The Bitcoin mining business has confronted a harsher working setting for the reason that 2024 halving, a core function of Bitcoin’s financial design that cuts block rewards roughly each 4 years to implement long-term shortage. Whereas the halving strengthens Bitcoin’s financial hardness, it additionally locations speedy strain on miners by slashing income in a single day.

In 2025, this resulted within the “harshest margin setting of all time,” based on TheMinerMag, which cited collapsing income and surging debt as main obstacles.

Even publicly listed Bitcoin (BTC) miners with sizable money reserves and entry to capital have struggled to stay worthwhile solely by way of mining. To make do, many have accelerated their push into different, title=”https://cointelegraph.com/information/bitcoin-miners-corporate-adoption-treasury-buying-slowdown”>Bitcoin miners may increase company adoption as crypto treasury buys sluggish

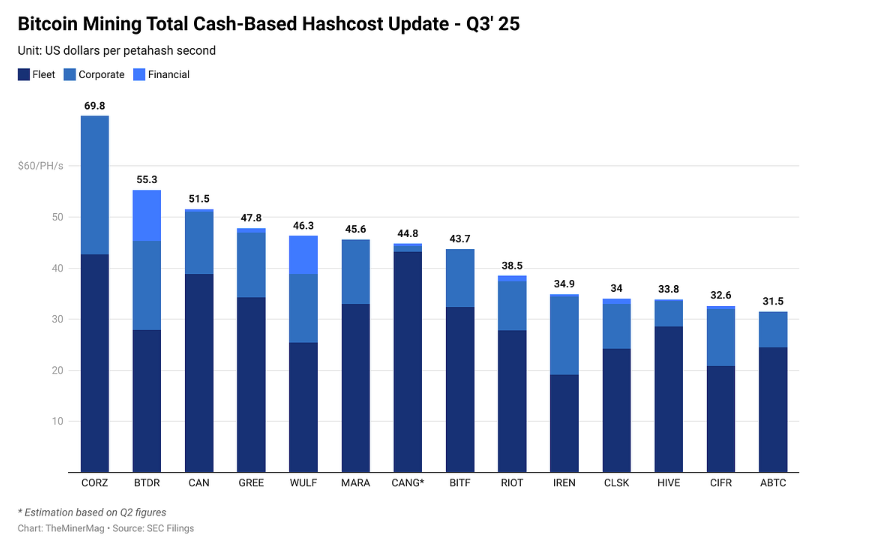

Common Bitcoin mining prices throughout 14 publicly listed mining firms in Q3 2025. Supply: TheMinerMag

By 2026, Bitcoin will nonetheless be working in its fourth mining epoch, which started after the April 2024 halving and is predicted to run till about 2028. With block subsidies fastened at 3.125 BTC, competitors is intensifying, reinforcing the business’s shift towards effectivity and income diversification.

Beneath are three key themes which can be anticipated to drive the Bitcoin mining business in 2026.

Mining profitability hinges on vitality technique and payment markets

Hashrate measures the computing energy securing the Bitcoin community, whereas hashprice displays the income that this computing energy earns. The excellence stays central to mining economics, however as block subsidies proceed to shrink, profitability is more and more formed by components past sheer scale.

Entry to low-cost vitality, together with publicity to Bitcoin’s transaction payment market, has turn out to be crucial as to whether miners can maintain margins by way of the cycle.

