Contemporary knowledge from CryptoQuant reveals Binance, the world’s largest crypto alternate tightening its grip on spot and derivatives buying and selling, setting new information. The exercise surge comes as on-chain and choices metrics recommend traders are repositioning for a extra lively market atmosphere.

The alternate is on observe to set new information throughout spot and derivatives markets in 2025, at the same time as merchants proceed to cost uncertainty within the crypto market.

Binance leads, others observe

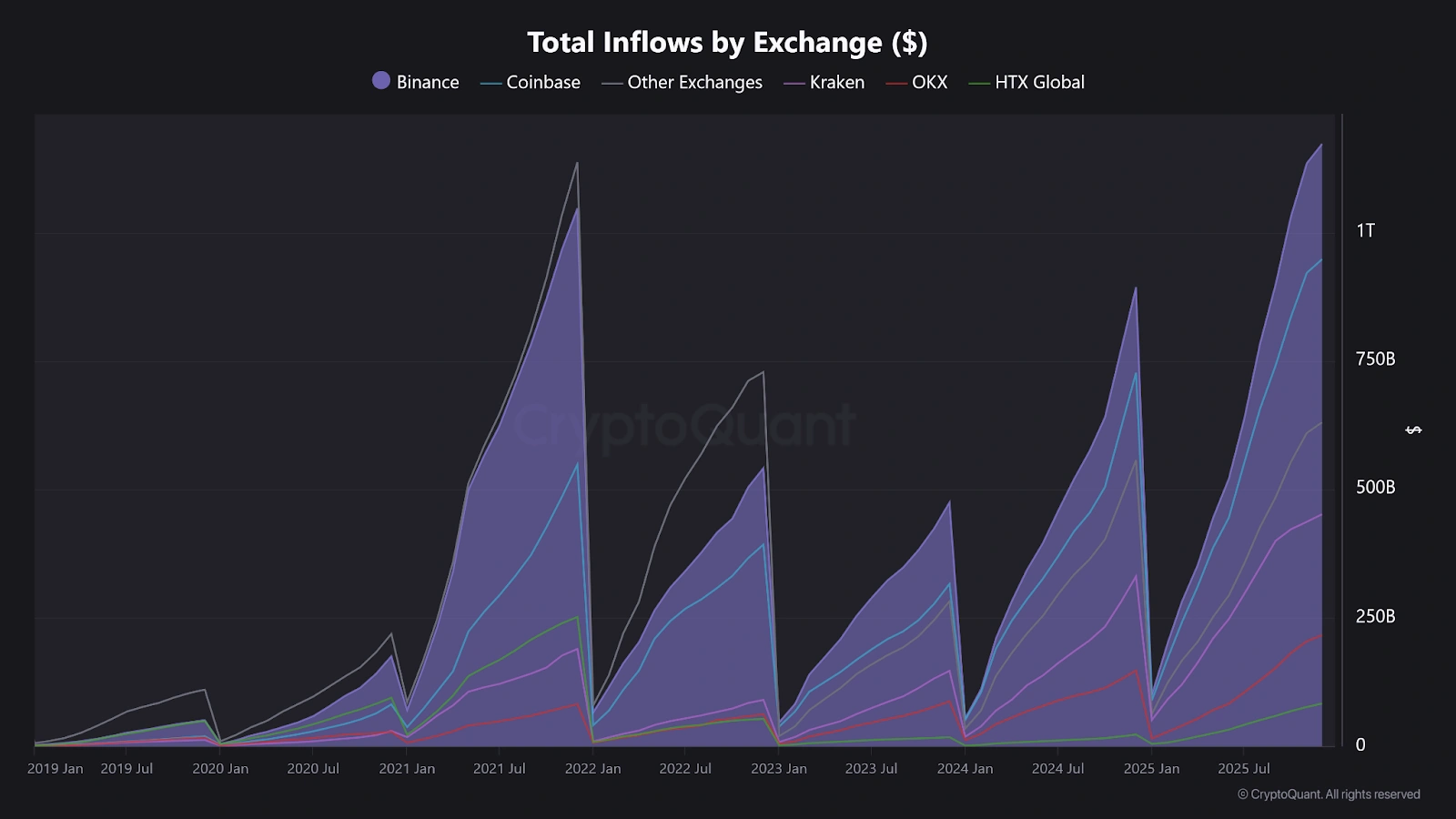

Supply: CryptoQuant

Crypto inflows into Binance hit $1.17 trillion in 2025, representing a 31% improve 12 months on 12 months. The influx, which widens the gulf between Binance and different exchanges, coincided with the platform surpassing 300 million registered customers.

