Ethereum is making an attempt a structured restoration after a number of weeks of downward strain, with value motion stabilizing close to $3,194. Market circumstances stay tense, but merchants proceed to look at the coin’s subsequent response round key resistance ranges.

Moreover the short-term rebound, analysts word that Ethereum now sits at an essential level the place value construction and community exercise intersect. This combine shapes expectations for December as a result of futures positioning, spot flows, and a brand new technical alert from the Ethereum Basis all affect sentiment directly.

Value Construction Tightens Close to Crucial Boundaries

Ethereum reclaimed short-term transferring averages on the 4H chart, which helps the continued restoration try. The following main hurdle stands on the 0.382 Fibonacci retracement close to $3,244.

This stage aligns with the 200-day EMA and types a decisive resistance cluster. Therefore, a clear 4H shut above this area might enable a transfer towards $3,438 and later $3,632. Considerably, merchants additionally define extension ranges at $3,908 and $4,260 if momentum accelerates.

ETH Value Dynamics (Supply: Buying and selling View)

Draw back ranges stay equally essential. Ethereum holds help close to $3,051, adopted by a key response zone round $3,000. If sellers push the coin under this space, the chart exposes deeper helps at $2,998, $2,902, and a broader swing low at $2,616. Furthermore, the broader construction nonetheless wants a confirmed breakout above $3,244 to shift the development.

Open Curiosity Climbs as Participation Expands

Supply: Coinglass

Ethereum futures open curiosity continues to rise and has reached about $38.3 billion. This development exhibits rising participation, particularly in periods of value volatility. Furthermore, the rise has remained regular from November into early December.

Associated: Chainlink Value Prediction: LINK Faces a Crucial Turning Level…

Merchants proceed constructing positions whereas ETH trades close to the mid-$3,100 vary. If value restoration continues, rising open curiosity might amplify short-term momentum and appeal to extra speculative flows.

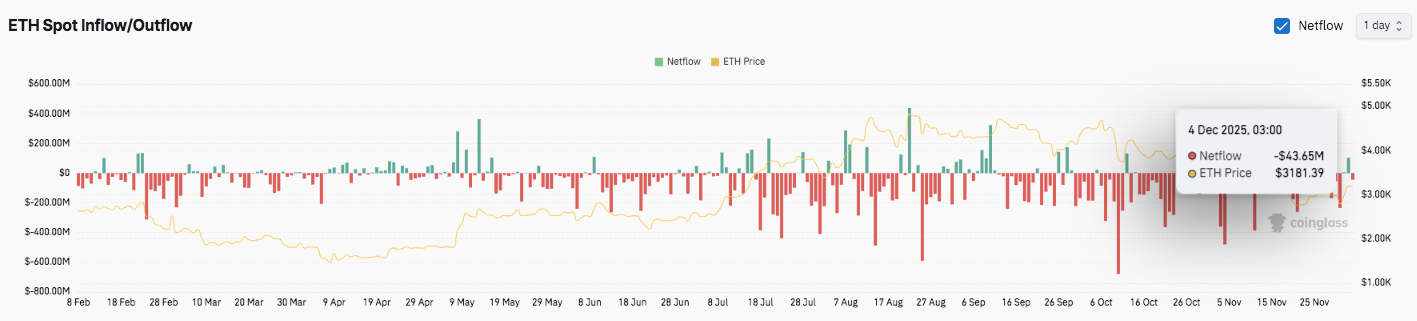

Supply: Coinglass

Spot flows, nonetheless, present a unique image. Exchanges report persistent outflows via 2025, together with a number of deep sell-side spikes. By December 4, web outflows stood close to $43.6 million. Therefore, traders stay cautious and proceed decreasing change balances throughout volatility.

Mainnet Configuration Warning Provides Technical Urgency

Ethereum builders issued a crucial discover relating to the Prysm consensus shopper following the Fusaka activation. CL nodes operating Prysm want pressing reconfiguration to stop disruptions.

🚨 PSA: There’s an ongoing challenge with the Prysm consensus shopper on mainnet. In case you are operating Prysm, you’ll need to reconfigure your CL node as per the linked tweet.

In case you are operating one other shopper, you aren’t affected and no motion is required. https://t.co/AngPNlzoTT

— Ethereum Basis (@ethereumfndn) December 4, 2025

The Basis confirmed a easy workaround that requires operators to disable last-epoch targets. Validator shoppers don’t require adjustments. Furthermore, nodes operating different shoppers stay unaffected by the problem.

Technical Outlook for Ethereum Value

Key ranges stay clearly outlined as Ethereum trades inside a tightening construction.

Upside ranges sit at $3,244, $3,438, and $3,632 because the instant hurdles. A breakout above these zones might prolong towards $3,908 and $4,260 if momentum strengthens.

Associated: Bitcoin Value Prediction: Sellers Block Restoration As Value Compresses Close to Main Assist

Draw back ranges embody $3,051 development help, adopted by $3,000 and $2,902. The deeper help base sits close to $2,616.

Ethereum now trades under a serious resistance ceiling on the 200-day EMA close to $3,244. This stage stays the crucial level to flip for medium-term bullish momentum.

The technical image suggests ETH is compressing between rising short-term help and a heavy overhead cluster, making a coil that usually precedes sharp volatility. A decisive breakout from this construction might set the tone for the subsequent directional transfer.

Will Ethereum Break Larger?

Ethereum’s subsequent steps depend upon whether or not patrons can defend the $3,051–$3,000 zone lengthy sufficient to mount a problem on the $3,244 resistance band. Compression and historic volatility patterns round year-end each level towards elevated motion forward. Sturdy inflows and sustained open curiosity growth might help a push towards $3,632 and the $3,908 extension.

Failure to carry $3,000 dangers breaking the near-term accumulation base and exposing the chart to $2,902 and $2,616. For now, ETH stays in a pivotal zone. Merchants keep a cautiously optimistic stance, however conviction flows and a confirmed breakout will decide the subsequent development leg.

Associated: BOB (Construct on Bitcoin) Value Prediction 2025, 2026, 2027-2030

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.