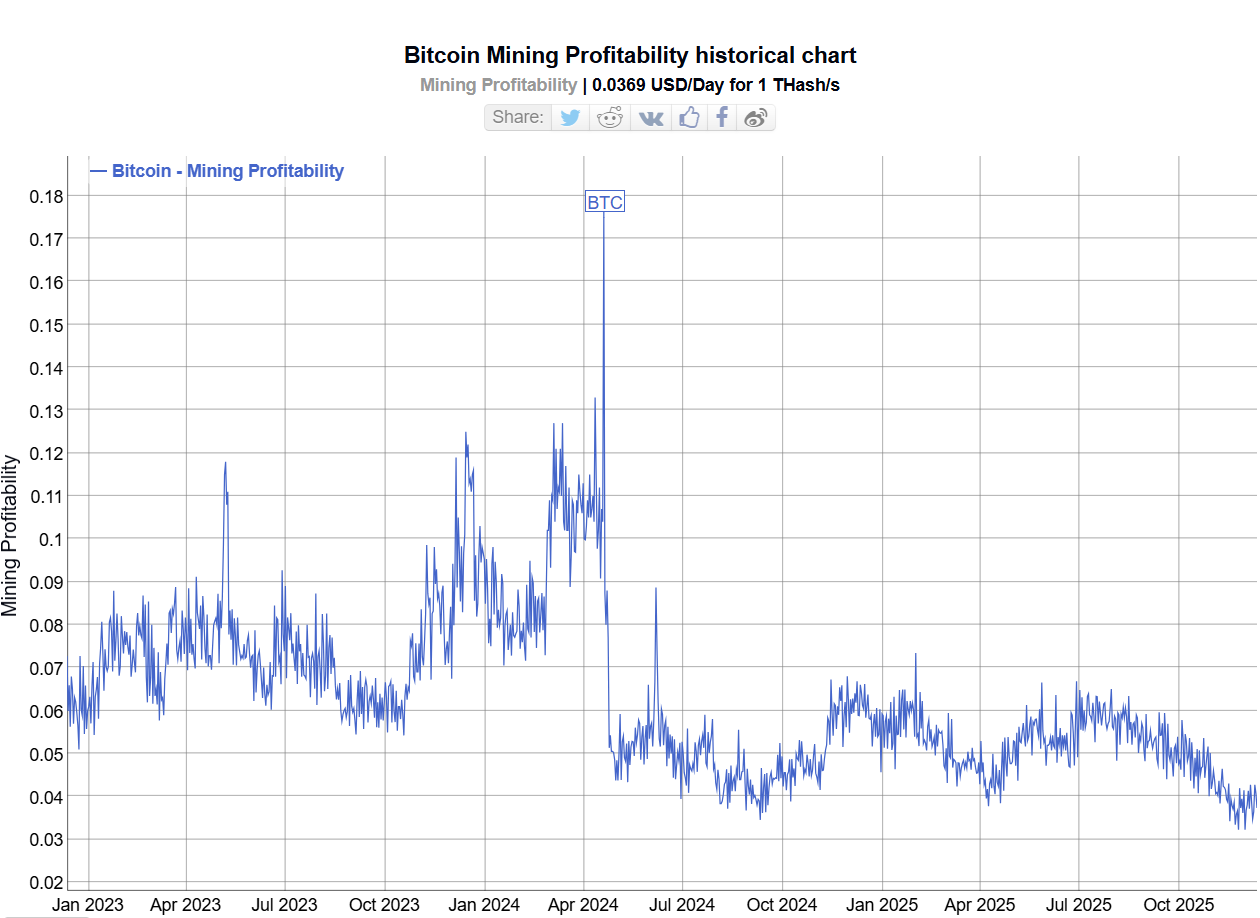

Bitcoin’s value nonetheless performs a disproportionately massive function. Nonetheless, 2025 didn’t produce the sort of blow-off high that many within the business had anticipated, or that sometimes follows within the 12 months following the halving.

As an alternative, Bitcoin moved larger in a extra measured style, stair-stepping upward earlier than peaking above $126,000 in October. Whether or not that marked the cycle excessive stays an open query.

Volatility, nevertheless, has had a transparent impression on miner income. Knowledge from TheMinerMag exhibits that the hash value has fallen from a median of about $55 per petahash per second (PH/s) within the third quarter to what the publication describes as a “structural low” of close to $35 PH/s.

Including to the pressure, common Bitcoin mining prices rose steadily all through 2025, reaching about $70,000 within the second quarter, additional compressing margins for operators already grappling with decrease hash costs.

The decline carefully tracked a pointy correction in Bitcoin’s value, which fell from its highs to beneath $80,000 in November. Strain on miners may persist into 2026 if Bitcoin enters a broader downturn, a sample seen in earlier post-halving cycles, although not assured to repeat.

Over the previous three years, Bitcoin mining profitability, measured in US {dollars} earned per unit of hashpower, has trended decrease, reflecting post-halving income compression and problem will increase. Supply: BitInfoCharts

AI, HPC and consolidation reshape the mining panorama

Publicly traded Bitcoin miners are not positioning themselves solely as Bitcoin firms. More and more, they describe their companies as digital infrastructure suppliers, reflecting a broader technique to monetize energy, actual property and information middle capabilities past block rewards.

