The dYdX group has accepted a plan that was proposed in late November 2025 known as the Liquidation Rebates Pilot Program. It has been touted as a reward system anticipated to mitigate the blowback from future liquidations, thereby encouraging liquidity and threat administration.

In response to a current X publish from dYdX, the plans for compensation have been accepted through a governance vote and shall be seen as a measured experiment, which suggests it may nonetheless be refined additional.

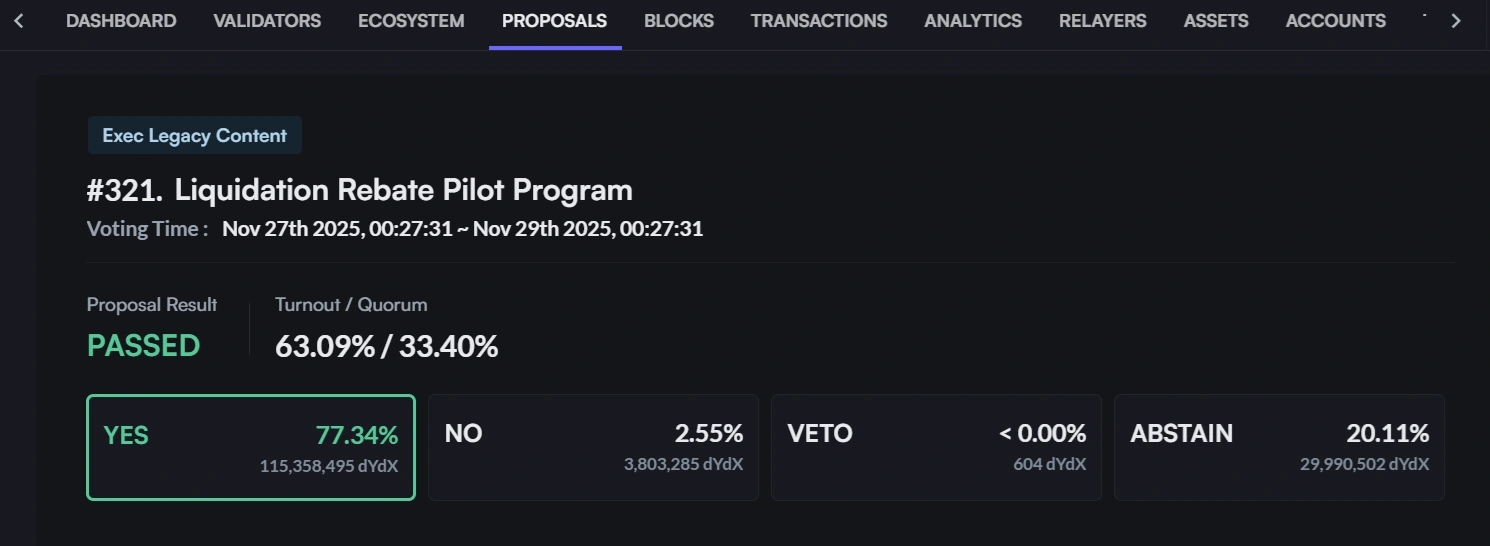

The publish revealed that 32 out of 42 Energetic Set validators and 112 accounts voted, with a 63.09% voting turnout wherein there have been 77.34% Sure votes, 2.55% No votes and 20.11% Abstain votes

dYdX accepted the Liquidation Rebates Pilot Program with a reward pool of as much as $1 million for liquidated merchants. Supply: Mintscan

Extra concerning the plans for compensation

The Liquidation Rebates Pilot Program proposes a one-month trial beginning on December 1, 2025, that can reward merchants who expertise a liquidation occasion with factors and rebates, with rewards capped at $1 million in complete.

Eligible members can accumulate the described rewards through the pilot’s structured framework, designed to supply tangible worth to lively merchants whereas sustaining a clear course of.

The scheme’s complete incentive pool of as much as $1 million has been praised as a measured strategy to supporting liquidity and threat administration inside the platform.

dYdX strikes on from October community outage

dYdX’s plans to compensate merchants come after the alternate was affected by a series halt that grounded operations for about eight hours amid final month’s market crash.

It was within the autopsy and replace that adopted that the alternate first floated the concept of voting on compensating affected merchants with as much as $462,000 from the protocol’s insurance coverage fund.

dYdX has claimed that the October 10 outage stemmed “from a misordered code course of, and its length was exacerbated by delays in validators restarting their oracle sidecar companies.”

In response to the DEX, when the chain resumed, “the matching engine processed trades/liquidations at incorrect costs as a result of stale oracle knowledge.”

It additional reported that no person funds had been misplaced on-chain; nevertheless, some merchants suffered liquidation-related losses whereas companies had been grounded through the halt. dYdX will not be the one alternate that has taken proactive steps following the October 10 market crash; Binance’s response to the turmoil has additionally been recommended.

The market crash, which worn out roughly $19 billion in positions and was the biggest liquidation occasion in crypto historical past, additionally examined Binance’s buying and selling companies because the alternate needed to take care of surging volatility, person considerations, and regulatory consideration.

It was known as out for technical glitches that prevented merchants from closing out positions, and there have been additionally interface issues that confirmed a number of tokens priced under zero, and the depeg of Ethena’s USDe.

Binance refused to imagine any legal responsibility for merchants’ losses. Nevertheless, it introduced a $400 million reduction initiative for affected merchants, together with $300 million in token vouchers and $100 million for ecosystem members who had been affected.

Binance additionally launched a $45 million BNB token airdrop to memecoin merchants that suffered losses through the crash to “enhance market confidence.” In complete, the alternate pledged $728 million for merchants affected by the sell-off.