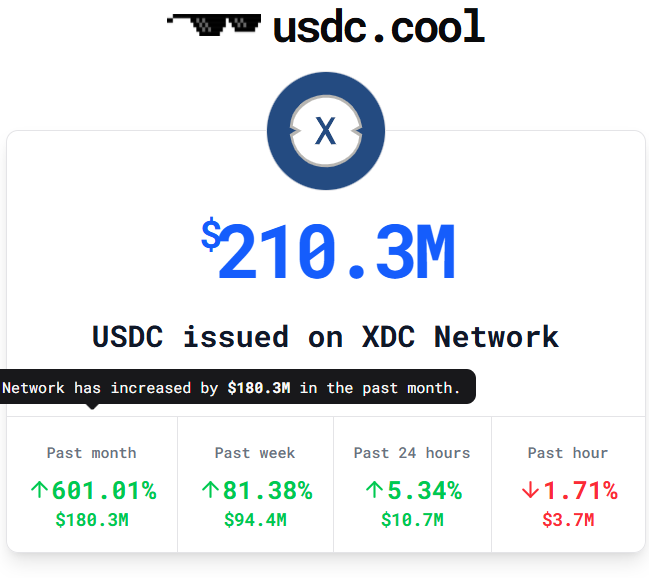

That is beginning to present within the information. The quantity of USDC issued on XDC has continued to rise and lately handed $200 million, indicating that utilization is shifting past early checks and into extra common exercise. Quite than temporary spikes, the numbers level to regular use by individuals who transfer funds usually.

Picture supply: USDC.COOL

From XDC’s aspect, integrations like Bybit’s are primarily about being helpful. The community is getting used as one other place the place stablecoin transfers can occur reliably, moderately than as one thing meant to draw consideration by itself.

XDC was additionally designed with institutional fee flows in thoughts, the place predictable settlement and constant prices matter greater than short-term optimization. That makes it sensible for companies and monetary establishments shifting stablecoins at scale, the place delays or sudden payment swings shortly flip into operational issues.

That focus is already exhibiting up in how the community is getting used. Past fundamental transfers, XDC helps extra complicated monetary workflows, together with international funds, tokenized settlement, and stablecoin-based liquidity. Belongings like USDC are more and more used inside these flows, together with as collateral, and greater than $500 million value of property have already been tokenized and settled on the community.

Picture supply: TradeFi Community

This sort of exercise is very related for commerce finance and cross-border settlement, the place funds want to maneuver reliably throughout jurisdictions moderately than fluctuate with market circumstances. As extra fee and commerce processes transfer on-chain, infrastructure that may deal with regular, high-volume transfers turns into much less of a nice-to-have and extra of a requirement.

Closing

Ultimately, selections like Bybit’s USDC help on XDC aren’t about any single community or promotion and extra about how exchanges are adjusting to a maturing market. For the trade, providing one other solution to transfer USDC is a part of that adjustment – ensuring the expertise holds up not simply throughout quiet intervals, however when exercise picks up and small frictions begin to matter. XDC’s position in that setup displays how infrastructure decisions have gotten a part of the trade’s duty, even when they keep largely out of sight.

“Good infrastructure doesn’t draw consideration to itself,” O’Callaghan concludes. “When it really works correctly, customers barely give it some thought, and that’s often the aim.”

The submit USDC Is Being Used for Extra Than Buying and selling, and Bybit Is Increasing Assist on XDC appeared first on BeInCrypto.