Coinbase comes second after Binance with respect to crypto inflows, seeing $946 billion in 2025, which is a 30% improve from the earlier 12 months.

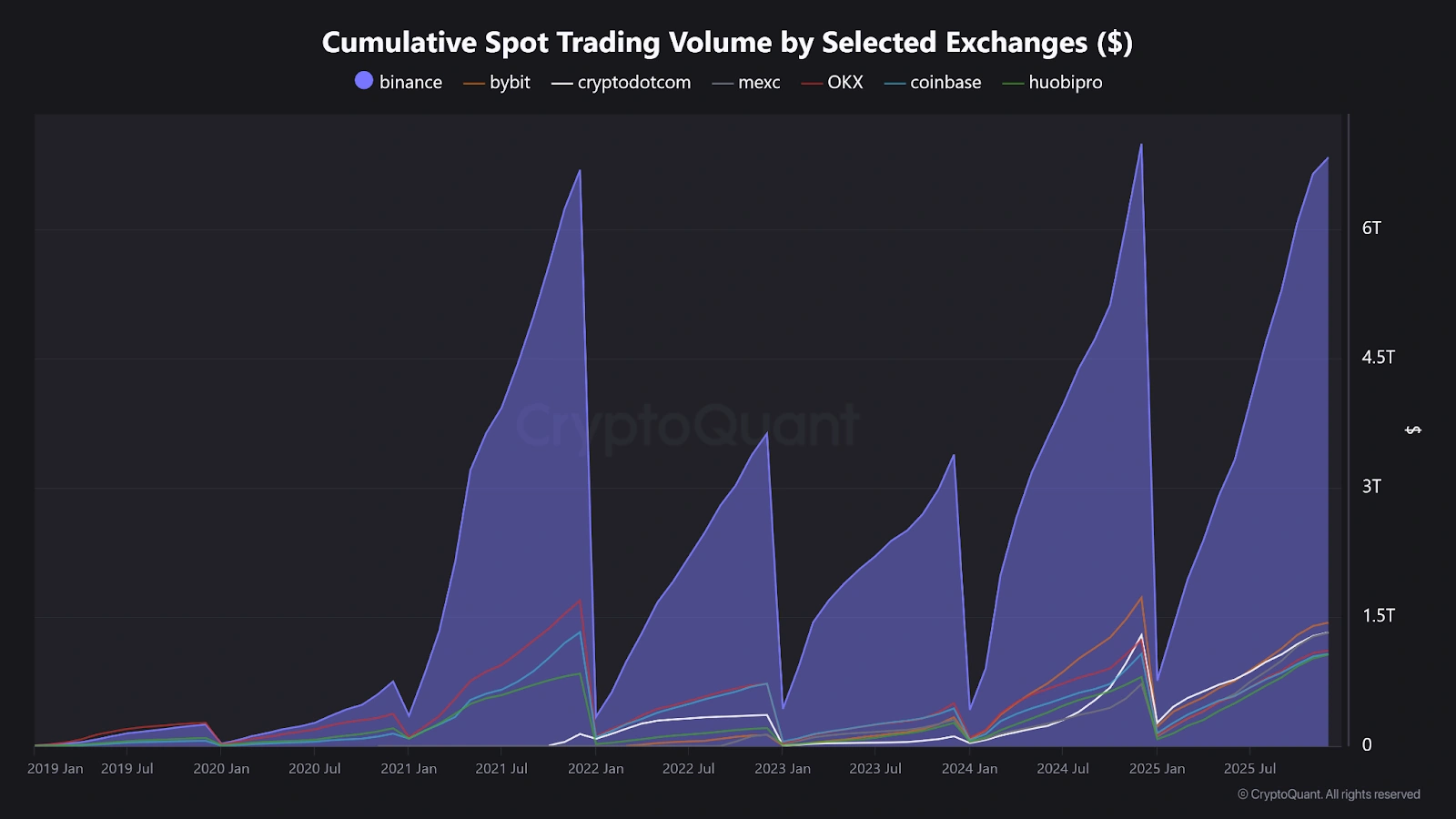

Supply: CryptoQuant

Binance spot buying and selling quantity is projected to achieve about $7 trillion by year-end, practically 5 occasions that of its closest competitor, Bybit. In response to CryptoQuant, “the overall variety of spot trades reached a brand new all-time excessive of 24.1 billion in 2025, up 4% 12 months over 12 months and greater than 3x larger than in 2022.”

