Lower than a month after TradeXYZ deployed tokenized Nasdaq futures (XYZ100) on Hyperliquid, a number of protocols have launched TSLA, NVDA, and SPACEX perpetuals over the past 24 hours.

TradeXYZ, the permissionless perpetual arm of Unit, the Hyperliquid tokenization layer, kicked off the gold rush yesterday with the launch of tokenized NVDA. Right this moment, Felix Protocol and TradeXYZ adopted swimsuit with TSLA, and Ventuals launched SPACEX.

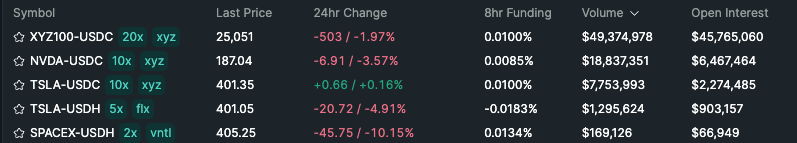

XYZ100 nonetheless leads the HIP-3 sector in complete quantity and open curiosity by a landslide, however TradeXYZ’s NVDA and TSLA markets are ramping up, producing $26 million in 24-hour quantity and nearly $9 million in open curiosity between them.

HIP-3 Markets by Quantity – Hyperliquid

A notable distinction between TradeXYZ’s markets and people deployed by Felix and Ventuals is that the XYZ markets are denominated in USDC, the dominant stablecoin on Hyperliquid, whereas Felix and Ventuals settle in USDH, Native Markets’ lately launched stablecoin.

This transfer marks the primary true supply of demand for USDH, which is able to funnel 50% of the yield on its reserves in direction of shopping for HYPE tokens.

All new markets have been launched with low open curiosity caps, that are anticipated to be raised over time because the groups proceed to watch their efficiency.

Scaling and Distribution in HIP-3 Markets

Charlie, a contributor at Felix Protocol, spoke to The Defiant about new HIP-3 developments, together with liquidity fragmentation throughout markets that signify the identical tokenized fairness, and the way the market can count on HIP-3s to develop past a crypto-native viewers.

He mentioned there may be at present an overlap between Unit and Felix, each of which supply tokenized TSLA markets. Nevertheless, this overlap is about to diverge as Felix develops separate companies that don’t rely simply on Hyperliquid’s UI as the primary TSLA/USDH distribution supply.

Charlie added that utilizing USDH gives a number of benefits, together with 20% decrease taker charges, 50% larger rebates, and 20% larger quantity contributions. “This implies it ought to be cheaper and extra liquid so that you can commerce the identical market on Felix – moreover, our price schedule will likely be decrease as effectively. So the first differentiator out of the gate between Felix and Unit is value.”

Whereas HIP-3 perpetual markets are nonetheless of their infancy, even in crypto-native use instances, groups need to increase the HIP-3 funnel and entice conventional finance merchants as effectively.

“I believe this [distribution to non-crypto audiences] will primarily come all the way down to regulatory readability and distribution, and the 2 play into each other. As soon as one main participant begins integrating perps after which fairness perps as a consequence of buyer demand, regulatory readability follows.”

“On the distribution aspect, non-crypto-natives seemingly don’t need to undergo the complexities of pockets administration, and so on, to commerce these markets. That is the place one thing like a Privy + Hyperliquid builder code integration right into a recognized interface like Bloomberg bridges the hole,” Charlie concluded.