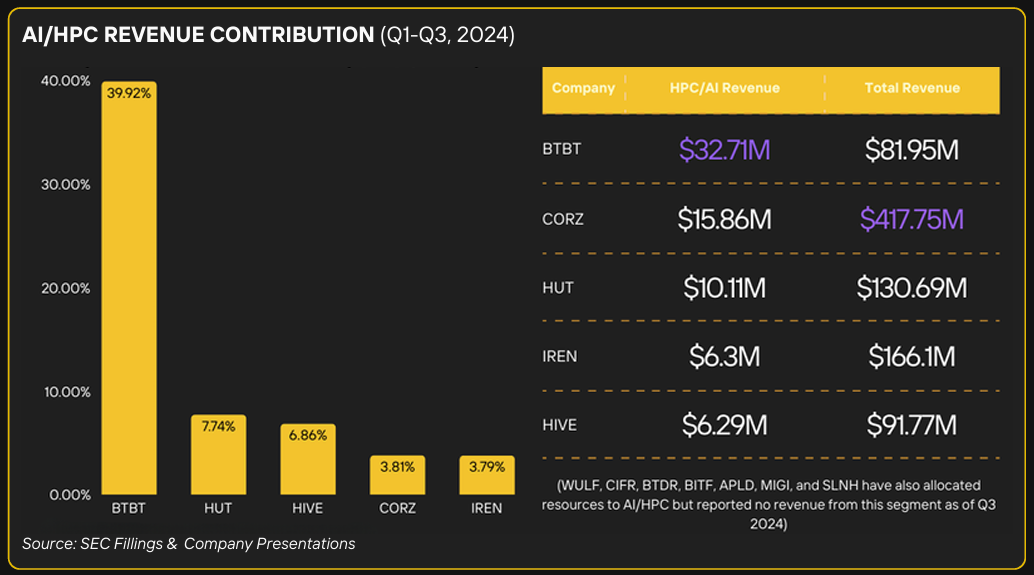

One of many earliest movers was HIVE Digital Applied sciences, which started pivoting a part of its enterprise towards high-performance computing in 2022 and reported HPC-related income the next 12 months. On the time, the technique stood out in an business nonetheless largely targeted on increasing hashrate.

Since then, a rising variety of public miners have adopted go well with, repurposing parts of their infrastructure, or signaling plans to take action, for GPU-based workloads tied to synthetic intelligence and HPC. These embrace Core Scientific, MARA Holdings, Hut 8, Riot Platforms, TeraWulf and IREN.

The size and execution of those initiatives fluctuate extensively, however collectively they point out a broader shift throughout the mining sector. With margins below strain and competitors rising, many miners now view AI and compute providers as a way to stabilize money circulation, moderately than relying solely on block rewards.

By 2024, AI and HPC had been already contributing significant income for some miners. Supply: Digital Mining Options

That shift is predicted to proceed into 2026. It builds on a consolidation pattern flagged in 2024 by Galaxy, a digital asset funding and advisory firm, which pointed to a rising wave of mergers and acquisitions amongst mining firms.

Associated: Texas grid is heating up once more, this time from AI, not Bitcoin miners

