A Polymarket dealer has earned almost $1 million by putting suspiciously correct bets on Google’s 2025 12 months in Search rankings, sparking heated debate about insider buying and selling on prediction markets.

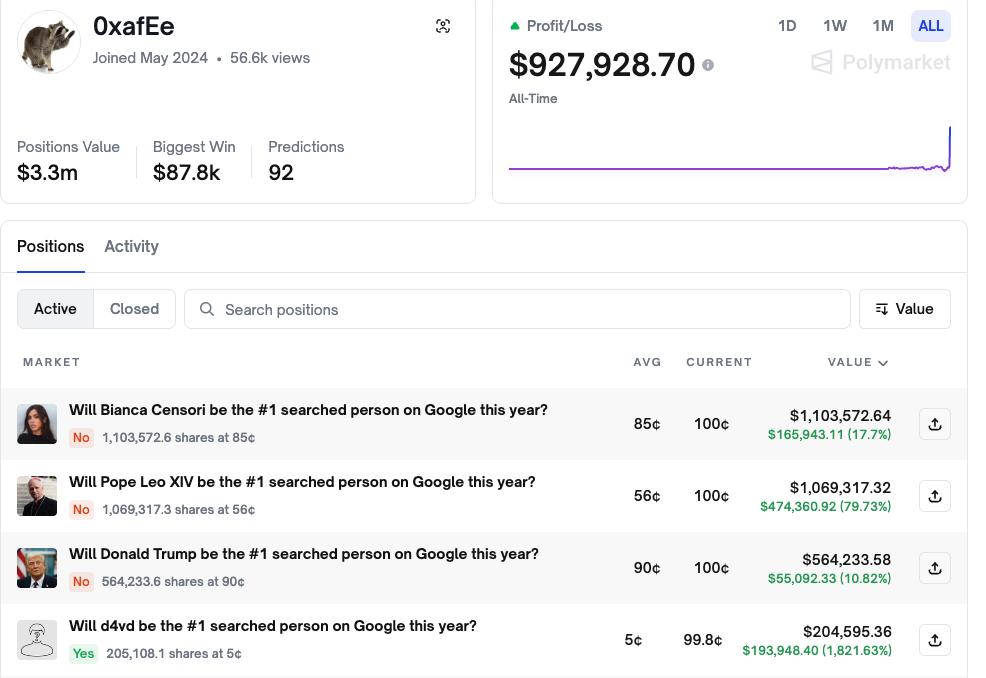

The pockets handle “0xafEe” (beforehand “AlphaRaccoon”) netted almost $1 million by accurately predicting almost each final result in Google search pattern markets.

Why Group is Suspicious of AlphaRaccoon

The dealer purchased “Sure” shares on d4vd, a 20-year-old singer given only a 0.2% likelihood of being probably the most searched particular person of 2025, turning a $10,647 wager into almost $200,000. The actual cash got here from betting “No” on favorites like Pope Leo XIV, Bianca Censori, and Donald Trump.

In response to Meta engineer Jeong Haeju, who uncovered the state of affairs on X, the dealer achieved a 22-for-23 success fee on Google search predictions. Public blockchain knowledge exhibits the pockets deposited $3 million into Polymarket final Friday and instantly started putting massive bets. The identical account beforehand gained over $150,000 by accurately predicting the precise Gemini 3.0 Flash launch date.

“This isn’t a fortunate streak. He beforehand made $150K+ predicting the early launch of Gemini 3.0 earlier than outcomes had been out. At this level it’s apparent: He’s a Google insider milking Polymarket for fast cash,” Haeju stated.

Nonetheless, there’s no affirmation that the dealer is definitely a Google insider. The allegations stay group hypothesis based mostly on the bizarre profitable streak.

Insider Buying and selling: Function or Bug?

The incident has divided the crypto group. Some argue that prediction markets are designed particularly for insider buying and selling, creating monetary incentives to share privileged info with the market.

“The rationale for prediction markets to exist is insider buying and selling. In shares it’s prohibited, with predictions it’s endorsed. It’s designed to be like this,” X consumer WiiMee stated

The controversy arises as Polymarket formally relaunched in america this week after receiving CFTC approval. The platform introduced Wednesday that its iOS app is now rolling out to waitlisted customers, beginning with sports activities markets.