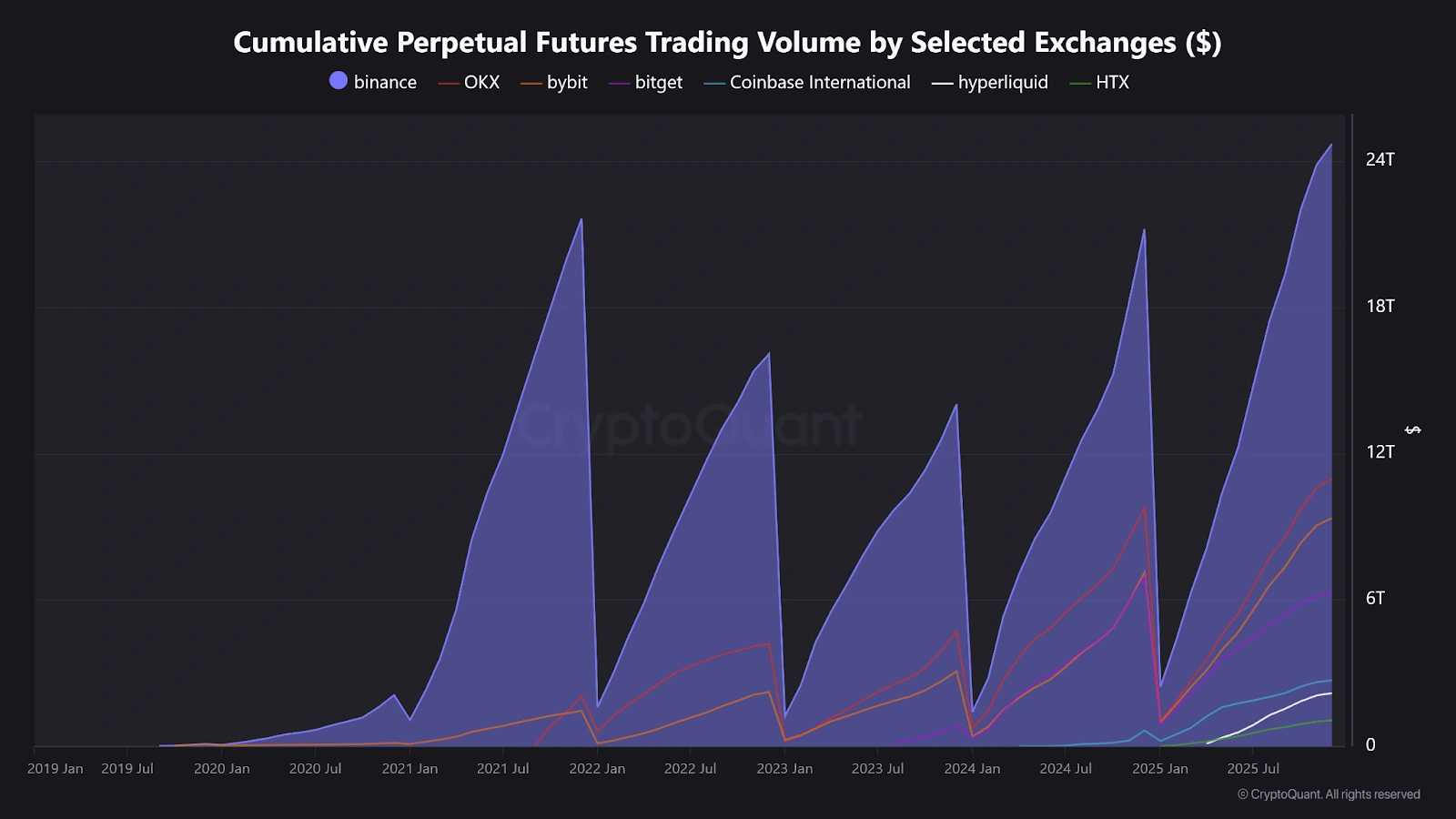

Binance additionally posted a report excessive this 12 months within the whole variety of perpetual futures trades, which reached 49.6 billion, 33% above final 12 months’s report excessive of 37.3 billion trades.

The platform’s perpetual futures quantity has already exceeded $24.6 trillion, greater than double the amount of OKX.

Supply: CryptoQuant

Julio, Head of Analysis at CryptoQuant, identified that this present increase in exercise metrics signifies “sustained progress in person exercise all through the present bull cycle.”

By June 2025, Binance had captured 41.1% of worldwide spot quantity, sustaining a market share of 39.8% amongst centralized exchanges the next month.

