Ethereum has reclaimed the $3,000 degree after weeks of heavy promoting stress, but the restoration stays fragile as momentum continues to fade. The market remains to be dominated by concern, and confidence amongst retail merchants has weakened considerably.

Analysts warn that bulls are dropping management of the development, and a few are starting to name for the early levels of a possible bear market. With Ethereum buying and selling practically 40% under its August all-time excessive, each transfer upward is being met with hesitation, and the broader market setting has but to stabilize.

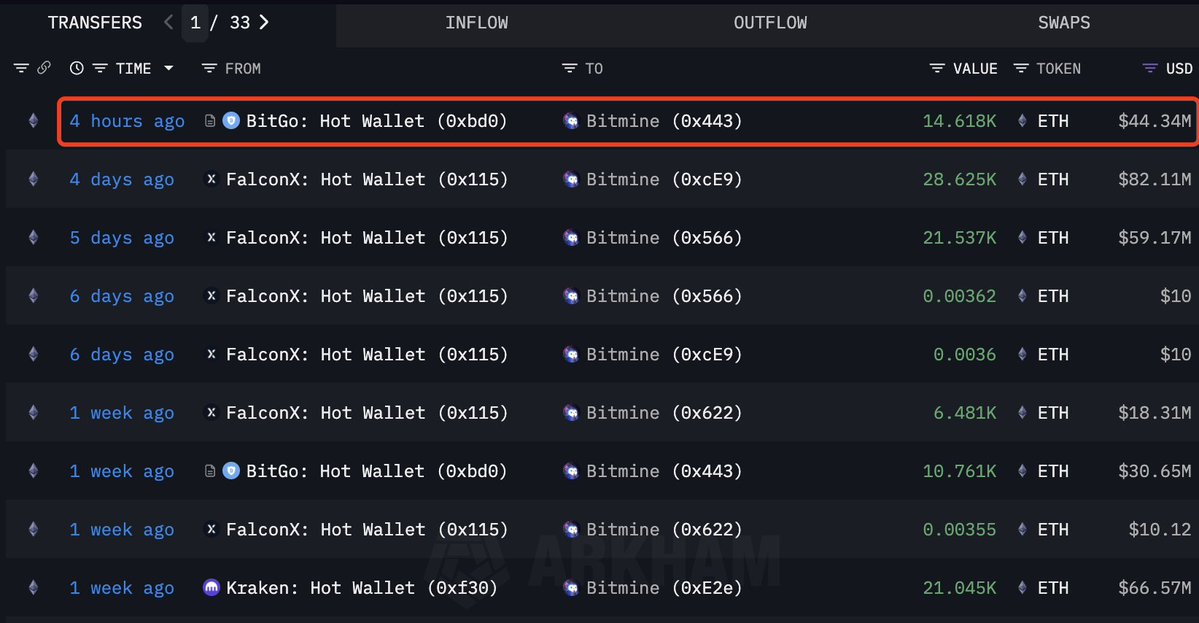

Regardless of this uncertainty, massive gamers proceed to build up ETH, providing a contrasting sign to the prevailing bearish sentiment. In keeping with new information from Lookonchain, Bitmine has been persistently shopping for Ethereum throughout this downturn, exhibiting no indicators of slowing its accumulation technique.

This persistent curiosity from massive holders means that institutional and high-net-worth consumers should see long-term worth at present ranges, whilst short-term merchants stay cautious.

Bitmine Deepens Accumulation as Ethereum Struggles for Momentum

Lookonchain experiences that Bitmine has continued its aggressive accumulation technique, buying one other 14,618 ETH—price roughly $44.34 million—just a few hours in the past. This new acquisition additional strengthens Bitmine’s already large Ethereum place, which now totals 3.436 million ETH. At present costs, their holdings are valued at roughly $10.39 billion, underscoring their long-term conviction regardless of the continued market turbulence.

This degree of accumulation from a significant participant stands in sharp distinction to the broader sentiment throughout the market, the place uncertainty and concern persist. Retail traders stay cautious, and plenty of analysts argue that Ethereum’s failure to reclaim momentum above $3,000 indicators a weakening development.

Nonetheless, Bitmine’s continued purchases recommend a basically totally different outlook—one rooted in long-term valuation quite than short-term volatility.

Massive, disciplined consumers usually accumulate in durations of market weak spot, viewing discounted costs as strategic entry factors. Bitmine’s habits mirrors this sample and will point out expectations of upper costs within the months forward.

Nonetheless, for Ethereum to learn from this institutional confidence, it should stabilize and construct a stronger assist base. The approaching weeks will reveal whether or not this sustained whale demand will outweigh broader promoting stress and assist ETH get away of its present downtrend.

ETH Makes an attempt Restoration however Faces Robust Resistance

Ethereum is making an attempt to get better after weeks of sustained promoting stress, reclaiming the $3,000 degree however nonetheless struggling to construct significant momentum. The chart reveals ETH bouncing from the current low close to the mid-$2,600s, the place a cluster of demand emerged and halted the sharp decline.

Nonetheless, regardless of this rebound, Ethereum stays under all three main shifting averages—the 50-day, 100-day, and 200-day—which now act as layered resistance zones.

The 50-day SMA is trending downward and has already crossed under the 100-day SMA, signaling a weakening market construction. In the meantime, the 200-day SMA sits barely above present costs, reinforcing the concept that ETH remains to be in a susceptible place. Value motion stays uneven, with decrease highs forming persistently for the reason that peak in early October, reflecting persistent bearish management.

Quantity patterns additionally verify this cautionary image. Whereas the current bounce got here with a modest enhance in shopping for exercise, it’s nonetheless far weaker than the promoting quantity noticed through the November capitulation. For a significant development reversal, ETH should break above the $3,300–$3,400 area, reclaim its shifting averages, and set up the next low.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.