The quantity of perpetual contracts traded on DEXs surged above $1 trillion in November, regardless of the uncertainties prevailing within the crypto market that month. November marked the second consecutive month with $1 trillion in perpetual buying and selling quantity after October’s $1.37 trillion.

Perpetual contracts have gotten more and more standard on decentralized exchanges, in response to on-chain information. Platforms equivalent to Hyperliquid, Lighter, and Aster recorded notable quantity in October and November in comparison with previous months.

November perpetual buying and selling quantity on DEXs exceeds $1 trillion

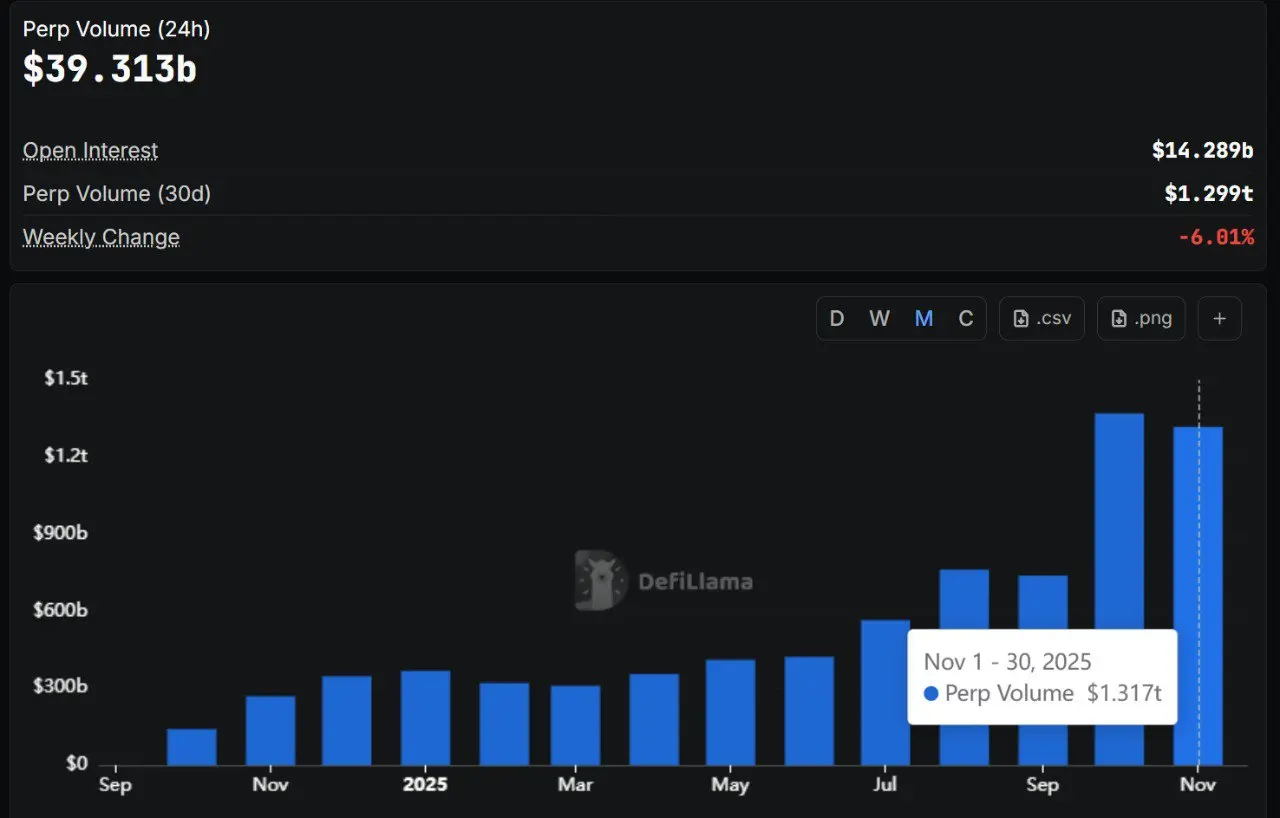

Supply: DefiLlama. Perpetual Buying and selling Quantity on Decentralized Exchanges

Information from DefiLlama, an open-source analytics platform for decentralized finance (DeFi), reveals that November marked the second consecutive month with $1.317 trillion in buying and selling quantity for perpetual contracts. The determine follows a surge in buying and selling exercise in October, which despatched the quantity to a brand new all-time excessive, surpassing $1 trillion. The quantity of perpetual contracts that DEXs processed in October stood at $1.37 trillion, surpassing $759 billion recorded in August and $564.622 million in July.

The numerous rise in quantity signifies rising confidence amongst buyers in decentralized on-chain platforms. The notable efficiency of newer DEX protocols, equivalent to Lighter and Aster, reveals that merchants are transferring away from centralized exchanges.

The information reveals that Lighter, a DEX based mostly on the Ethereum community, leads the pack with a complete buying and selling quantity of $290.605 billion recorded within the final 30 days and $8.882 billion within the final 24 hours. The protocol has claimed the highest spot after falling second to Hyperliquid in October, with a buying and selling quantity of $265.4 billion. Hyperliquid ranked first in October with a buying and selling quantity of $317.6 billion.

Aster has additionally displaced Hyperliquid, presently claiming the second spot with a buying and selling quantity exceeding $248 billion within the final 30 days and $7.414 billion within the final 24 hours. The change recorded $177.6 billion in October, claiming the third place after Hyperliquid and Lighter. Hyperliquid now ranks third, with a 30-day buying and selling quantity of $237.86 billion and a 24-hour quantity of $6.316 billion.

edgeX additionally appeared within the highlight, rating fourth with a 30-day buying and selling quantity of $163.533 billion and $4.088 billion within the final 24 hours. Apex Protocol follows with $80.337 billion within the final 30 days and $2.822 billion within the previous 24 hours. Single-day perpetual contracts buying and selling quantity for November peaked at $68.642 billion, a $10 billion decline from the earlier month’s $78.014 billion.

Centralized exchanges nonetheless lead the crypto futures market regardless of DEXs’ growth

The numerous shift in investor confidence is attributed to numerous components, together with the emergence of new-generation platforms with extra user-friendly interfaces and buying and selling incentives equivalent to airdrops and point-awarding packages. These incentives have possible performed a serious function in attracting crypto merchants who initially executed most of their buying and selling actions on centralized exchanges.

Quite a few scandals on centralized exchanges, equivalent to hacks and evolving regulatory scrutiny, might have additionally introduced decentralized exchanges as appropriate options for buying and selling actions. Many merchants now view decentralized exchanges as safer platforms that enable them to retain custody of their funds and supply earlier entry to new tokens.

Nonetheless, centralized exchanges nonetheless lead in crypto futures’ open curiosity and buying and selling quantity. Information from Coingecko reveals that centralized exchanges have amassed a complete derivatives quantity of $570 billion within the final 24 hours, in comparison with $39.313 billion witnessed on decentralized exchanges throughout the identical interval. Binance (Futures) leads with $58.4 billion in 24 hr buying and selling quantity, adopted by Bybit (Futures) with $20.1 billion.

The information comes after Metamask introduced it had teamed up with Hyperliquid to supply merchants perpetual futures buying and selling on the Ethereum pockets’s cell software. The announcement additionally detailed that the duo will supply rewards to incentivize merchants to make the most of the function.