Market uncertainty drives hedging exercise

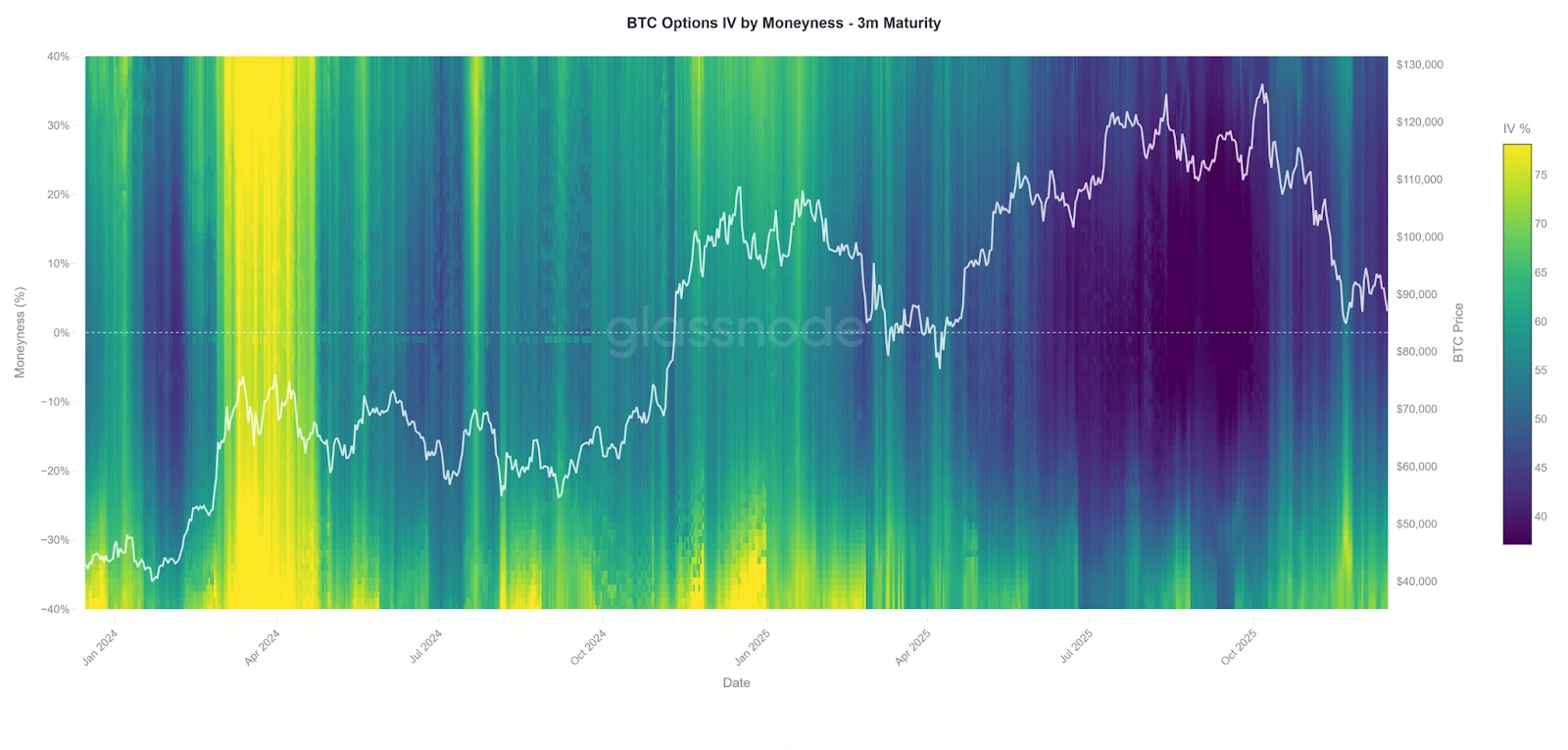

The renewed concentrate on liquidity comes as volatility reveals indicators of returning after a steady six-month interval. Glasnode evaluation signifies that in a pointy drawdown available in the market a number of weeks in the past, danger hedging exercise elevated considerably, with elevated put demand as Bitcoin costs moved into the low-$80,000 vary.

Supply: Glassnode on X

Whereas market circumstances have stabilized, and expectations for excessive strikes have moderated, “implied volatility stays elevated relative to the exceptionally low-volatility regime noticed over the prior six months, suggesting a shift towards a extra lively volatility atmosphere,” based on Glassnode.

Giant centralized exchanges have a tendency to profit when volatility rises, as hedging, arbitrage, and high-frequency methods all depend on deep and steady liquidity. Binance’s scale throughout spot and perpetual futures markets locations it on the heart of that exercise.

The focus of liquidity on Binance highlights a structural function of crypto markets, which is that liquidity tends to pool the place liquidity already exists.

Different exchanges proceed to play necessary roles in particular areas or product niches, and institutional exercise on regulated venues stays influential for benchmark pricing.