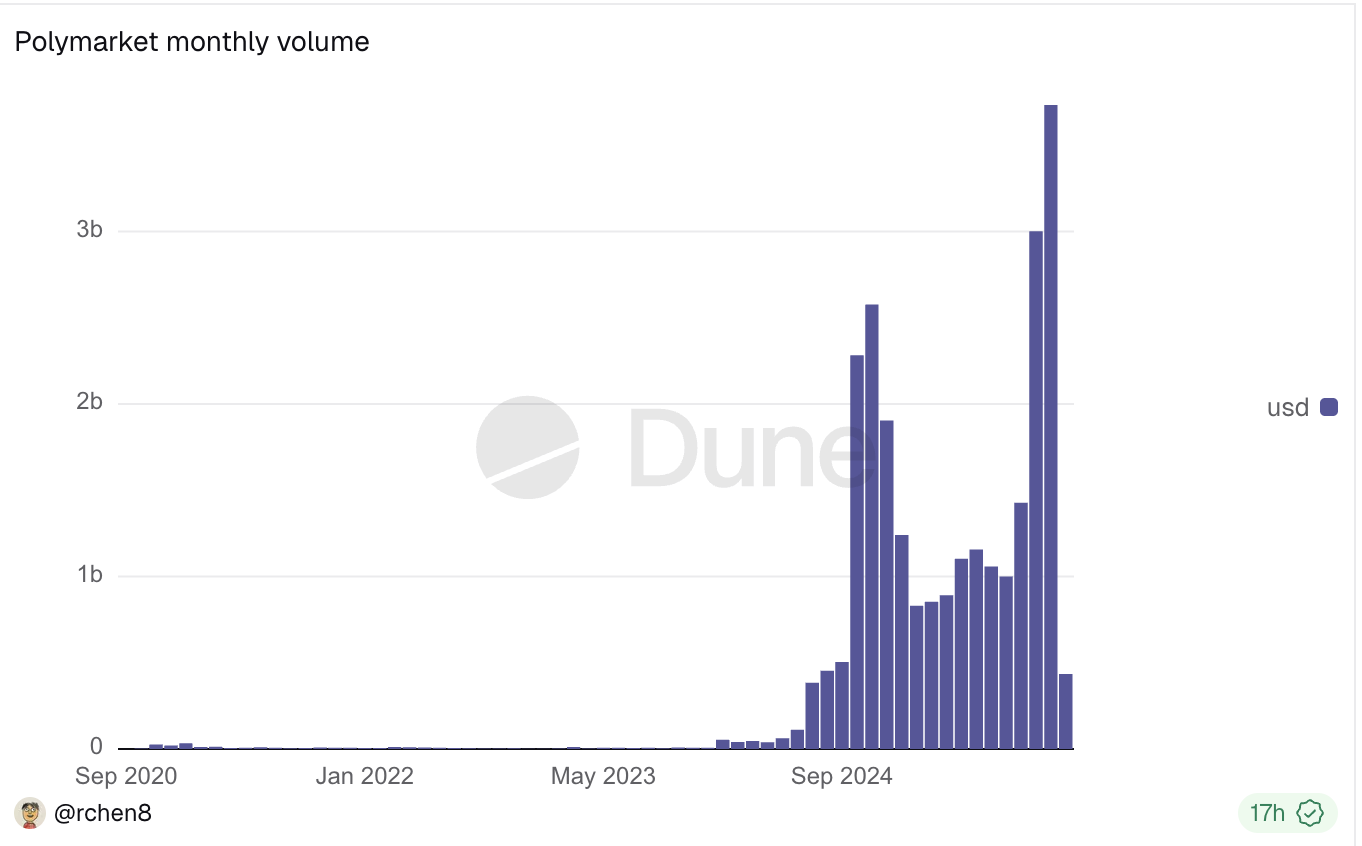

Polymarket processed over $3.7 billion in buying and selling quantity in November 2025. The platform obtained a large increase when Intercontinental Alternate (ICE), mum or dad firm of the NYSE, invested as much as $2 billion in October, valuing Polymarket at roughly $9 billion. Current stories recommend the corporate is now in search of further funding at a $12 billion valuation.

Polymarket Month-to-month Quantity. Supply: Dune

Chief Advertising and marketing Officer Matthew Modabber confirmed the platform will launch its native POLY token together with an airdrop for customers, although not instantly.

“We might have launched a token each time we needed, however we would like it to be with true utility, longevity, and to be round eternally,” Modabber stated.

The token launch is predicted to happen in 2026, following the stabilization of the US platform.

For Polymarket, which confronted scrutiny over alleged manipulation throughout the 2024 presidential election, the way it handles insider info might outline its regulatory future. The Google search markets saga serves as a take a look at case for whether or not prediction markets are environment friendly info aggregators or insider revenue machines.

The submit Polymarket Dealer Makes $1 Million on Google Search Bets, Sparking Insider Buying and selling Fears appeared first on BeInCrypto.