Ethereum has retraced from the $3,240 stage and is now testing the $3,150 zone as help, a key space that merchants are intently watching. Bulls are trying to defend this stage after a modest rebound, however uncertainty stays excessive because the market tries to determine route following weeks of volatility and aggressive promoting stress. Whereas some analysts view this consolidation because the early levels of a restoration, others warn that ETH should still be weak to deeper pullbacks if momentum fails to strengthen.

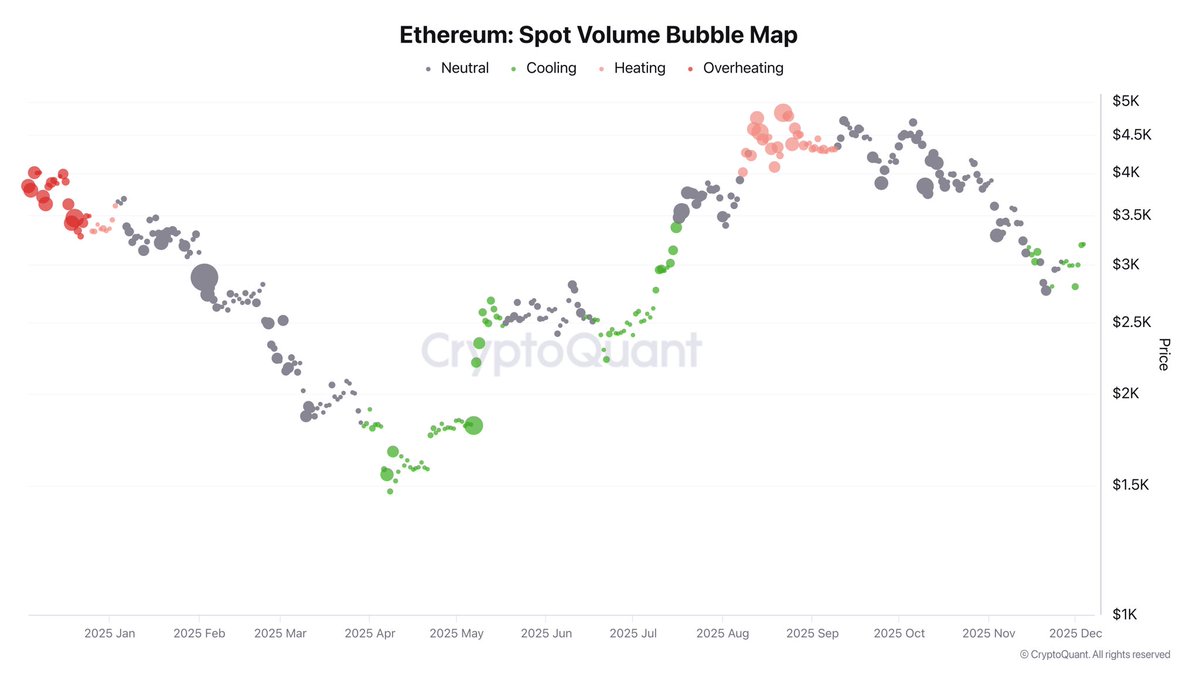

In response to high analyst Darkfost, Ethereum’s latest value motion is being formed by a notable shift in market construction. Over the previous few days, spot volumes have continued to say no, whilst the value tried a small restoration. This weakening in spot exercise reduces the influence of precise shopping for and promoting on the underlying asset, making futures markets more and more influential in dictating short-term value route.

As Darkfost explains, when spot quantity thins out, futures usually turn out to be the dominant driver of volatility. This dynamic can speed up each upside and draw back strikes, relying on merchants’ positioning. With Ethereum now sitting at a vital help stage, the market awaits clearer alerts to find out whether or not this rebound can evolve right into a sustained restoration or merely represents a brief pause within the downtrend.

Futures-Pushed Momentum Raises the Stakes for Ethereum

Darkfost expands on this dynamic by noting that when spot volumes weaken to the extent seen over the previous few days, the danger of heightened volatility will increase sharply. Skinny spot liquidity means fewer purchase and promote orders can be found to soak up sudden strikes, permitting futures-driven momentum to exert an outsized affect on value. This atmosphere usually produces sharper swings and fast directional shifts, as leveraged merchants and algorithmic methods dominate short-term market habits.

For now, the futures market is tilting upward, offering a constructive power that’s serving to Ethereum maintain above the $3,150 help zone. Darkfost emphasizes that this upward stress from futures may work within the bulls’ favor, as volatility—if it expands to the upside—could push the spot market to observe the identical trajectory.

In different phrases, a sustained futures-led rebound may act because the spark wanted for a broader restoration, particularly if spot patrons achieve confidence and start re-entering the market.

Nevertheless, this setup cuts each methods. With out stronger spot participation, any reversal in futures positioning may shortly translate into accelerated draw back stress. For now, Ethereum sits in a fragile part the place volatility is each a possible catalyst and a possible risk, making the following few classes essential for figuring out the market’s short-term route.

ETH Weekly Construction Holds Key Assist

Ethereum’s weekly chart reveals a market trying to stabilize after a steep downturn from the $4,500 area. ETH has rebounded towards $3,140, reclaiming its 100-week shifting common (inexperienced line) — a traditionally necessary help stage that usually defines the boundary between mid-term bullish and bearish phases. This bounce alerts renewed demand at a vital zone, particularly after the sturdy wick rejection seen close to $2,700, the place patrons stepped in aggressively.

Nevertheless, Ethereum nonetheless faces significant resistance overhead. The 50-week shifting common (blue line), now hovering close to $3,400–$3,500, has flipped into resistance and stays the following main hurdle for bulls. A profitable reclaim of this zone would materially enhance ETH’s technical construction and open the door to a problem of upper ranges. Till then, the weekly pattern stays impartial to barely bearish.

Quantity provides an encouraging sign: the latest rebound occurred with a noticeable uptick in shopping for exercise in comparison with prior weeks, suggesting strengthened curiosity at these decrease ranges. But the broader construction reveals a sample of decrease highs since August, that means ETH should display follow-through to keep away from slipping again into deeper consolidation.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.