Regardless of the red-hot begin to the month, the traditionally bullish “Uptober” interval has not significantly gone in accordance with the expectations for the Bitcoin value. Following the market-wide downturn on October 10, the premier cryptocurrency has not been in a position to mount a transparent restoration again to its former highs.

In truth, the Bitcoin value motion continues to wrestle below lasting bearish strain, falling to a brand new low round $103,000 on Friday, October 18. With uncertainty taking up the market, buyers are left questioning whether or not the bull run is over or the sluggish motion is a minor blip.

In accordance with a latest outlook, the present technical place of the BTC value might supply perception into its subsequent step.

BTC At Threat Of Deeper Correction If It Loses $99,900 Help

In an October 17 put up on the social media platform X, Glassnode put ahead an fascinating analysis of the present Bitcoin value setup. The outstanding crypto analytics agency revealed that the flagship cryptocurrency is at the moment sitting between two main help zones.

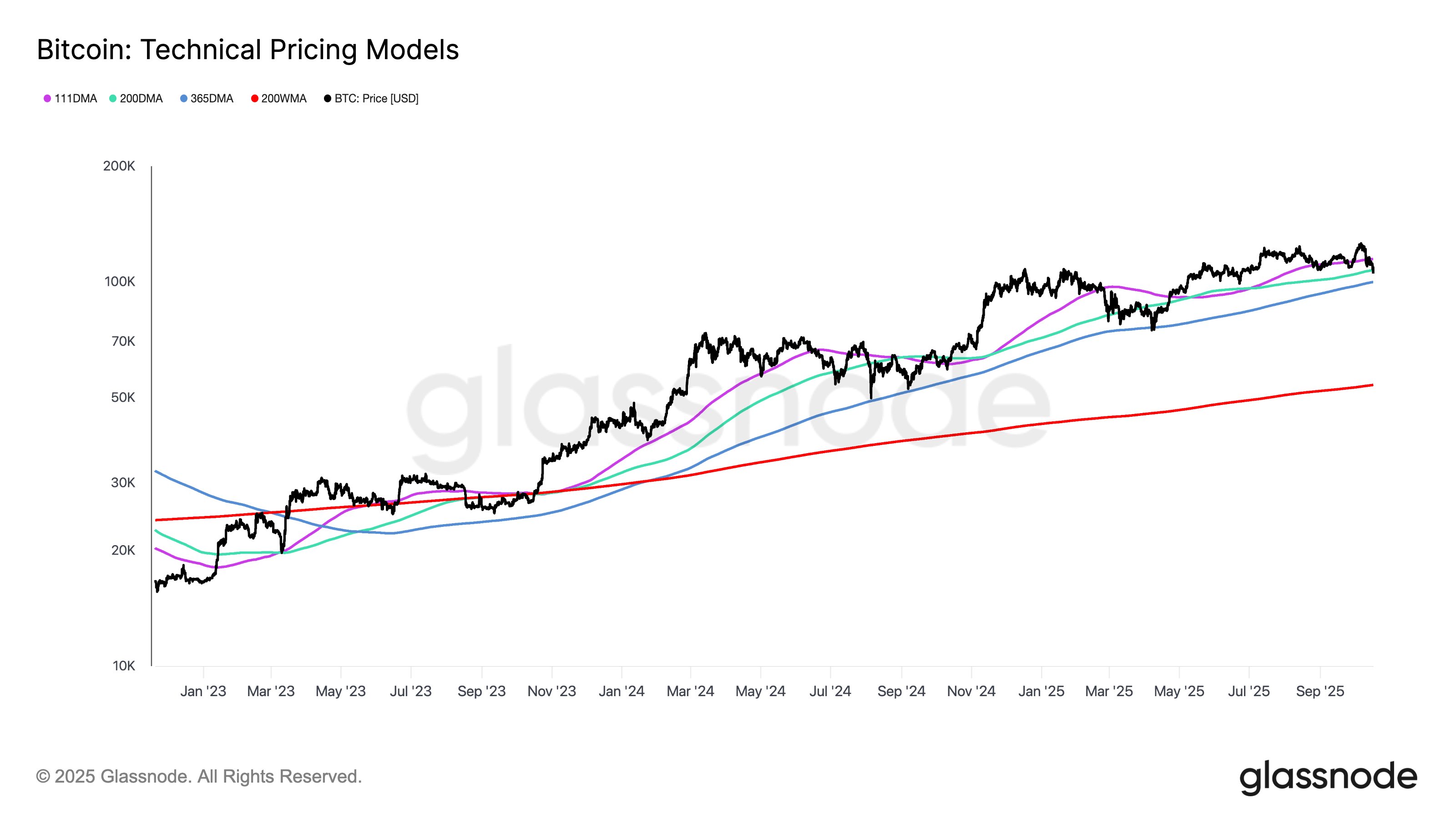

This evaluation relies on the Glassnode Technical Pricing Mannequin, a chart containing plenty of technical indicators, together with the Pi Cycle indicator, the Mayer A number of, the Yearly Shifting Common (MA), and the 200-Week Shifting Common.

In accordance with Glassnode, the Bitcoin value is at the moment wedged between the Mayer A number of ($107,400) and the Yearly MA ($99,900).

Supply: @glassnode on X

The Mayer A number of (200-Day Easy Shifting Common) is a well-liked technical indicator typically linked with the transition level between a bull and bear market. In the meantime, the 365 Day SMA provides a long-standing baseline for high-timeframe market momentum.

Following the most recent dip, the Bitcoin value slipped beneath the 200-day Shifting Common, signaling a attainable shift from a bullish market situation to a bearish one. Whereas BTC nonetheless holds above the 365-day MA, the premier cryptocurrency wants to remain above this degree to regular the present development.

In the end, buyers would possibly need to keep watch over the BTC value, as a break beneath the $99,900 degree might spell a lot greater hassle for the world’s largest cryptocurrency. It’s value noting {that a} return to above the Mayer A number of might be important for Bitcoin’s development, albeit with value resistance across the 111-day transferring common (at the moment at $114,700).

Bitcoin Value At A Look

As of this writing, Bitcoin is valued at round $106,427, reflecting an nearly 2% value drop up to now 24 hours.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.