Biomedical and scientific corporations are turning to blockchain know-how and crypto treasury methods to fund analysis, overhauling conventional capital formation and analysis funding constructions that may delay life-saving cures by a long time.

Portage Biotech, a biomedical know-how firm, pivoted to develop into a Toncoin (TON) treasury firm in September, incomes working revenues from staking to safe the community and investing in Telegram ecosystem tasks, together with video games and mini-apps.

The corporate will funnel among the income generated from the working enterprise and the capital appreciation of TON to fund most cancers analysis, AlphaTON CEO Brittany Kaiser advised Cointelegraph.

Variations between conventional scientific analysis funding fashions and decentralized science constructions. Supply: Cointelegraph

She stated the corporate is exploring real-world asset tokenization (RWA) as a substitute funding mechanism to decentralize scientific growth and take away monetary and entry limitations to analysis funding inherent within the conventional system. She stated:

“We’re doing analysis into the most effective case research and what has labored and what hasn’t, from tokenization of the mental property, to tokenization of fairness of the corporate that owns the analysis, to tokenizing future earnings of the analysis.”

Kaiser and Anthony Scaramucci, strategic advisor to AlphaTON, stated that biomedical analysis as an working vertical units the corporate other than different digital asset treasuries, which frequently lack working companies.

“Most cryptocurrency treasury corporations take over the shell and eradicate the first elements of the unique enterprise, however it is a new case as a result of there are very useful belongings within the shell,” Scaramucci advised Cointelegraph.

Associated: BNB treasury race accelerates as Utilized DNA, CEA Industries increase holdings

Ideosphere desires to fund scientific analysis by means of prediction markets

Ideosphere, a decentralized science startup, is exploring funding early-stage scientific analysis by means of prediction markets. Prediction market platforms act as crowdsourced intelligence and voting mechanisms.

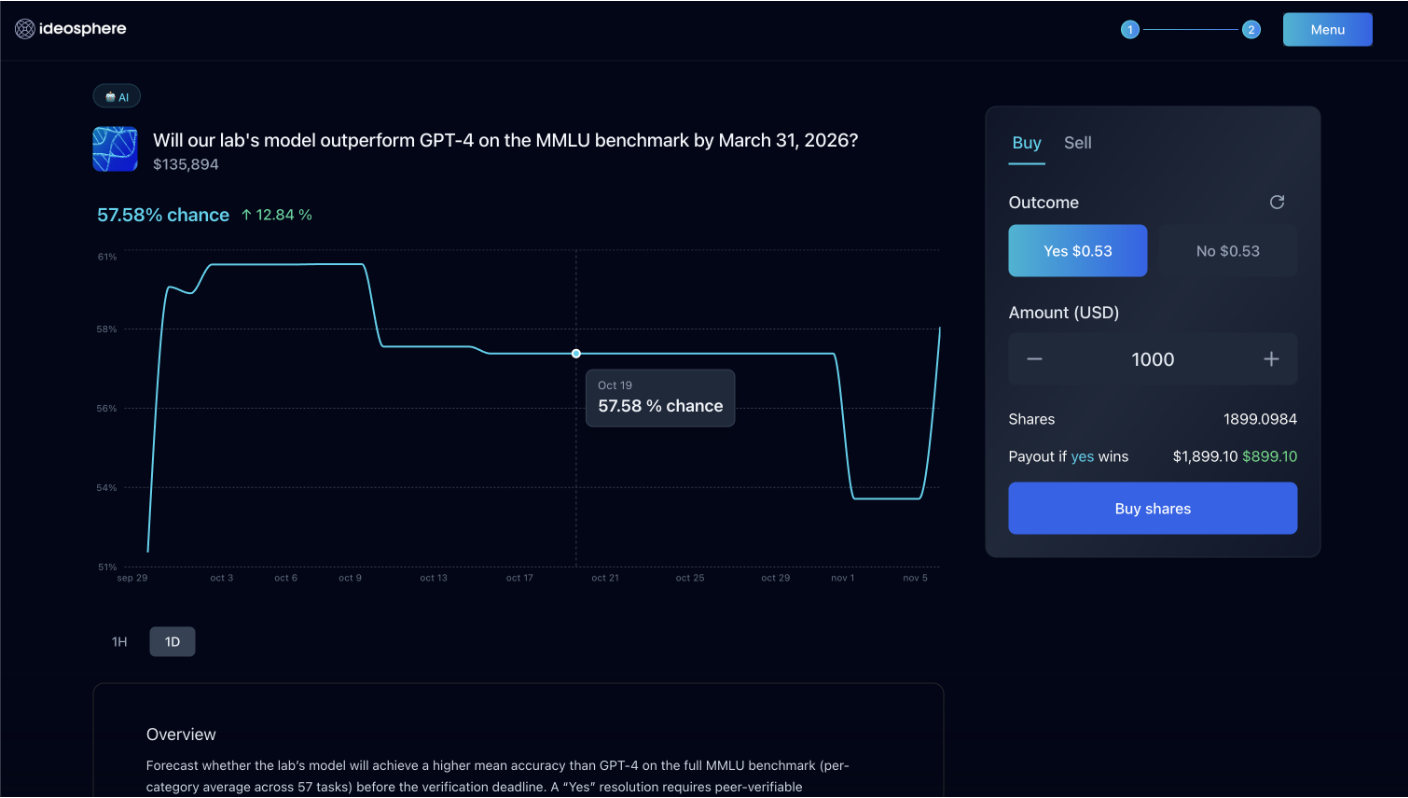

A mock-up instance of what the Ideosphere prediction market would seem like. Supply: Ideosphere/Cointelegraph

“If you happen to can create prediction markets round early stage analysis, you may make these markets a market of concepts that may really deliver the cash in,” Ideospehre co-founder and head of know-how Rei Jarram advised Cointelegraph.

“Researchers can put ahead hypotheses that they’re engaged on, and merchants can speculate on it, and the unfold goes to the researcher,” she added.

Bio Protocol secures funding from Animoca Manufacturers

In September, Bio Protocol, a decentralized science platform combining synthetic intelligence, blockchain, and group participation to analysis drug discovery, secured $6.9 million in funding from Web3 firm Animoca Manufacturers and the Maelstrom fund.

Maelstrom founder Arthur Hayes stated the platform has the potential to develop into a full-fledged “AI-native analysis market” that may change the way in which scientific analysis is carried out.

Journal: Crypto followers are obsessive about longevity and biohacking: Right here’s why