Bitcoin mining shares: Volatility and dilution dangers

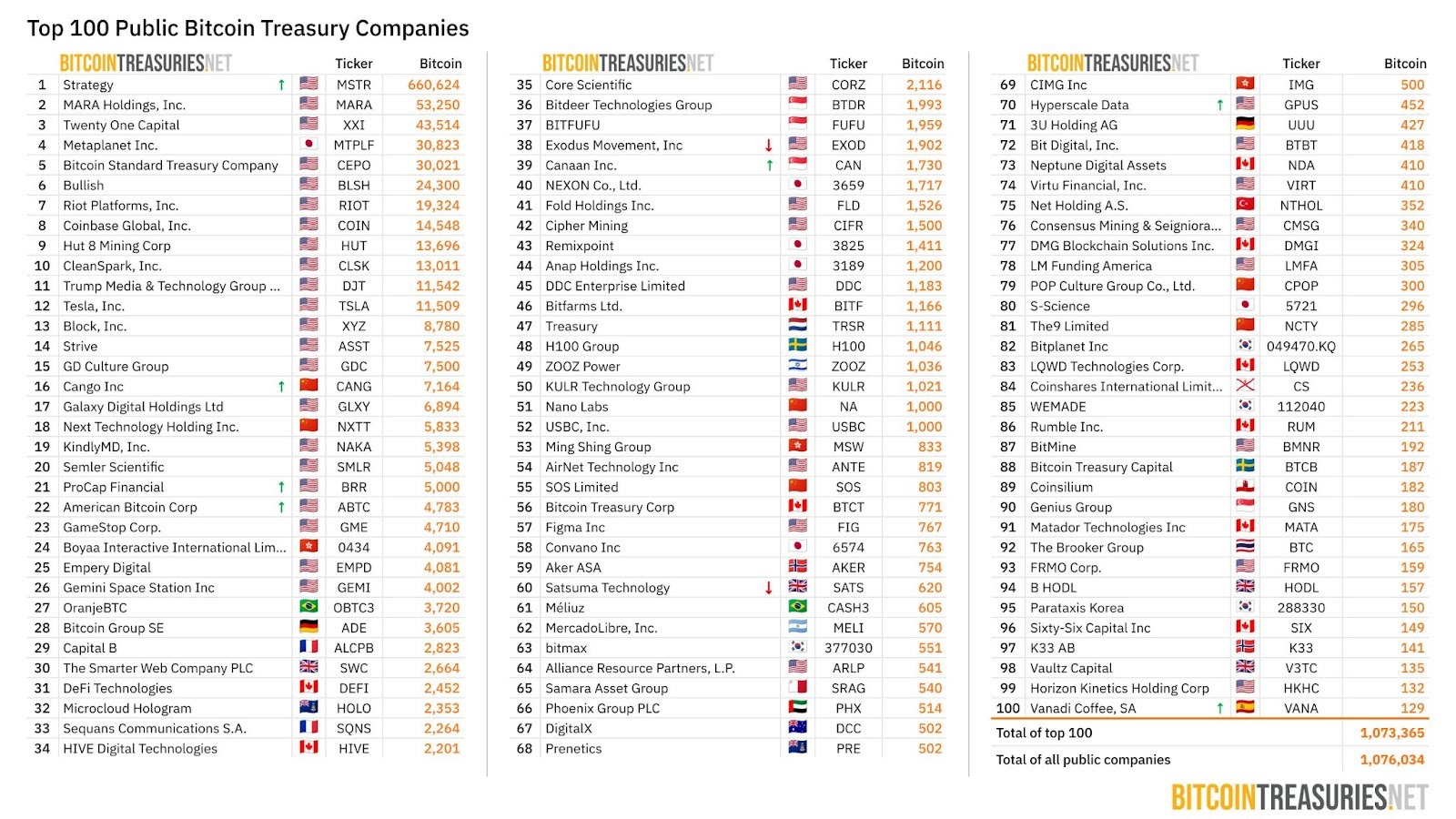

Public Bitcoin miners play an outsized function out there, not solely by securing the community, but in addition by rising as a number of the largest company holders of Bitcoin. Over the previous a number of years, many listed miners have moved past a pure working mannequin and begun treating Bitcoin as a strategic balance-sheet asset.

As Cointelegraph reported in January, a rising variety of miners had taken cues from Michael Saylor’s playbook at Technique, adopting extra deliberate Bitcoin treasury methods by retaining a portion of their mined BTC. By year-end, miners ranked among the many largest public Bitcoin holders, with MARA Holdings, Riot Platforms, Hut 8 and CleanSpark all touchdown within the high 10 by whole BTC held.

The biggest public Bitcoin treasury firms. Supply: BitcoinTreasuries.NET

That publicity, nevertheless, has elevated volatility dangers. As Bitcoin’s value swings, miners with massive BTC treasuries expertise amplified balance-sheet fluctuations, just like different digital asset treasury firms which have come below pressure throughout market drawdowns.

Mining shares additionally face persistent dilution threat. The enterprise stays capital-intensive, requiring ongoing funding in ASIC {hardware}, information middle enlargement and, throughout downturns, debt servicing.

When working money circulation tightens, miners have regularly turned to equity-linked financing to take care of liquidity, together with at-the-market (ATM) applications and secondary share choices.

Latest fundraising exercise underscores that pattern. A number of miners, together with TeraWulf and IREN, have tapped debt and convertible markets to shore up stability sheets and fund varied progress initiatives.

Trade-wide, Bitcoin mining firms raised billions of {dollars} by way of debt and convertible word choices within the third quarter alone, extending a financing sample that gained momentum in 2024.

Looking forward to 2026, dilution threat is prone to stay a key concern for buyers, notably if mining margins keep compressed and Bitcoin enters a bear market.

Operators with larger breakeven prices or aggressive enlargement plans might proceed to depend on equity-linked capital, whereas these with decrease breakeven prices and stronger stability sheets shall be higher positioned to restrict shareholder dilution because the cycle matures.

Associated: Google takes 14% stake in Bitcoin miner TeraWulf, turning into high shareholder