Bitcoin Worth As we speak: The place the Market Really Stands

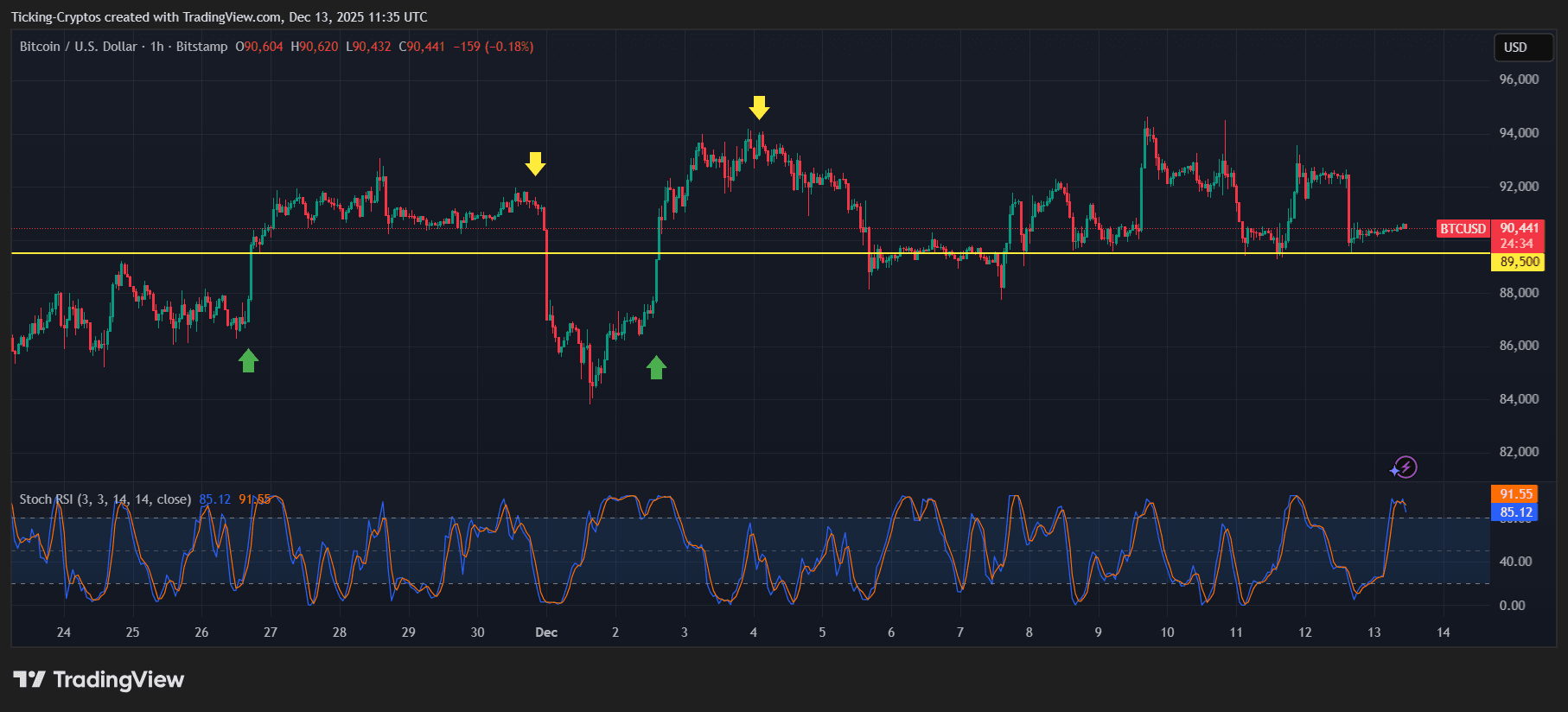

$Bitcoin is at the moment buying and selling round $90,550, based mostly on the most recent market information and the connected chart. Worth motion over the previous weeks reveals consolidation somewhat than growth, with Bitcoin struggling to reclaim larger resistance zones after a pointy correction.

BTC/USD 1-hour chart – TradingView

Regardless of this, a rising variety of analysts and social media commentators proceed to assert that Bitcoin will attain $150,000 by the top of the 12 months, an announcement that doesn’t align with historic efficiency, sensible market mechanics, or present macro situations.

How A lot Would Bitcoin Must Rise to Attain $150,000?

To grasp how unrealistic this goal is, you will need to take a look at the numbers.

- Present $BTC value: ~$90,550

- Goal value: $150,000

This is able to require a achieve of roughly 65.7% in a matter of weeks.

For Bitcoin to attain this, it will want one of many strongest quick time period rallies in its complete historical past, with out a comparable catalyst similar to a worldwide liquidity shock, emergency financial easing, or unprecedented institutional inflows.

Bitcoin December Returns: What Historical past Tells Us

Bitcoin’s historic December efficiency gives essential context.

The strongest December on report occurred in December 2020, when Bitcoin gained 46.92%. Whereas spectacular, even this historic rally falls properly wanting the 65%+ achieve required to succeed in $150,000 from present ranges.

Different December performances paint a good clearer image:

- 2021: –18.9%

- 2022: –3.59%

- 2023: +12.18%

- 2024: –2.85%

Statistically, December shouldn’t be a month identified for explosive upside strikes of this magnitude. Anticipating Bitcoin to outperform its strongest December ever by a large margin shouldn’t be supported by historic information.

The place the $150,000 Narrative Comes From

The $150,000 Bitcoin goal is commonly attributed to well-known bullish figures within the crypto house, however most of those statements are long run projections, not quick time period 12 months finish forecasts.

Michael Saylor and different long run Bitcoin advocates have referenced $150,000 as a possible milestone tied to institutional adoption and multi 12 months progress cycles. Nonetheless, these views are steadily misquoted or reshaped into close to time period predictions.

In the meantime, main establishments have change into extra conservative, no more aggressive. Normal Chartered, for instance, has lately revised its Bitcoin outlook, pushing a $150,000 goal into 2026, whereas reducing expectations for the close to time period.

This divergence highlights a key subject: many on-line “analyst” predictions are based mostly on sentiment and extrapolation somewhat than up to date macro information and market construction.

Why the $150,000 Bitcoin Prediction Is Deceptive

Unrealistic Timeframe

A 65% rally in weeks would require sustained shopping for strain far past what the present market is exhibiting, particularly since we’re already 15 days in December already.

Seasonality Does Not Assist It

Bitcoin has by no means posted a December achieve giant sufficient to justify this expectation.

Institutional Forecasts Have Been Softened

Main banks and analysis desks are moderating expectations, not escalating them.

Social Media Amplification

Many $150,000 calls originate from recycled headlines, influencer posts, or selectively quoted interviews, somewhat than formal analysis.

The Larger Image for Bitcoin

This doesn’t imply Bitcoin lacks long run upside. Structural adoption, ETFs, and institutional participation stay essential drivers over the approaching years.

Nonetheless, complicated long run potential with quick time period value actuality creates false expectations and undermines critical market evaluation.

Bitcoin reaching $150,000 should still be doable in a future cycle, however presenting it as a close to time period certainty is deceptive and unsupported by information.