On-chain prediction markets have grown rapidly over the previous two years, with complete month-to-month quantity leaping from underneath $100 million in early 2024 to greater than $13 billion right this moment.

That’s a 130-times enhance, making them one of many fastest-growing monetary sectors, in accordance with a brand new report from Keyrock and Dune Analytics, shared with The Defiant. A lot of the development in 2025 is coming from non-sports-related markets, regardless of sports activities betting main U.S. prediction market exercise in latest months.

“Economics” and “Tech & Science” present the most important quantity beneficial properties this 12 months, up 10 instances and 17 instances, respectively. Open curiosity can be increasing quickest in Economics (7x) and Social & Tradition (6x).

Politics, Elections, and Economics dominate the principle platforms, in accordance with the report. On Kalshi — the U.S.-regulated platform that began including crypto infrastructure this 12 months — these three classes maintain 2.5 instances the open curiosity of Sports activities bets, whereas on Polymarket, Politics outpaced Sports activities by 400% this 12 months.

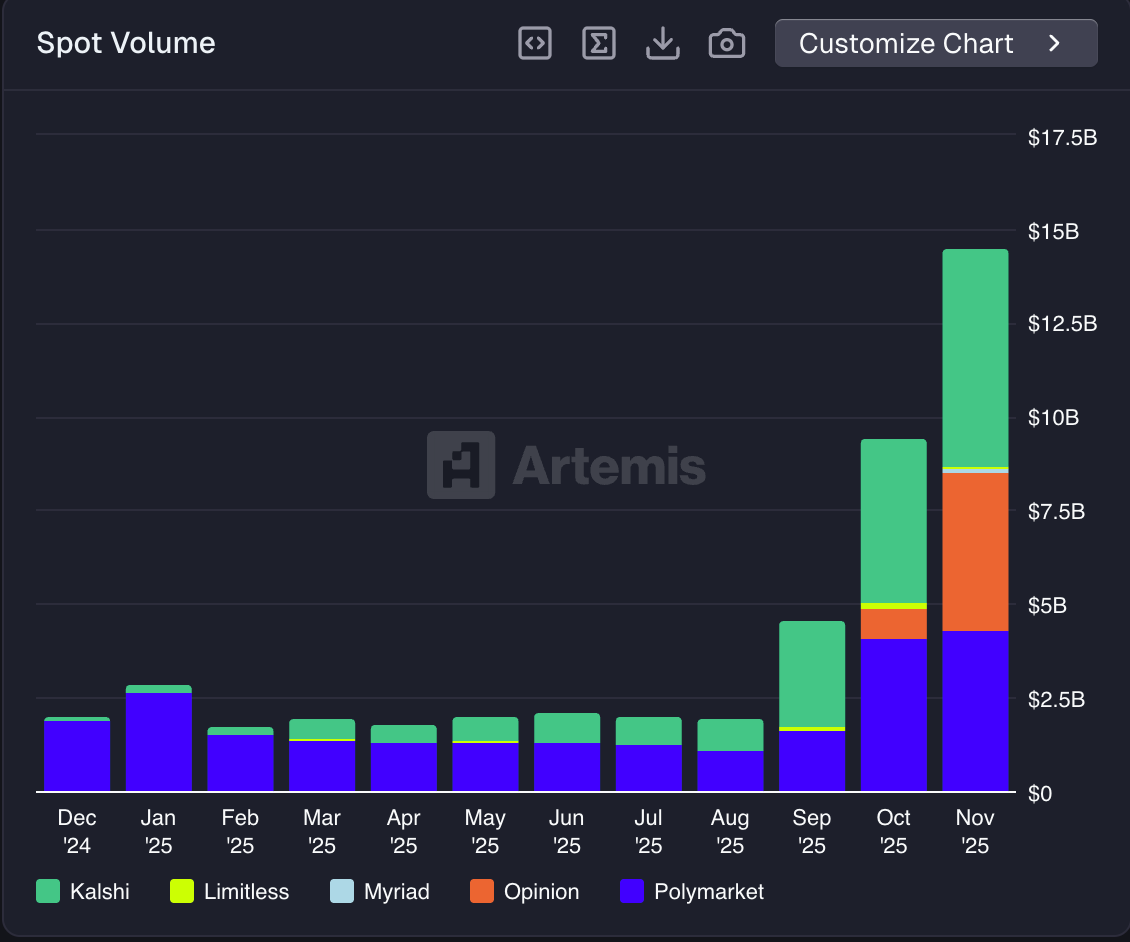

In the meantime, knowledge from Artemis exhibits even greater volumes, with complete spot quantity for the sector reaching as excessive as $14.5 billion final month, setting new information for each Polymarket and Kalshi, up from $9.4 billion in October.

1-year spot volumes throughout decentralized predictions markets. Supply: Artemis

The rise of prediction markets underscores how they’re turning into a number one software for real-time insights, boosted additional by high-profile partnerships with information media giants like CNN, CNBC, and Yahoo Finance. In contrast to conventional fashions, these markets regulate consistently, typically recognizing developments earlier than standard indicators, the report famous. For instance, Kalshi’s inflation market is 4.3-times much less risky than the Cleveland FedNow mannequin.

Based on the joint report, they’re additionally extremely correct, as Polymarket and Kalshi forecasts have Brier scores round 0.09, generally even 200 days earlier than occasions resolve. The Brier rating is a metric that measures the accuracy of probabilistic predictions — a rating of 0 refers to good accuracy and 1 displays inaccuracy.

Polymarket costs outcomes accurately 90-95% of the time, the report said, with accuracy rising as liquidity will increase. One month earlier than an occasion, forecasts are 90.4% right, dipping to 88.5% someday earlier than decision, and climbing to 94.1% within the last 4 hours.

US Growth

The findings come just a few weeks after Polymarket formally returned to the U.S., after receiving CFTC approval late final month. The platform initiated its U.S. rollout with the launch of its app within the U.S. App Retailer for waitlisted customers, in a transfer that lets People place real-money prediction bets on sports activities, politics, and different occasions.

In a latest interview, Polymarket’s founder, Shayne Coplan, referred to as prediction markets “essentially the most correct factor” we have now proper now. “You generate income in case you’re proper. You lose cash in case you’re incorrect,” he mentioned. “And consequently it creates this data that is actually helpful for individuals.”

Polymarket’s return to the U.S. additionally adopted a $2 billion strategic funding from Intercontinental Trade (ICE), the proprietor of the New York Inventory Trade.